Bitcoin: Even as profitability jumps, gains elude investors

- About 12.7% of Bitcoin’s total circulating supply became profitable in the recent rally.

- The supply of Bitcoin on exchanges was little more than 6% of the overall supply.

Bitcoin [BTC] has held at its yearly highs in recent weeks, following the June rally that brought cheers and hopes to market participants. Compared to the November 2022 lows, this was a remarkable turnaround as prices have nearly doubled to $31,288.40 at press time, data from CoinMarketCap revealed.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Supply in profit increases

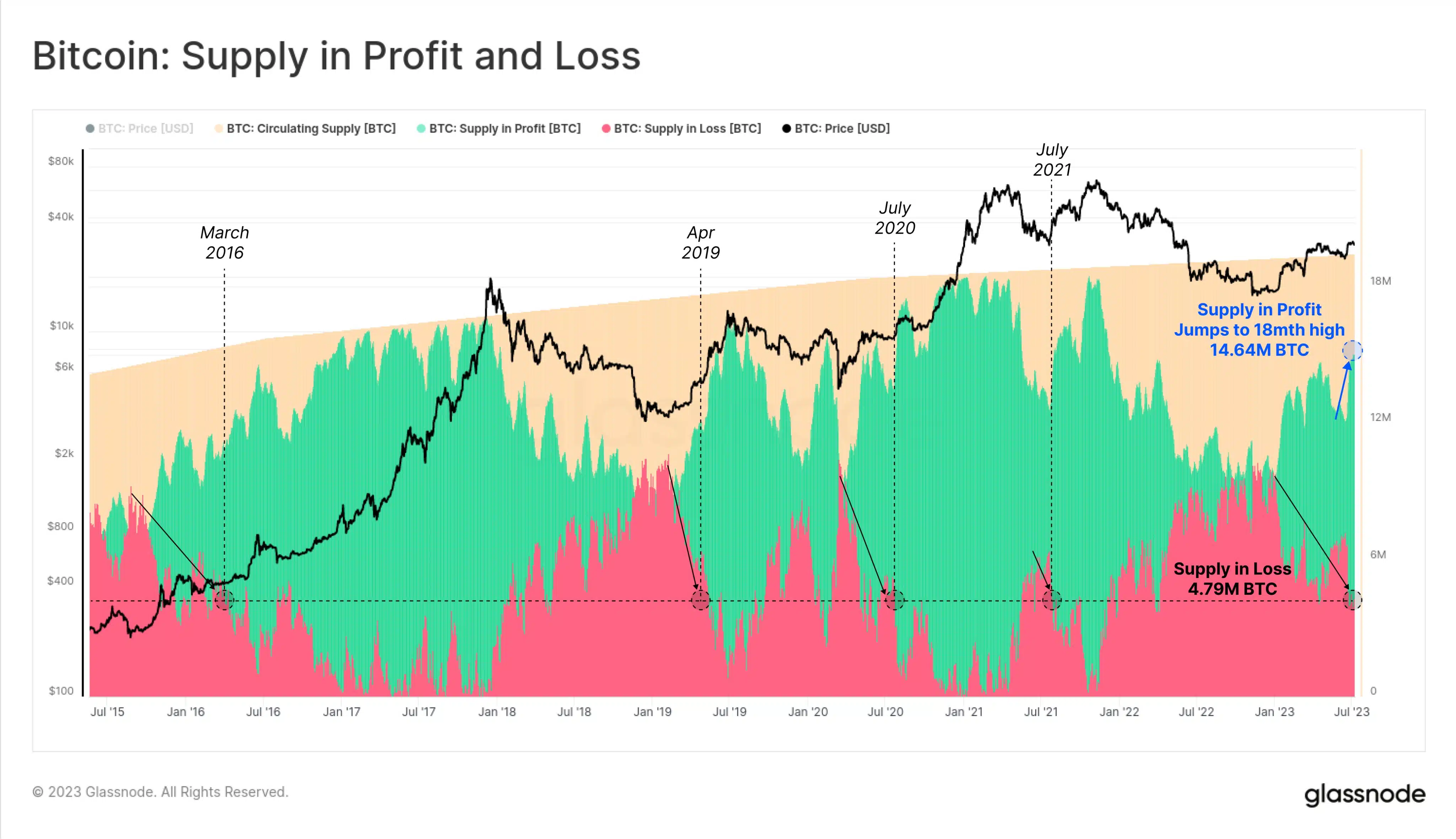

The surge in prices boosted the overall profitability of the Bitcoin network. According to on-chain analytics firm Glassnode, the total supply in profit soared to an 18-month high as of 13 July.

As evident in the graph below, a large chunk of this supply was accumulated during the market’s dip to $25,000 in mid-June. Consequently, nearly 2.47 million loss-making BTC tokens, amounting to 12.7% of the total circulating supply, became profitable.

On the other hand, the supply in loss plunged to just 4.79 million, reminiscent of levels seen during the bull market of July 2021. With a profit-to-loss supply ratio of 75:25, the market entered a stage of equilibrium, as per Glassnode’s analysis.

This phase, also referred to as the ‘re-accumulation period’, has historically followed the recovery from the lows of a bear market, and trends sideways for extended periods of time.

Traders HODLing on

While the network on average was in profit, there were no clear indicators suggesting that investors were locking in gains. At the time of publication, the supply of Bitcoin on exchanges was little more than 6% of the overall supply, indicating little liquidity for spot trade.

Furthermore, whale addresses, who were active during the first few days of the recent bull market, lowered their exchange interaction considerably. The count of transactions transferring BTC coins worth more than $100,000 declined from the recent peak.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Open Interest surges

While BTC was largely insulated from the regulatory tussles in the U.S. market, the news of payments-focused crypto Ripple [XRP] clearing a major legal hurdle could add more bullishness to the king coin in the days to come.

At the time of writing, BTC was up 2.06% to $31,186.79, as per CoinMarketCap. Speculative interest in BTC spiked considerably over the last 24 hours. According to Coinglass, the Open Interest (OI) in BTC futures contracts jumped almost 5% to $14.9 billion, a new yearly high.