Bitcoin, a better investment option than gold now? A Sharpe look says…

- Bitcoin’s Sharpe Ratio was higher than Gold’s and that of other key equity and commodity markets

- Bitcoin’s 30-day realized volatility in the first week of April was the highest since late 2022

World’s largest cryptocurrency Bitcoin [BTC] outperformed mainstream financial instruments of the market in risk-adjusted returns, all while maintaining its typical “high-volatility” characteristics.

The best investment option currently?

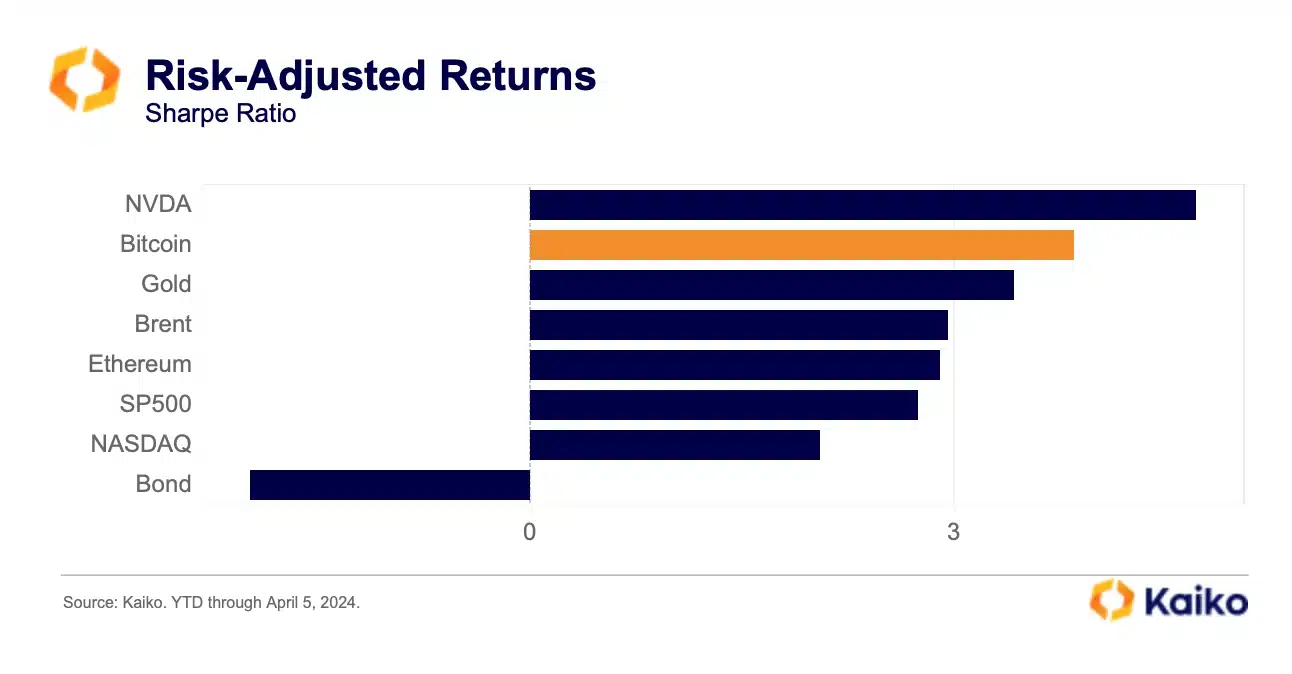

According to crypto-market data provider Kaiko, Bitcoin’s Sharpe Ratio was higher than Gold’s and that of other key equity and commodity markets in early April.

The Sharpe ratio is a widely used metric in finance, measuring the risk-adjusted returns on a financial instrument. Put simply, it compares the performance of the asset relative to its volatility – Both downside and upside.

Typically, a Sharpe ratio of one or higher is considered a good risk-adjusted return rate. In the aforementioned graph, Bitcoin’s Sharpe ratio is around four.

