BNB’s road to recovery – Tracing the path to $600

- BNB’s price declined by more than 3% in the last seven days

- Few of the on-chain metrics remained bearish, despite its 24-hour recovery

As Bitcoin [BTC] struggled to raise its price, several altcoins like BNB also met a similar fate. However, things were starting to change in the last 24 hours. In fact, if the latest data is to be believed, then altcoins might soon record a bull rally, one which could allow BNB to recover from its latest losses.

BNB turns green

World Of Charts, a popular crypto analyst, recently shared a tweet highlighting an interesting development. As per the same, the market capitalization of altcoins is now moving inside a pattern on the charts.

In fact, the bullish falling wedge pattern emerged on the chart back in March and at press time, it was testing the lower support of the pattern. If altcoins manage to test that pattern, then investors might see altcoins rallying, in turn allowing BNB to turn bullish.

In fact, at the time of writing, BNB already seemed to be recovering somewhat. According to CoinMarketCap, BNB fell by over 3% in the last seven days. On the contrary, the altcoin registered some gains in the last 24 hours or so.

Will BNB remain bullish?

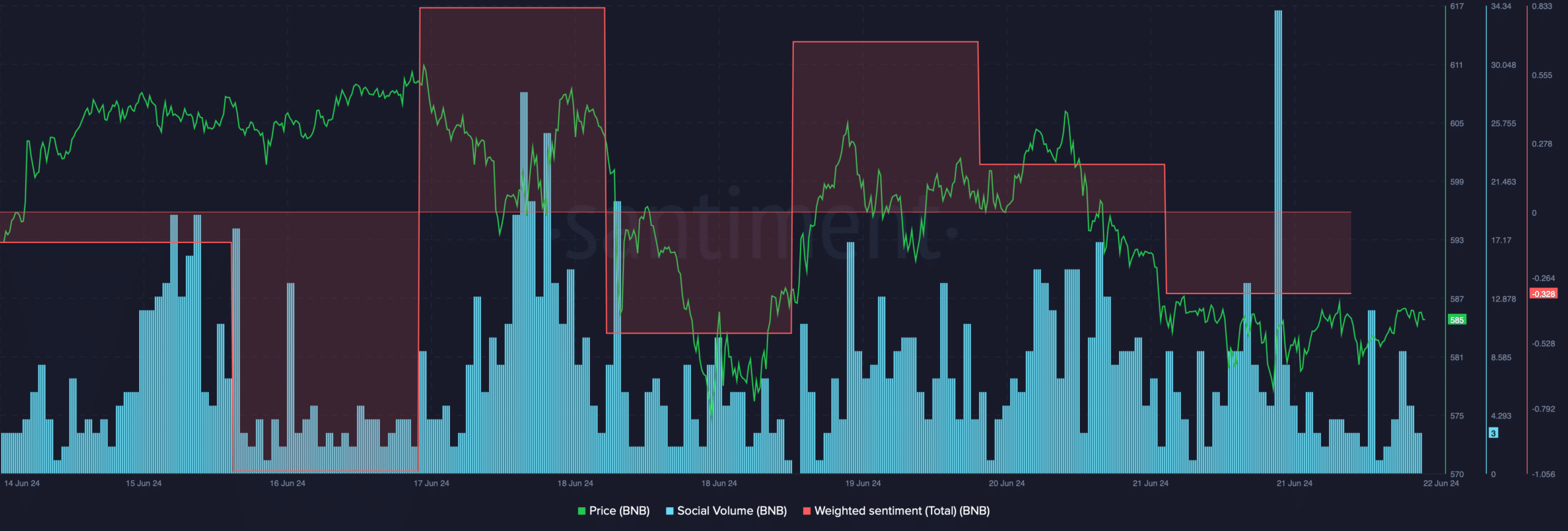

Since there were chances of BNB recovering from last week’s price drop, AMBCrypto took a closer look at the coin’s state to better understand what to expect. As per our analysis of Santiment’s data, BNB’s social volume spiked sharply on 21 June, highlighting a rise in the coin’s popularity in the crypto space.

Additionally, our look at CFGI.io’s data revealed that BNB’s fear and greed index had a reading of 37% at press time. This meant that the market was in a “fear” phase. Historically, whenever the fear and greed index shows that the market is in a “fear” phase, it is usually followed by a price uptick.

However, not everything was in the coin’s favor. For instance, the coin’s weighted sentiment was in the negatives. A drop in this metric alludes to the dominance of bearish sentiment across the market.

On top of that, Coinglass’ data revealed that BNB’s long/short ratio noted a sharp decline. A low long/short ratio indicates a higher proportion of short positions relative to long positions in a trader’s portfolio. The aforementioned finding underlined the bears’ dominance, with a greater emphasis on selling or shorting assets.

Read Binance Coin [BNB] Price Prediction 2024-2025

If bears take over once again and push the coin’s price down, then investors might soon see BNB dropping to $571. However, if bulls manage to beat the bears, then there are chances of BNB hitting $613 in the coming weeks.