Dogecoin death cross forms: Why this is a worrying development

- Dogecoin has formed a bearish market structure.

- The rejection from the daily moving averages solidified the case of bearish momentum.

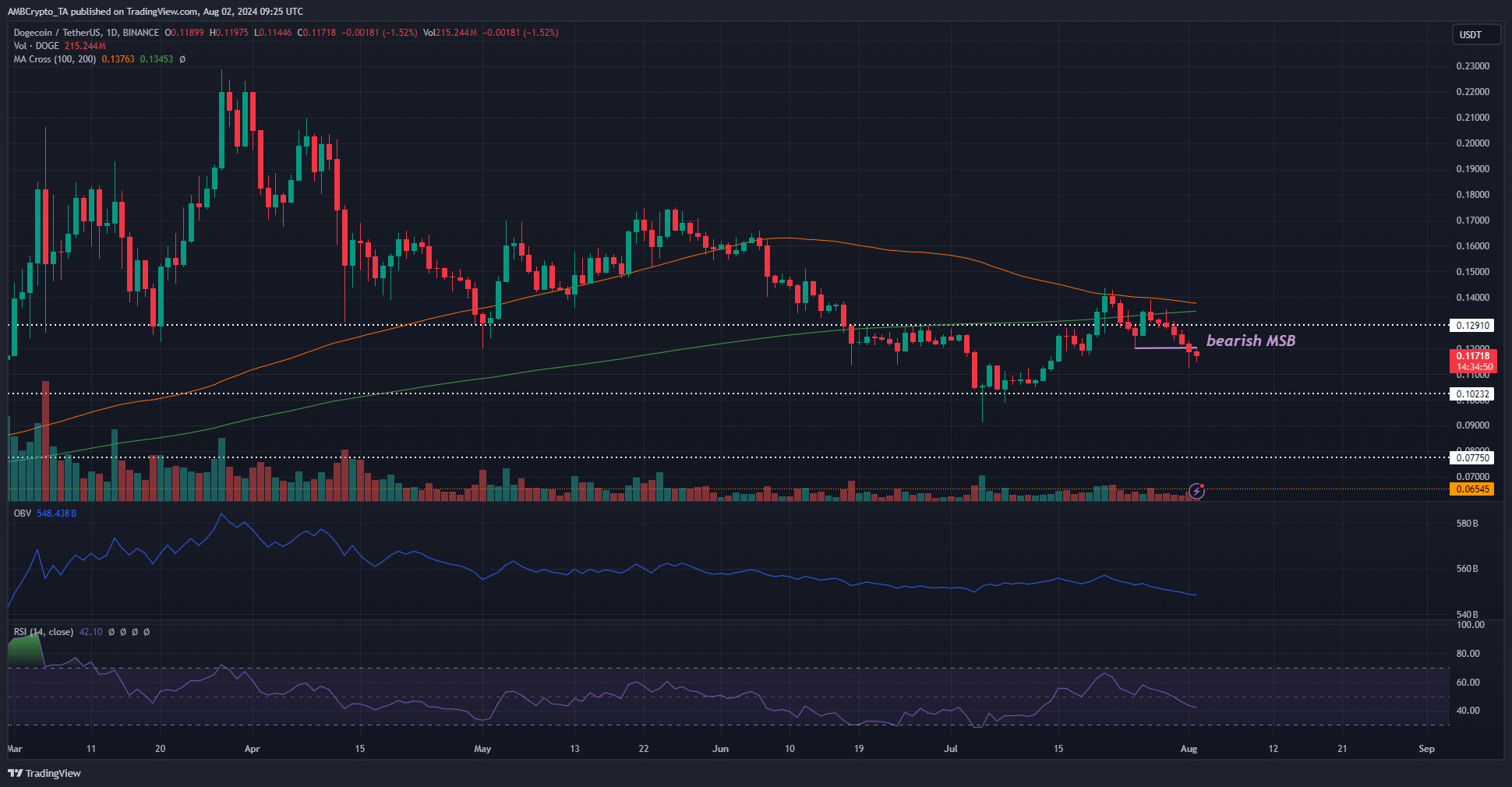

The price action of Dogecoin [DOGE] has been bearish in the past ten days. The daily moving averages were on the verge of forming a Death Cross, which would be a strong bearish signal.