High volatility, but higher returns

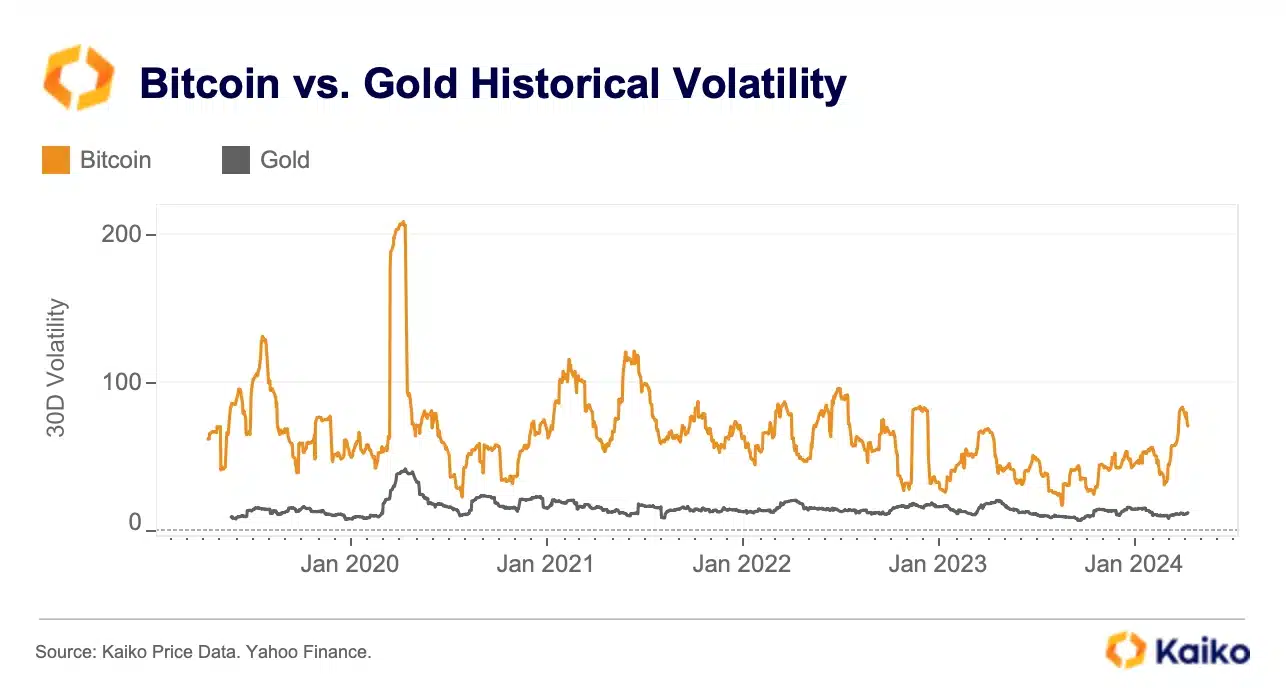

Here, it is worth noting that Bitcoin’s 30-day realized volatility in the first week of April was its highest since late 2022. Moreover, it exceeded volatility of assets like Gold significantly. This suggested that despite the wild swings in prices, Bitcoin emerged as an attractive investment option.

Bitcoin has bounced 60% since the beginning of 2024, and more than 4x from the lows of the 2022 bear market. At the time of writing, it was trading around its high $67k levels, with multiple analyses predicting a strong bullish surge in the months to come.

