Identifying if altcoins’ losses were actually stablecoins’ gains

- The stablecoin market cap has hit its second-highest mark in history.

- USDT held over half of the market cap at press time.

Amid a general downtrend in the overall cryptocurrency market capitalization, the stablecoin sector exhibited contrasting behavior, achieving a record-high market cap.

This divergence highlighted the unique dynamics within different segments of the crypto market.

Stablecoin market cap hits record

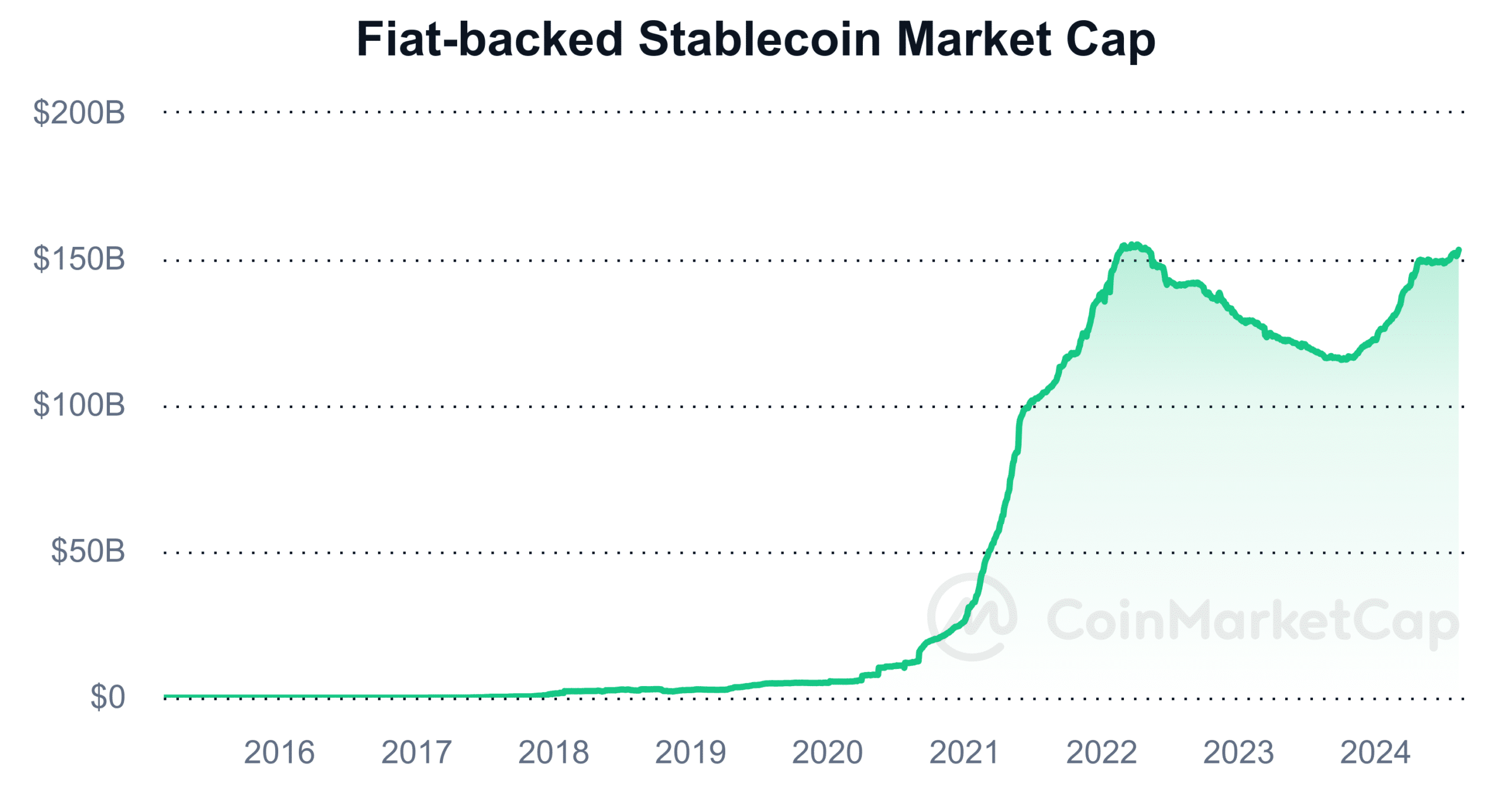

The stablecoin market capitalization has shown remarkable growth starting in late 2020, aligning with the broader expansion of the market.

This growth was largely driven by growing interest in decentralized finance (DeFi) and a wider acceptance and utilization of stablecoins.

The market cap for stablecoins reached its zenith at the onset of 2022, touching the $154 billion mark. However, this peak was followed by a noticeable retreat in market cap, dropping to around $116 billion.

Despite this downturn, the market cap showed signs of stabilization and recovery as it increased in 2024. As of this writing, the stablecoin market cap was around $153.2 billion, closely approaching its all-time high.

Possible reasons for the increase

The growth in the stablecoin market capitalization is a significant indicator of liquidity in the cryptocurrency market. It facilitates easier entry and exit for traders and investors.

Additionally, a rise in stablecoin market capitalization, especially during periods of broader market uncertainty, often reflects a flight to safety within the crypto ecosystem.

Investors turning to stablecoins, which are typically pegged to stable assets like the US dollar, suggest a cautious approach.

Conversely, a decrease in the market cap of stablecoins, paired with an inflow of funds into other, more volatile cryptocurrencies, can signal a bullish sentiment among investors. This shift often indicates an increased risk appetite.

USDT, USDC hold dominant market shares

AMBCrypto’s analysis of the stablecoin market showed that it was dominated by Tether [USDT] and USD Coin [USDC].

As of press time, Tether’s market cap stood at over $115 billion, maintaining its position as the leading stablecoin by a considerable margin.

In comparison, USDC held a market cap of over $34 billion, firmly placing it as the second most dominant stablecoin.

A detailed look at the changes in market cap revealed that USDT has experienced notable increases recently. One significant jump occurred around the 8th of July, when its market cap surged from $114 billion to $115 Billion.

Following this, there has been a slight uptick in its market cap, now recorded at approximately $115.4 Billion.