Exploring the effect of PEPE whales’ exit ahead of Ethereum ETF launch

- PEPE’s large holders sold off significant portions of their holdings in the last 30 days

- On-chain data revealed that the memecoin was undervalued and could rally after the event

Many investors in the market consider the upcoming Spot Ethereum [ETH] ETF launch to be bullish. However, AMBCrypto found that large holders of Pepe [PEPE] seem not to share a similar sentiment.

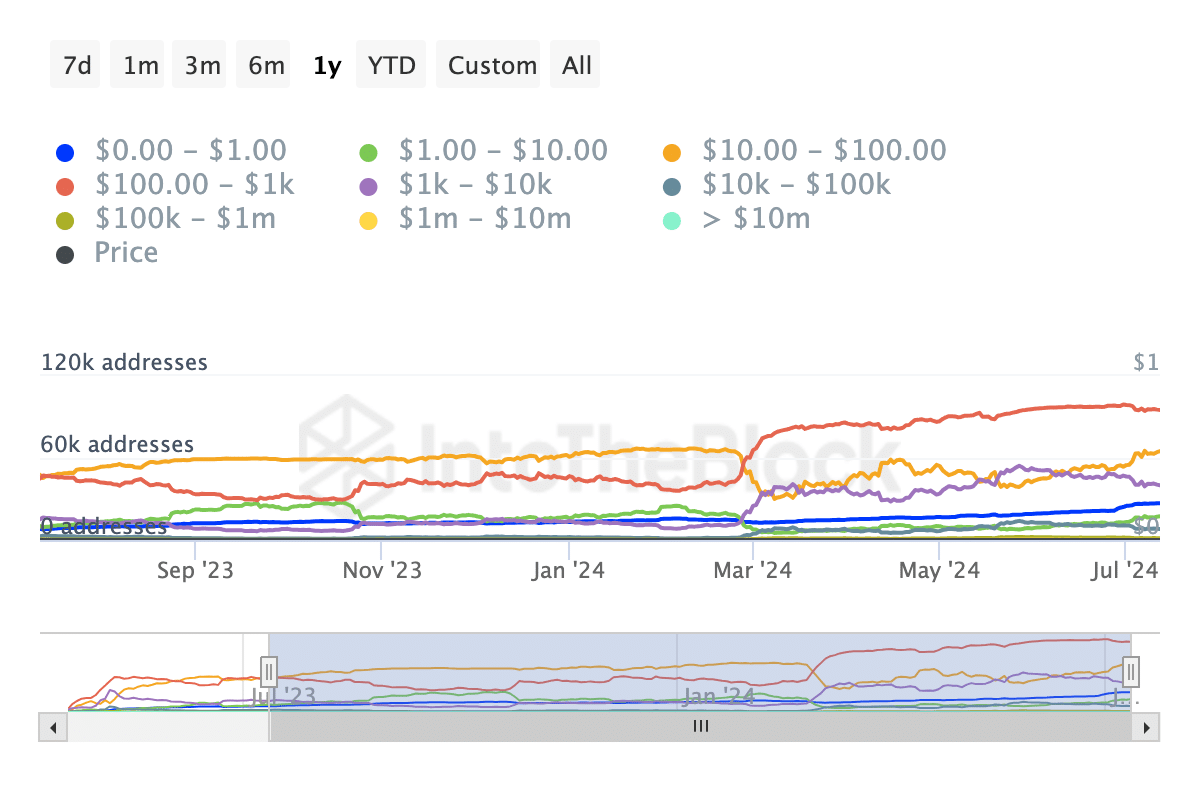

We found this information after examining the addresses by holdings data. This indicator groups addresses into different segments and shows if they are accumulating or selling off their assets.

Is the memecoin in chains?

At press time, AMBCrypto noticed that PEPE addresses holding tokens worth $100,000 to $10 million fell by double-digits. This decline implies that they have sold off some of their tokens within the last 30 days.

This is a surprise, primarily because PEPE is the top memecoin on the Ethereum blockchain. Therefore, it was expected that the big wigs of the memecoin sector would give the same bullish cues as the rest of the bullish market.

If this stays the same when the spot Ethereum ETFs go live, PEPE’s price might hike as a result of the development. However, it could be challenging to sustain the hike unless buying pressure increases.

