ApeCoin struggles to rally: Can the bounce to $1.3 boost bulls?

- ApeCoin has a firm bearish structure and momentum in the 12-hour timeframe

- The spot and futures markets were in agreement about one thing- bulls remain sidelined

ApeCoin [APE] is the ecosystem token associated with the Bored Ape Yacht Club [BAYC]. AMBCrypto’s analysis of the NFT volume showed that the volume was declining on the Ethereum [ETH] network but soaring on Bitcoin [BTC].

The decline in BAYC floor price contributed to APE’s loss of relevance in the markets. With sentiment in favor of the sellers, does the bounce to $1.3 suggest bulls are beginning to turn things around?

The bearish breaker block posed a threat to APE bulls

The market structure on the 12-hour chart was bearish. Last week, the price fell below the swing low at $1.233 where the February rally was initiated. The Fibonacci retracement levels for the recent impulse move downward highlighted levels of resistance on the lower timeframes.

The recent bounce from the $1 lows saw the CMF climb above +0.05 to reflect strong buying pressure. Yet, the RSI was below neutral 50 on the 12-hour chart, signaling momentum has not shifted.

The $1.3 resistance zone was highlighted in red because it was a bearish breaker block. If APE can climb past $1.32, the next key level would be $1.64, the 78.6% retracement level.

On the higher timeframes, a move past $1.82 would switch the market structure bullishly.

The lack of capital inflows showcased bearish caution

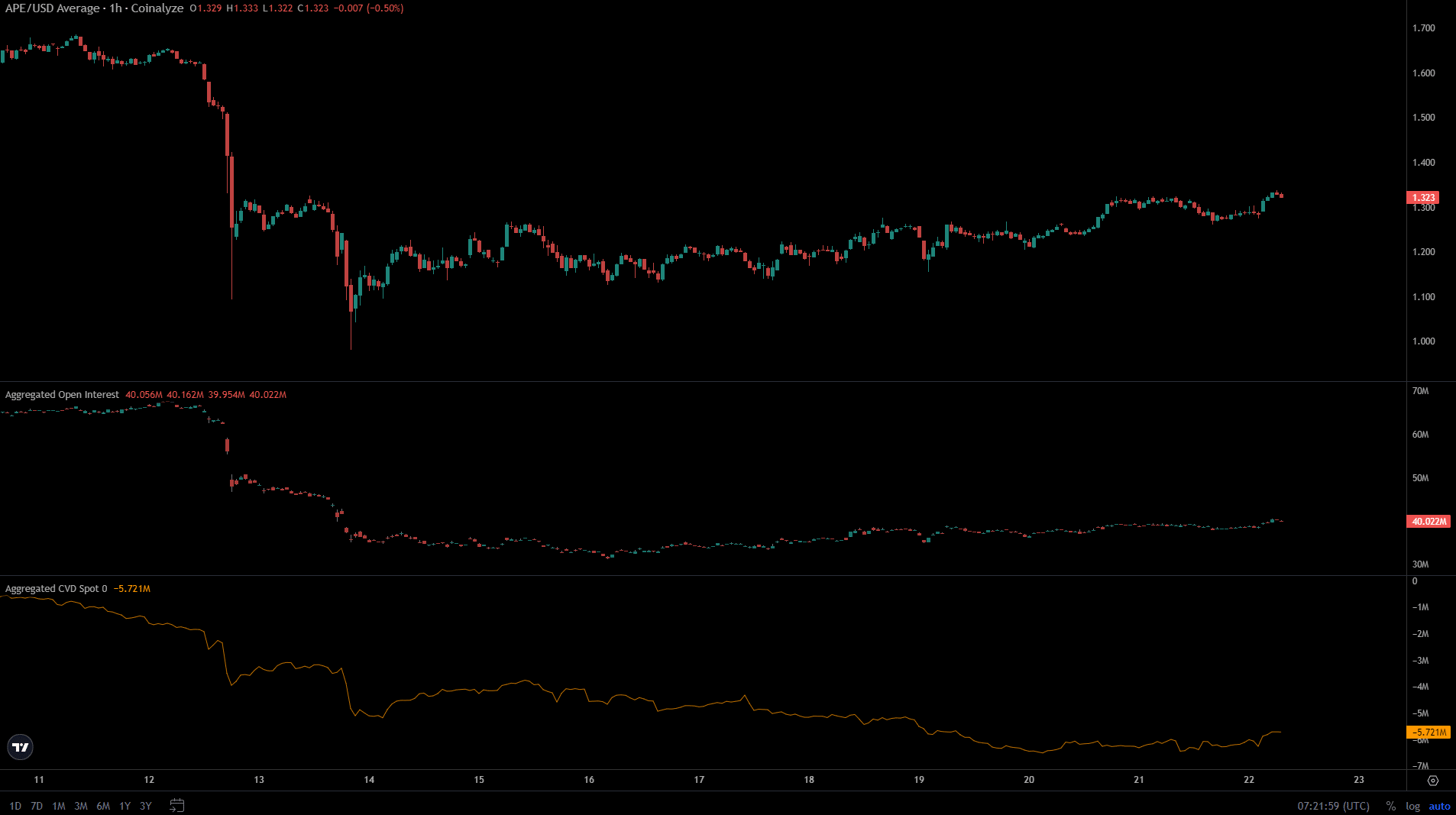

Source: Coinalyze

The data from Coinalyze showed a disappointing picture for the bulls. Over the past week, the spot CVD continued to trend downward. Despite the 30% bounce over the past two days, the demand in the spot market was negligible.

Is your portfolio green? Check the ApeCoin Profit Calculator

The Open Interest rose slowly alongside the prices, but did not indicate bullish conviction. Both the futures and the spot market participants did not fancy the chances of an ApeCoin revival at press time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.