How Bitcoin surged back to $60K despite bearish trends

- At press time, Bitcoin was trading above $60,000 despite declines.

- However, the BTC price trend remained bearish.

Over the past few weeks, Bitcoin [BTC] has experienced significant volatility, characterized by rapid price movements.

Despite this turbulence, there have been encouraging signs in the market dynamics, particularly regarding trading activity and new addresses.

Recently, this heightened activity coincided with a price rebound, which helped BTC surge back to the $60,000 range.

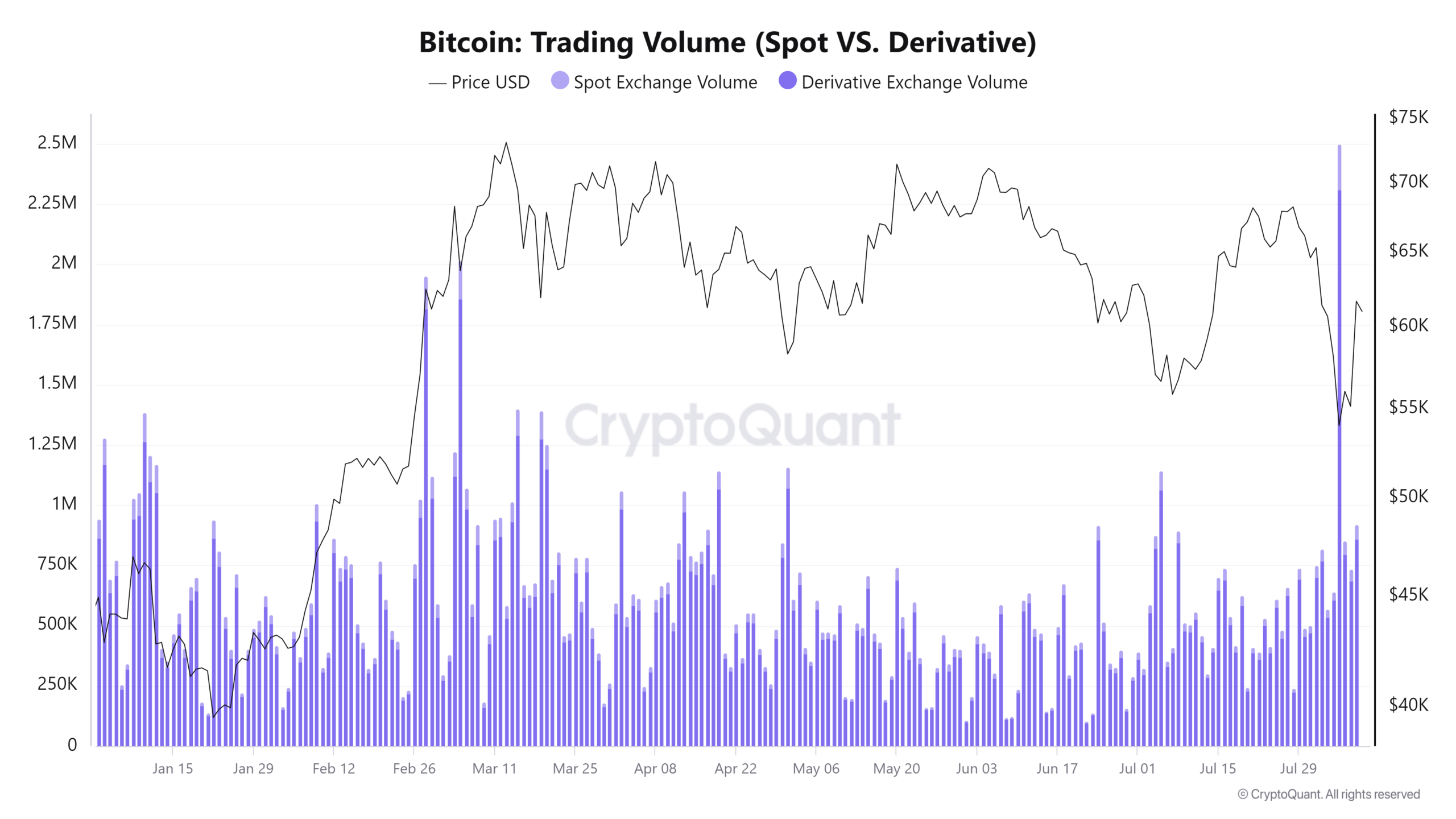

Bitcoin sets record volumes

During a recent downturn in Bitcoin’s price, which saw it drop to around $50,000, there was a significant surge in market activities.