Is your portfolio green? Check out the BTC Profit Calculator

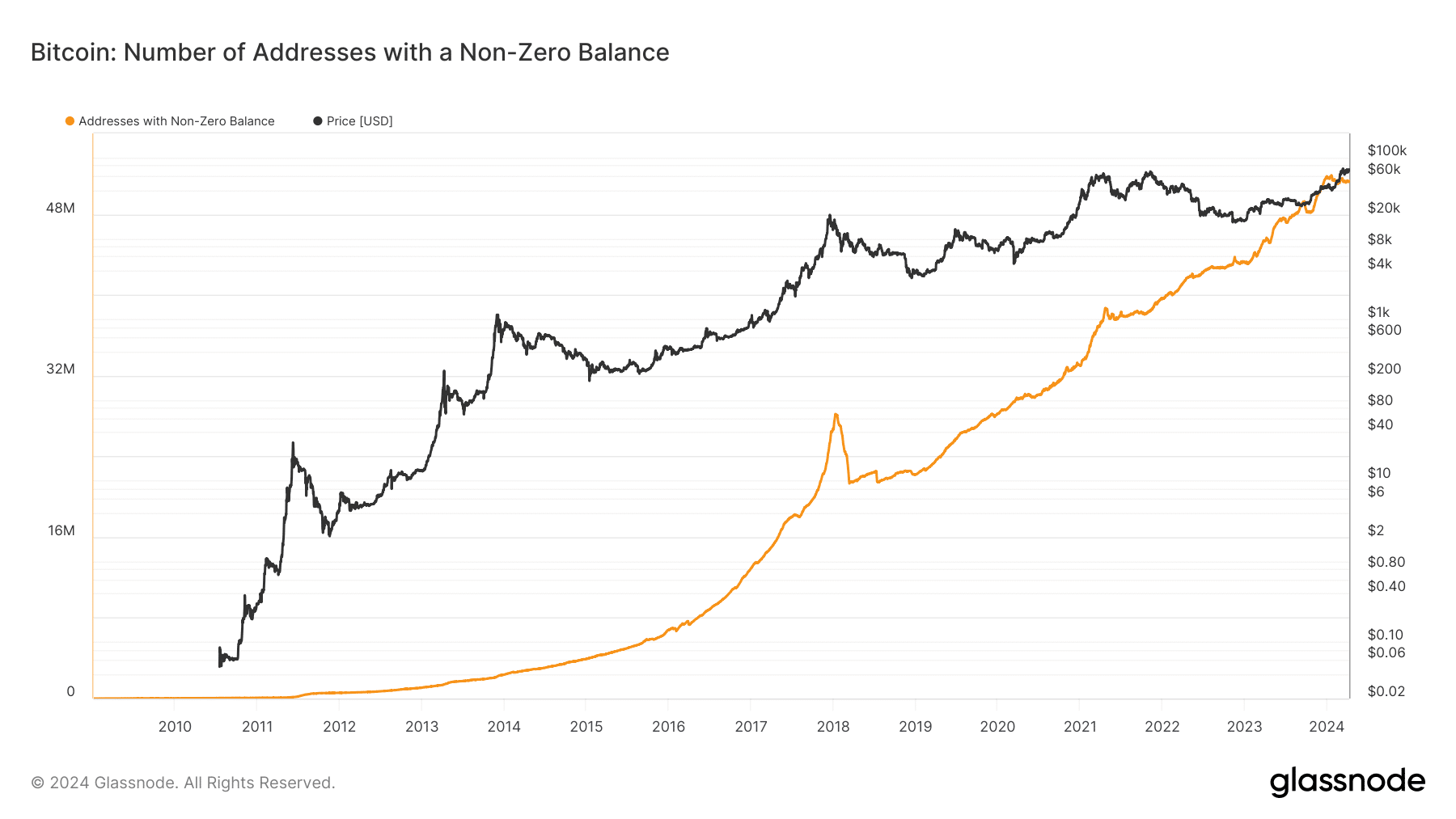

A higher risk-adjusted return bodes well for the future adoption of the world’s largest cryptocurrency. In fact, the inklings of this are already noticeable too.

Finally, according to AMBCrypto’s analysis of Glassnode’s data, Bitcoin wallets with non-zero balances have grown sharply in recent years, implying confidence in the asset’s long-term potential.