Polygon Q2 report – Slight positives, some negatives, and MATIC’s path in Q3

- The number of active addresses on Polygon picked up in Q2.

- MATIC remained bearish as Q3 commenced.

Polygon [MATIC] recently disclosed its performance data for Q2, revealing a mixed picture of its network activity and financial health.

While the data highlighted some positive trends regarding active addresses, there were notable declines in key financial and operational areas. Additionally, the Total Value Locked (TVL) also took a hit.

The positives and negatives of the Polygon report

The positives

The Q2 report for the Polygon network highlighted several positive trends.

Firstly, the number of daily active addresses rose to 1.2 million, marking a 47% increase from the previous quarter and a substantial 234% increase YoY.

Weekly active addresses saw a 31% rise this quarter, with an impressive 123% growth YoY.

The report also noted a 3.3% quarterly increase in daily transactions, nearly a 70% increase compared to last year.

Moreover, there was a notable rise in the number of MATIC holders, which grew by over 18% this quarter and exceeded a 70% increase year-on-year.

The negatives

The Q2 report for the Polygon network also revealed some significant challenges.

Notably, the fees collected by the network declined by over 40% in the second quarter and dropped by more than 64% YoY. Similarly, revenue decreased substantially, falling by almost 80% YoY and over 41% in Q2.

Despite the growth in daily active addresses, the number of daily new addresses introduced to the network decreased by over 37% from the previous quarter and over 63% compared to last year.

Analyzing Polygon’s TVL

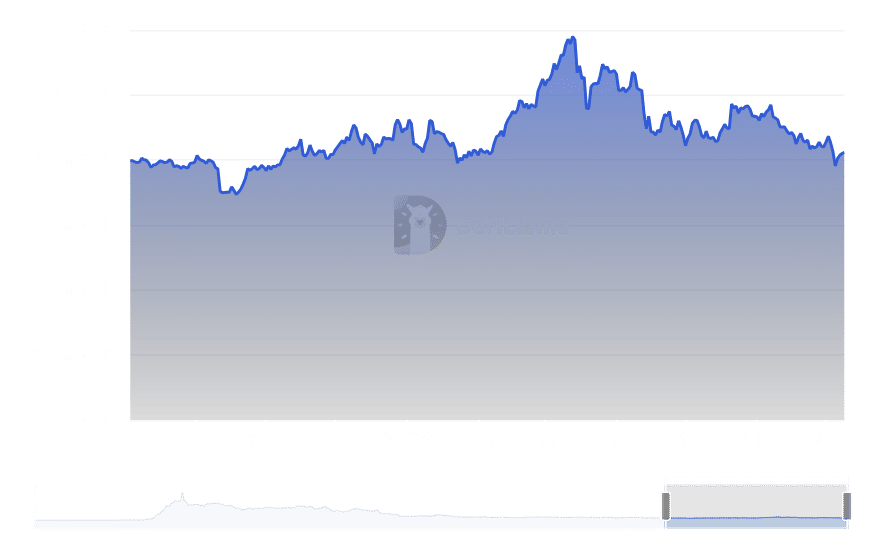

The Total Value Locked (TVL) on the Polygon network has declined over the past few months, according to AMBCrypto’s look at DeFiLlama data.

Following a peak in February, where TVL rose to over $1.1 billion, there has been a noticeable downward trend.

At the beginning of Q2, the TVL stood at over $1 billion but decreased to approximately $823 million. This represented a decline of over 23% within the quarter and an over 13% decrease on a YoY basis.

