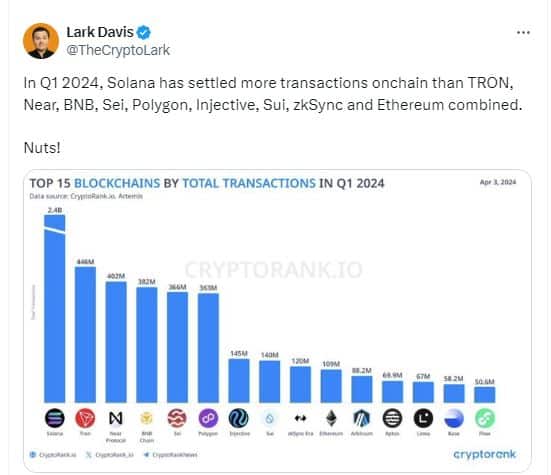

Solana’s 2.4 billion high in Q2, here’s what it means for you

- Solana handled more transactions than the next 9 chains combined.

- Solana was the third-highest revenue generator in March.

Solana [SOL] signed off the first quarter of 2024 on a high, emerging as the most widely utilized blockchain by some distance.

A look at Solana’s Q1 achievements

An X post shared by popular crypto influencer Lark Davis showed Solana facilitating a whopping 2.4 billion transactions in Q1. The dominance could be gauged by the fact that the combined count of transactions handled by the next nine networks on the list was lower than that of Solana.

While Solana has historically dominated transaction activity in the Web3 space, last month’s memecoin frenzy pushed it to its limits. Indeed, a barrage of coins were created on the chain out of thin air, drawing hordes of retail traders.

The speculation led to more number of transactions, and in turn, higher fee revenue for the network.

As per AMBCrypto’s analysis of Token Terminal data, Solana raked in more than $34 million in March, becoming the third-highest revenue generating platform in Web3. Compared to the previous month, Solana’s revenue jumped nearly 6x.

Apart from fees, the number of users actively participating on the network also surged, more than doubling from 426k in February to 932k in March.

Solana gets a reality check

While Solana was clearly a beehive of activity in Q1, the high network usage started to expose few chinks in its armory.

AMBCrypto reported previously how the chain was struggling with high transaction failure rates and that its developers were unable to issue a quick fix to address the problem.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The FUD from network congestion impacted market sentiment for the native coin, SOL. According to AMBCrypto’s analysis of Santiment’s data, the fifth-largest cryptocurrency was grappling with more negative commentary around it than positive in the last week.

The pessimism translated into a 7% decline in its price over the week.