At press time, the value of PEPE was. $0.0000087. This price meant that it was down 49.27% from the all-time high it hit on 27 May.

Going by the analysis above, further distribution could drag the price, and the token could be 55% down for the highs. However, post-Ethereum ETF’s launch, the token might perform well on the charts.

Higher highs will come later

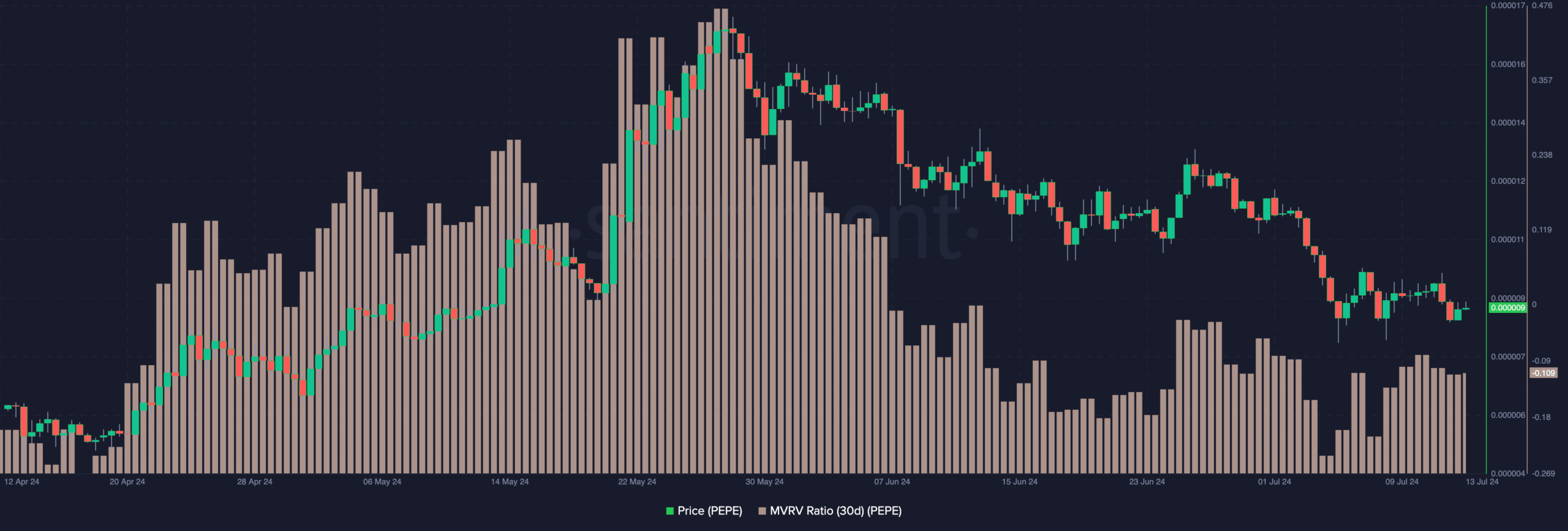

This was the signal the Market Value to Realized Value (MVRV) ratio gave. This ratio provides insights into profitability in the market.

When the ratio rises, it means that the market cap is outpacing the realized cap. In this instance, holders of a cryptocurrency have motive to sell. However, if the ratio falls, it means that the realized cap is much more than the market cap.

Most of the time, this brings about unrealized losses and there is little to no motive to sell. At the time of writing, PEPE’s 30-day MVRV ratio was -10.90%, indicating that it experienced a poor level of demand dynamics lately.

However, the good part is that the negative ratio might force market participants to hold on to the token. Therefore, the memecoin could be termed undervalued relative to its current market conditions.

As such, if buying pressure intensifies much later, we could see the price attempt to revisit its May highs. Despite the bearish signs pre-ETF launch, some analysts believe that the memecoin would gain from the development.

Realistic or not, here’s PEPE’s market cap in ETH terms

One of them is Donny Dicey, an analyst on X. The quote below is what Dicey thinks of the token’s reaction to the Ethereum ETF launch.

“This could be sparked by the Ethereum ETF going live, bringing hype back to the market for upside Not saying it’s likely, but this would cause another wave up for memecoins Even if it just makes it to 5.5 billion market cap again”