Polymarket is good news for Polygon, but what about MATIC’s price?

- Polymarket now accounts for 6% of transaction fees on the Polygon network

- However, MATIC’s price action still unaffected by its recent growth

Prediction platform Polymarket is now one of the key drivers behind Polygon’s POS (Proof of Stake) network transaction fees. According to recent data from Blockworks, the prediction site now accounts for 6% of the transaction fees on the Ethereum L2 Polygon network.

“The application is now responsible for 6% total transaction fees on Polygon PoS.”

In fact, Blockworks’ on-chain analyst Dan Smith claimed that the surge in transaction fees followed a recent hike in users and translation volumes on Polymarket. The platform hit a record $100 million in June, thanks to greater bets on U.S elections.

Interestingly, the prediction site beat legacy media in predicting that Joe Biden would drop out of the presidential race. Its real-time odds feature has made it a darling of speculators in sports, politics, and everything in between.

However, the big question is – Can MATIC benefit from this traction?

Will Polymarket’s success help MATIC?

According to venture capitalist Evan Luthra, the predictions category is still hot, unlike other crypto market sectors.

“While other narratives have cooled, prediction markets are red hot. Total value locked across the top platforms has increased nearly 70% so far in 2024 with over 40% from PolyMarket.”

However, despite Polymarket’s significant traction in June, MATIC declined by 19% on the charts. The drop was not unique to MATIC though, especially since the overall market suffered drawdowns too.

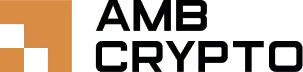

On the network front, MATIC recorded an uptick in daily active addresses in July than June. The July surge, which happened on the 19th, coincided with the trial test for tokenized assets on the network by the ECB (European Central Bank).

In short, MATIC network effects surged on tokenized assets speculation, compared to Polymarket’s record transaction volume in June.

At press time, there seemed to be another surge in daily users, possibly to capitalize on the recent relief rally as Bitcoin [BTC] retested $67k.

Put differently, Polymarket’s traction might help boost Polygon’s network revenue, but it has little impact on MATIC prices.

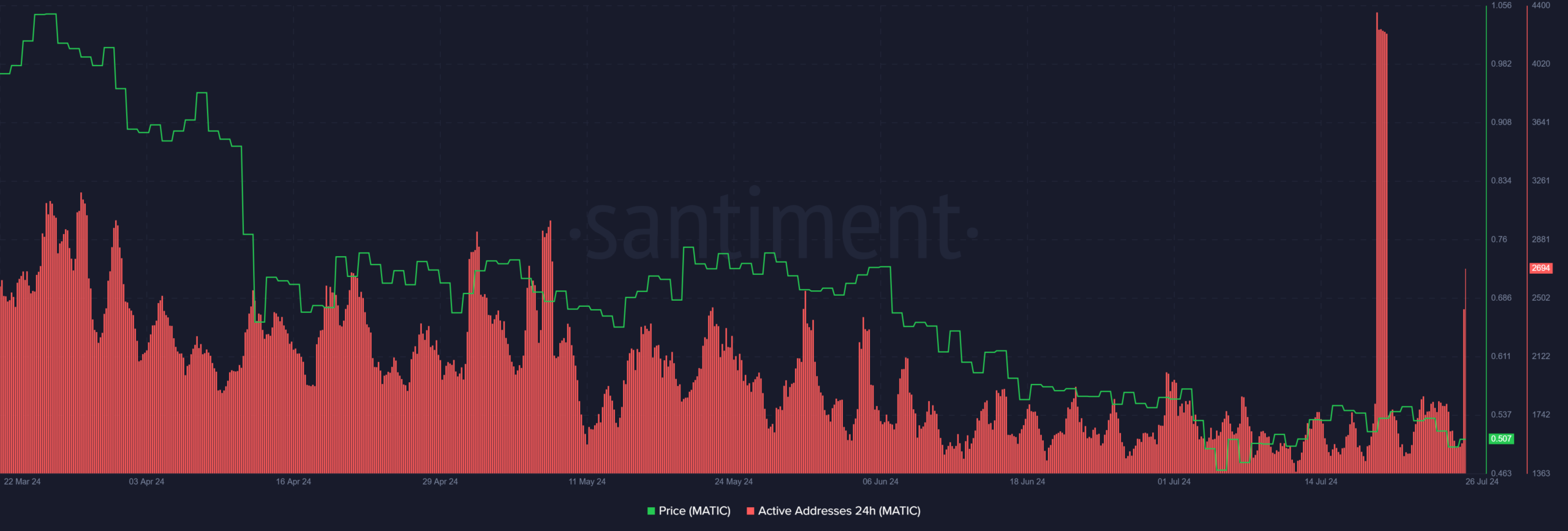

On the price chart, the recent rebound faced resistance at $0.5. The weak buying pressure, as shown by the below-average reading on the RSI (Relative Strength Index), meant that $0.51 was a crucial roadblock.

The low CMF (Chaikin Money Flow), denoting weak capital inflows, further reinforced that the mounting above the 20-day SMA (Simple Moving Average) could be a problem on the 4-hour chart.

So, a cool-off of the relief bounce at the hurdle could drag MATIC to $0.49.

However, should bulls clear the hurdle amidst sustained bullish momentum by Bitcoin [BTC] hitting $70k, then MATIC could see an extra 8% recovery rally to $0.56.