Data showed that both derivative and spot trading volumes reached near-historic levels.

According to data from CryptoQuant, on the day of the price drop, the futures trading volume soared to an all-time high (ATH) of $154 billion.

This spike in Futures volume indicated a heightened level of trading activity, likely driven by traders capitalizing on the volatility to place large bets on the price direction of Bitcoin.

Simultaneously, the spot trading volume saw a massive increase, reaching $83 billion. This figure represented the second-highest volume in Bitcoin’s trading history.

Such a significant volume level during a sharp price decline typically suggests a mix of sell-off and buying pressure.

Existing holders are either trying to cut losses, or new or existing investors are looking to accumulate at lower prices.

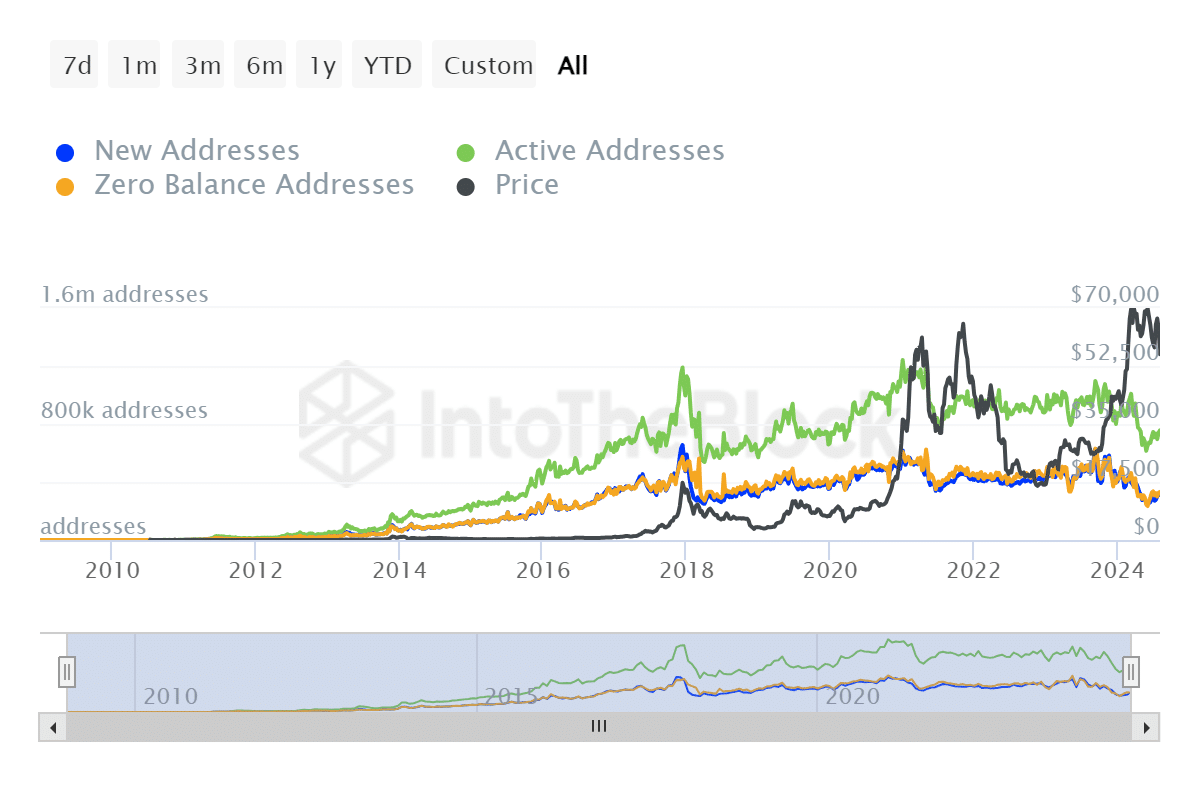

Bitcoin addresses see a slight increase

Recent data from IntoTheBlock highlighted a notable shift in Bitcoin activity, specifically regarding new addresses.

Although the trend for new daily addresses has been on a decline since November 2023, there has been a recent uptick.

This increase in the formation of new addresses over the past few weeks suggested a renewed interest from retail investors.

