Here’s how Toncoin fared after TON’s Binance listing

- Toncoin’s trading volume soared by 258% after Binance’s listing.

- TON’s prices surged by 11% amidst positive market sentiment.

Toncoin [TON] secured a huge boost in its trading activities after Binance [BNB] announced its listing. The leading crypto exchange by volume announced the upcoming listing of Toncoin through its official website.

Toncoin trading volume soars after listing

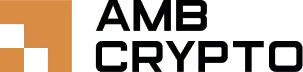

After Binance announced the listing, Ton experienced exceptional growth in trading volume. According to CoinMarketCap, the trading volume surged by 258.37% to $1.1 Billion over the past 24 hours.

According to Coinglass, TON’s trading volume surged from a previous low of $176.1 million on the previous day to $229.98 million at press time, a surge from a very low of $166 million over the past seven days.

This shows the listing has massively impacted Ton’s trading volume.

Impact on price charts

As of this writing, Ton was trading at $6.36 after an 11.07% increase on daily charts. Equally, TON’s market cap has surged by 11% to $16 billion over the past 24 hours.

Thus, AMBCrypto’s analysis showed that TON had a strong upward movement on daily charts.

TON’s simple moving average (SMA) was below the current prices, which suggested that current prices are higher than the average price over the last 20 days.

This is a bullish signal, showing the prices of altcoin in the uptrend.

Additionally, the Relative Strength index has been rising over the past seven days. RSI has surged from a low of 20 on the 5th of August to 50 at press time.

Thus, TON has been in the oversold zone, which presented a buying opportunity and drove buying pressure, as indicated by the trading volume surge.

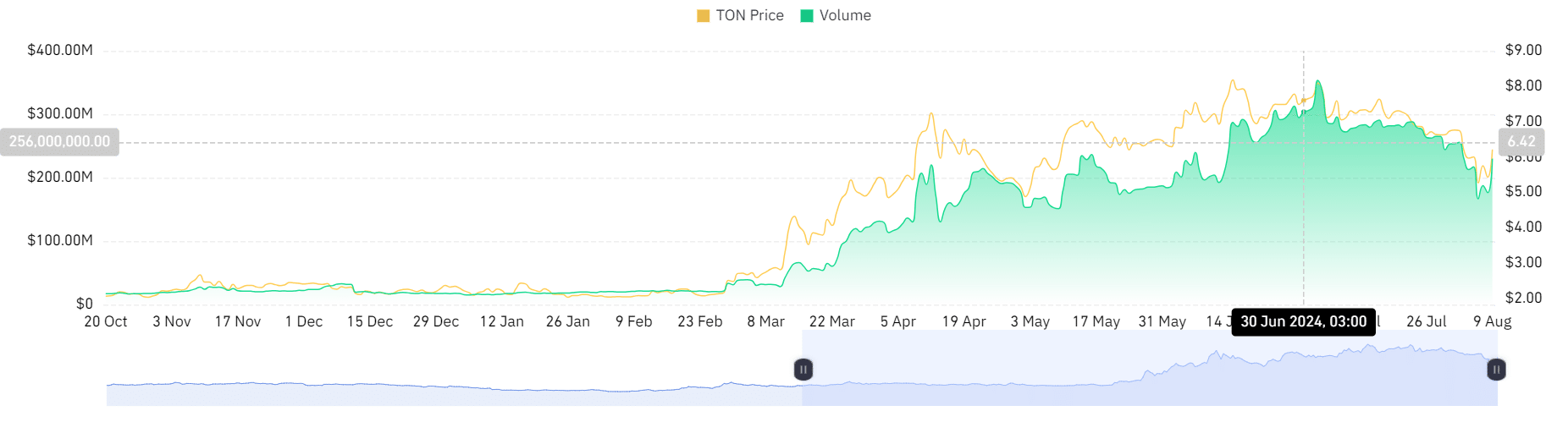

Further, our analysis of Coinglass showed that liquidation for long positions has declined over the past 24 hours. Accordingly, short positions liquidation at $209k is higher than long positions at $63k.

This showed that investors betting against short-term price increases were forced out of their positions than those betting for further price rallies.

Is your portfolio green? Check out the TON Profit Calculator

Therefore, in the short term, the Binance listing has helped TON by pushing prices by 11% over the past 24 hours and increasing trading volume.

Thus, if the prevailing market conditions are maintained, Ton will attempt its next resistance level at $6.74.