This came after DOGE’s rejection at the $0.141 resistance.

Crypto analysts pointed out that if historical patterns repeat themselves, Dogecoin could surge to $10 in this bull run. Does the potential death cross suppress this bullish possibility?

The feared death cross — should DOGE investors sell and wait for a trend reversal?

A death cross in technical analysis forms when two long-term moving averages form a bearish crossover. In this instance, the 200 and 100 daily moving averages were chosen.

Dogecoin has already tested the 100 DMA as resistance at $0.141 and slid lower.

The price being below the moving averages meant bearish momentum was gaining strength. The daily RSI reflected this with a drop below neutral 50. The buying pressure was not present either.

The OBV agreed with the bearish price action. It attempted to recover in July, but the bears were too strong. The OBV downtrend resumed, and a bearish market structure break was also spotted on the 1st of August.

Overall, it appeared likely that the $0.102 support level would be tested in the coming days.

Social sentiment and sell activity were at odds

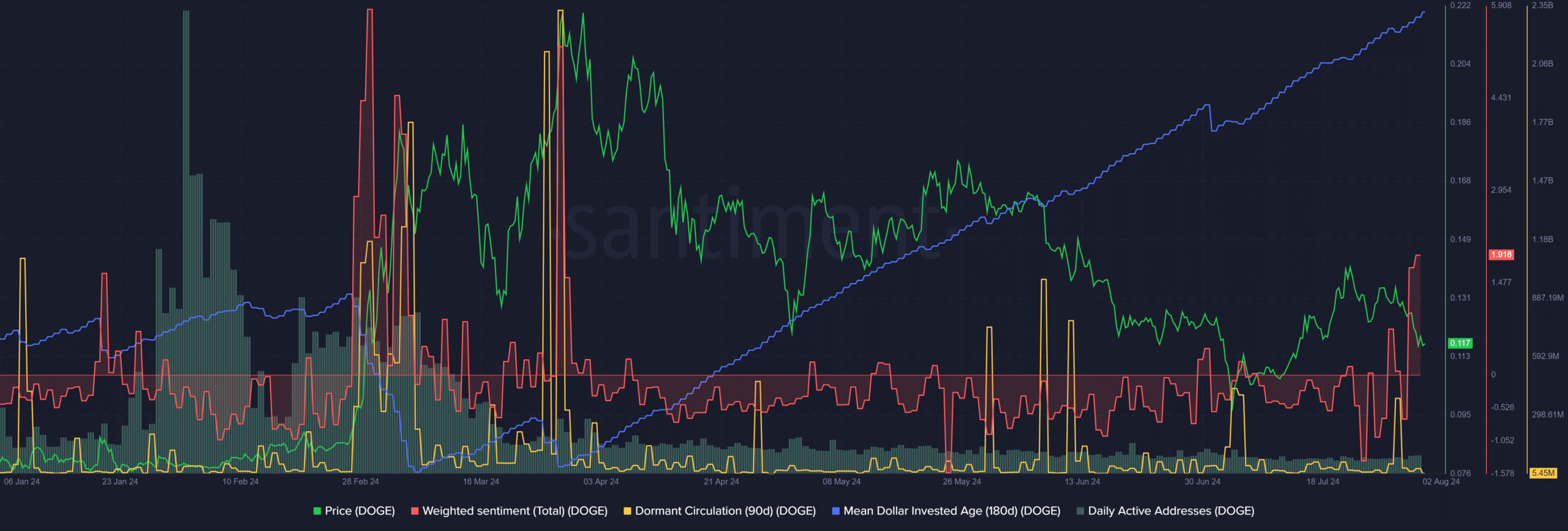

Source: Santiment

The Weighted Sentiment shot into the positive territory, evidence that social media engagement was bullish and hopeful. The other metrics did not support such a bias.

The dormant circulation saw a spike like the one in the first week of July.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

However, the Dogecoin mean dollar invested age has been on an uptrend since March. This was a sign that old tokens remained in their wallet, and new investments were not given space.

The network stagnancy was growing, and a downtrend in the metric could help the bull run to take place.