Benefits and Future Trends in Digital Asset Investment: Margex Report

The regulatory landscape for the cryptocurrency market has seen significant growth over the past few months as it plays crucial roles in shaping the cryptocurrency industry and increasing adoption among traditional financial (TradFi) institutions looking to adopt blockchain technologies.

Despite many regulatory uncertainties, Bitcoin (BTC), Ethereum (ETH), and other cryptocurrencies with large market capitalizations have seen over a 200% rally from the previous bear cycle of 2022.

The United States (US) Security and Exchange Commission (SEC) has played a huge role in its regulatory crackdown, ensuring proper regulation of the cryptocurrency market. This has opened opportunities for institutional crypto investments, coupled with the push for approval for spot Bitcoin and Ethereum exchange-traded funds (ETFs), signaling promising signs for the cryptocurrency market.

Beyond the regulatory front and the change in cryptocurrency prices, the crypto space has been greatly influenced by market trends such as tap-to-earn, crypto copy trading, and macroeconomic factors.

Navigating the cryptocurrency market requires following up with regulatory developments, market trends, macroeconomic factors, and institutional money flow into the crypto space; these all help make informed investment decisions.

Cryptocurrency Adoption and Bitcoin Surge

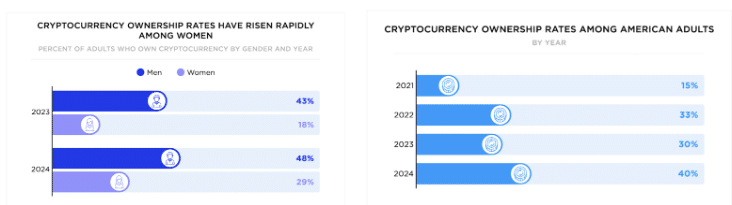

Since the start of 2024, cryptocurrency adoption has been on the increase as compared to 2023. Statistics for 2024 show that 4 out of 10 Americans own one or more cryptocurrencies, with men more likely to hold crypto than women, but the overall trend for ownership has been commendable.

According to data from Security.org, there has been a significant jump among women in the past year regarding cryptocurrency ownership and adoption due to increased visibility and blockchain development, making waves regarding investment opportunities.

The approval of spot Bitcoin ETF and Ethereum ETF has greatly impacted cryptocurrency adoption, with many individuals and institutions owning more Bitcoin than other cryptocurrency assets.

This mass adoption has seen the price of Bitcoin (BTC) rally by over 300% in 2024, putting the gains of Bitcoin (BTC) as one of the most traded assets in the cryptocurrency industry.

Coinmetrics data shows that the cryptocurrency market has seen tremendous growth in its market capitalization, reaching a high of over $2 trillion from its low in the last crypto winter of 2022, which saw many crypto assets plummet.

All of these factors have contributed to the widespread adoption of crypto, together with capital inflow from financial institutions entering the crypto space to adopt and leverage blockchain technologies.

May and June 2024 saw a much larger outflow in Bitcoin ETF. Still, recent on-chain data suggest a much larger inflow compared to previous weeks, with many staying put in their positions as there is high speculation that the cryptocurrency market will outperform previous bull cycles.

Tap-to-earn a New Crypto Paradigm for Users

The emergence of tap-to-earn witnesses a bold and intriguing shift in the cryptocurrency industry from complex and time-consuming market trends such as the play-to-earn (P2E) model that dominated the crypto space before the bear market to a more simplified and easier way of earning.

A new earning model that has created a lot of buzz in the cryptocurrency industry is tap-to-earn games, which provide a simple, enjoyable, and straightforward approach to earning rewards in the form of airdrops.

This evolution marks a pivotal moment in the digital world, opening the doors to mass adoption.

The tap-to-earn model provides easy access for favored users with minimal effort and seamless entry points by leveraging Telegram as its interface to play these games. As a result, it positions itself for endless user engagement as it bridges the complex world of cryptocurrency and the ordinary digital user.

The shift in market trend suggests more than just an evolution in the gaming industry but rather a much larger movement in terms of inclusivity and accessibility in the cryptocurrency space, enabling users around the world to interact with digital currency.

An Automated Trading Regime

The emergence of artificial intelligence has engineered means to automate trading, taking off long hours of analysis and sitting in front of screens looking to take a single trade. At times, traders make huge losses as a result of manipulations from smart money or institutions that are both technically equipped and understand the financial market better.

With the help of automation, copy trading enables many users today to automate their trades and replicate the trades of experienced traders with good trading knowledge and the best strategies. They also better understand what trading entails to stay profitable throughout the years.

Crypto copy trading has become an innovative phenomenon in the cryptocurrency space as it bridges the gap between traditional financial systems and is a cutting-edge technology that allows users and institutions to mirror the trades of seasoned traders and leverage their insight into the market.

In recent years, copy trading has witnessed an unprecedented surge in adoption among novice traders and organizations. This shift in trading style is influenced by simplicity, accessibility, and high-potential investment opportunities without much understanding of market intricacies.

Crypto copy trading has become a win-win opportunity for both users and professional traders. Professional traders look to monetize their experience as expert traders, while novice traders leverage their strategies to remain profitable while focusing on diversification and harnessing better trading strategies.

Margex’s automated crypto copy trading platform remains the best. It offers a user-friendly experience that allows both users and expert traders to navigate its platform easily and enjoy seamless trading.

With real-time data about trader history, such as strategies, most traded digital assets, return on equity (ROE), traders’ equity, and others, users can make informed decisions about which trader to follow and copy their trades.