MATIC remains bearish

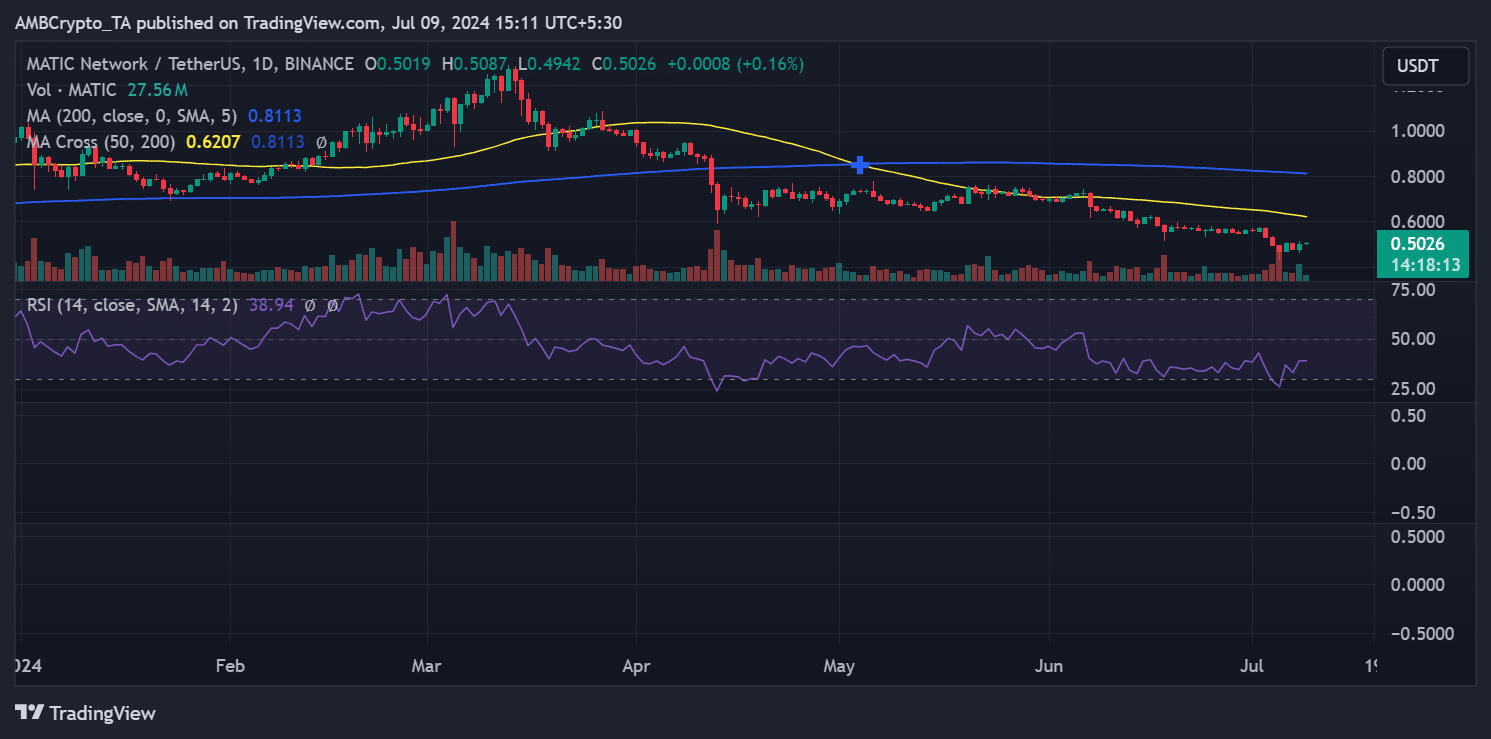

AMBCrypto’s analysis of MATIC‘s price trend on a daily time frame highlighted that although the price has generally not performed well, there has been a recent uptick.

In the last 24 hours, MATIC’s price increased by 5.02%, reaching around $0.501 on the 8th of July. As of this writing, it was trading slightly higher at around $0.502.

Is your portfolio green? Check out the MATIC Profit Calculator

Despite this recent increase, MATIC’s price trend continued to be predominantly bearish.

The Relative Strength Index (RSI) remained below the neutral 50 line, indicating that the asset was still within a bearish trend at press time.