The uptrend in new addresses is a positive sign, typically interpreted as a bullish indicator, as it points to a growing number of new participants entering the market, particularly from the retail sector.

This change could signal a broader engagement with Bitcoin, potentially driving further market activity and investment.

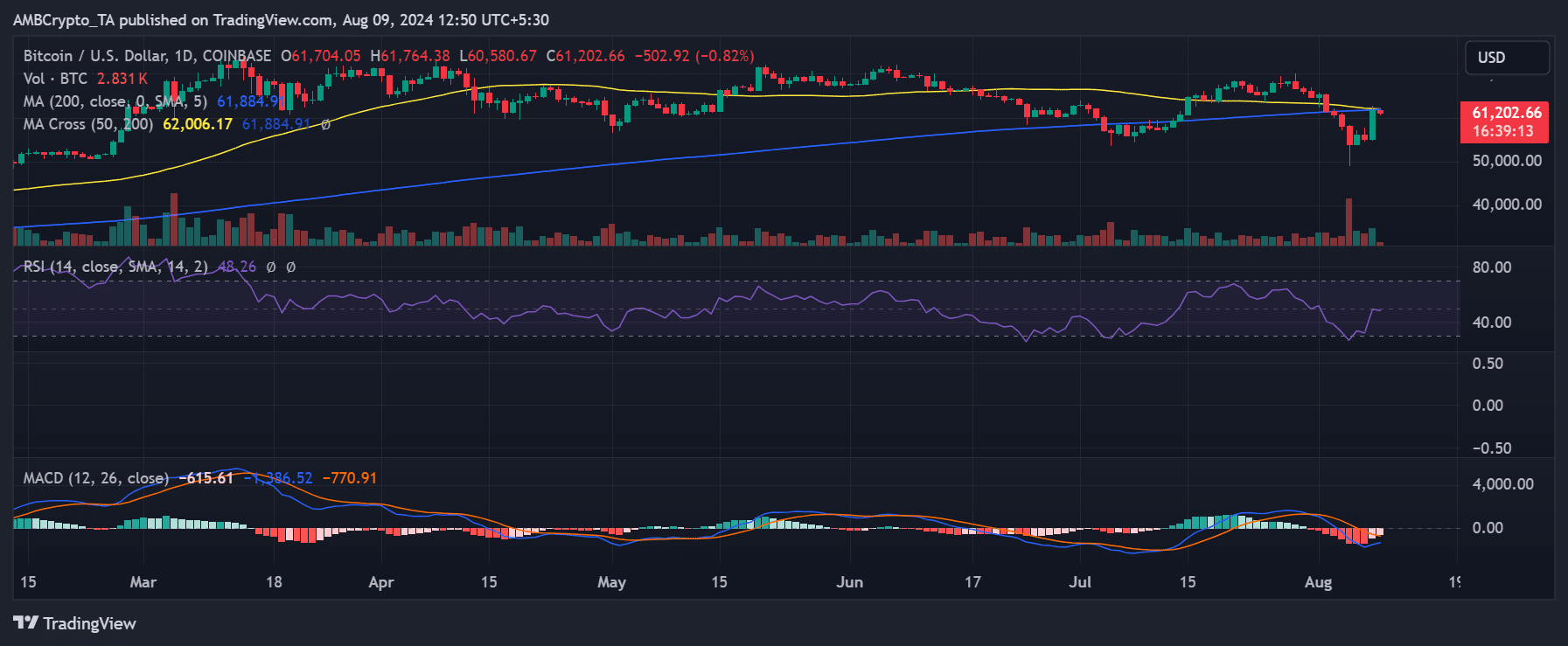

BTC sees a nice rebound

AMBCrypto’s analysis of Bitcoin on a daily timeframe has captured a significant rebound during the last trading session.

The king coin experienced an 11.89% spike, which boosted its price from around $55,000 to a peak of over $62,000. The session eventually closed with Bitcoin at $61,705 at press time.

Despite this notable increase, the surge was not strong enough to shift Bitcoin fully into a bull trend. The Relative Strength Index (RSI) remained below the neutral 50 mark, indicating that it was still in a bearish phase.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This suggests that while the price spike represents a significant positive movement, it has not yet been sufficient to alter the broader market sentiment definitively.

As of this writing, the price has seen a slight decline of over 1%, adjusting to approximately $60,900.