Ethereum a ‘major disappointment’ – Expert delivers harsh verdict!

- Analysts predict peak cycle for Bitcoin and Ethereum amid regulatory uncertainty.

- Regulatory debates and SEC allegations intensify negative sentiment toward Ethereum.

As Bitcoin [BTC], the leading cryptocurrency, dips below the $60,000 threshold, analysts suggest that BTC may have reached its peak for this cycle.

Ethereum [ETH] seems to be mirroring the movements of Bitcoin, as both cryptocurrencies are currently experiencing a downward trend.

Commenting on the uniqueness of this crypto cycle, crypto veteran Alex Krüger said,

“The crypto cycle has been almost entirely driven by the bitcoin ETF.”

He further added,

“ETH has been a major disappointment, but it has performed well overall for stakers and airdrop farmers.”

Why is Ethereum losing its limelight?

Undoubtedly, Bitcoin achieved remarkable performance by reaching new record highs in this cycle. However, Ethereum’s position has declined, falling below Solana in terms of product-market fit and retail trader popularity.

This raises a question: Can Ethereum’s price plummet to $2500 within the next 7 days?

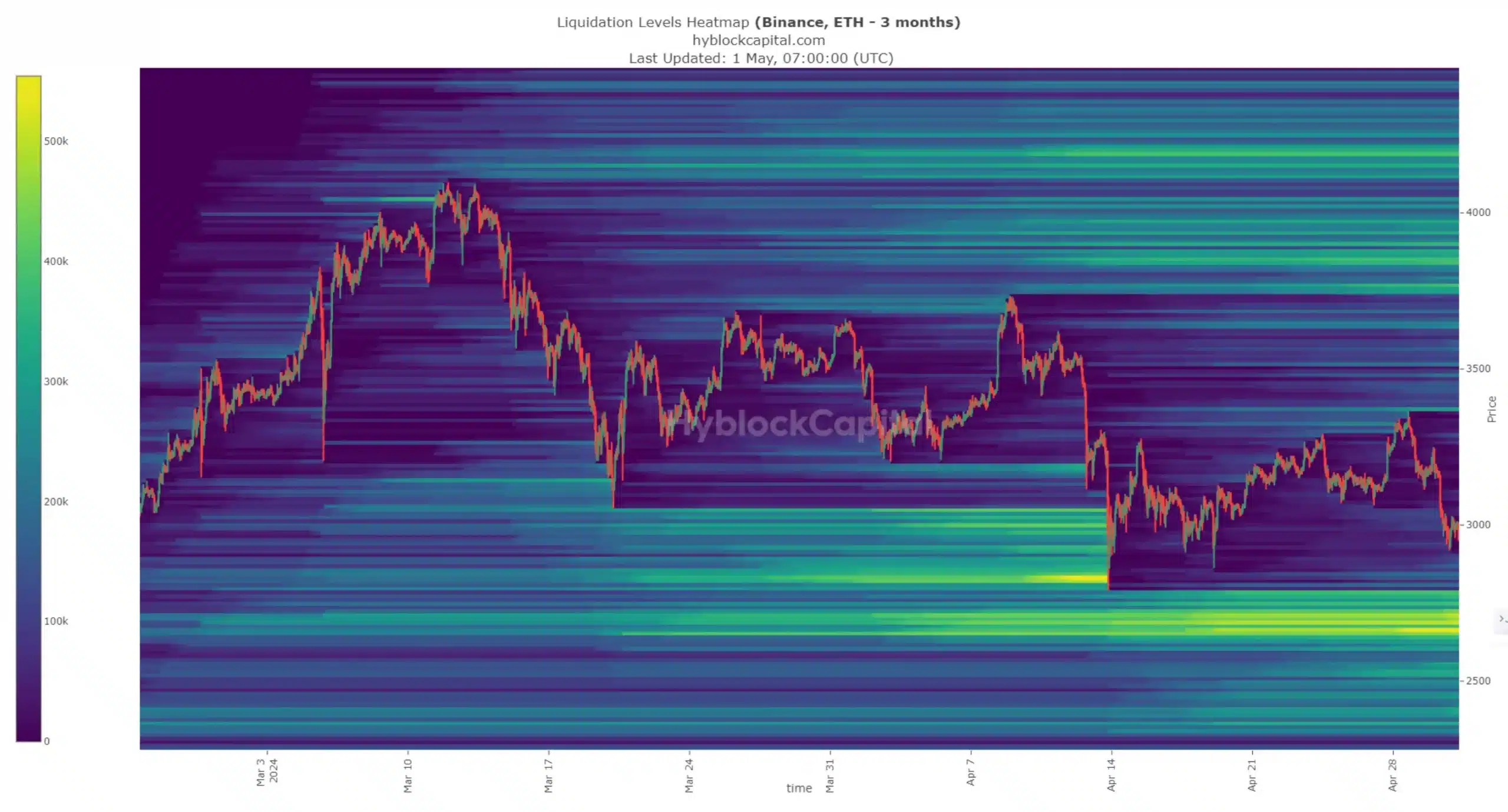

Well, to answer this, AMBcrytpo analyzed the liquidation levels for ETH.

According to the analysis, the Ethereum market has a cluster of liquidation levels between $2640 and $2750, attracting traders due to high liquidity. Additionally, this price range aligns with a bullish order block observed at the range highs, further reinforcing its significance.

This underlines that Ethereum’s price is expected to decline to this liquidity pocket before a potential reversal.

The concerns surround ETH’s classification as a security

Moreover, the ongoing debate surrounding whether ETH is a security has intensified negative investor sentiment toward Ethereum.

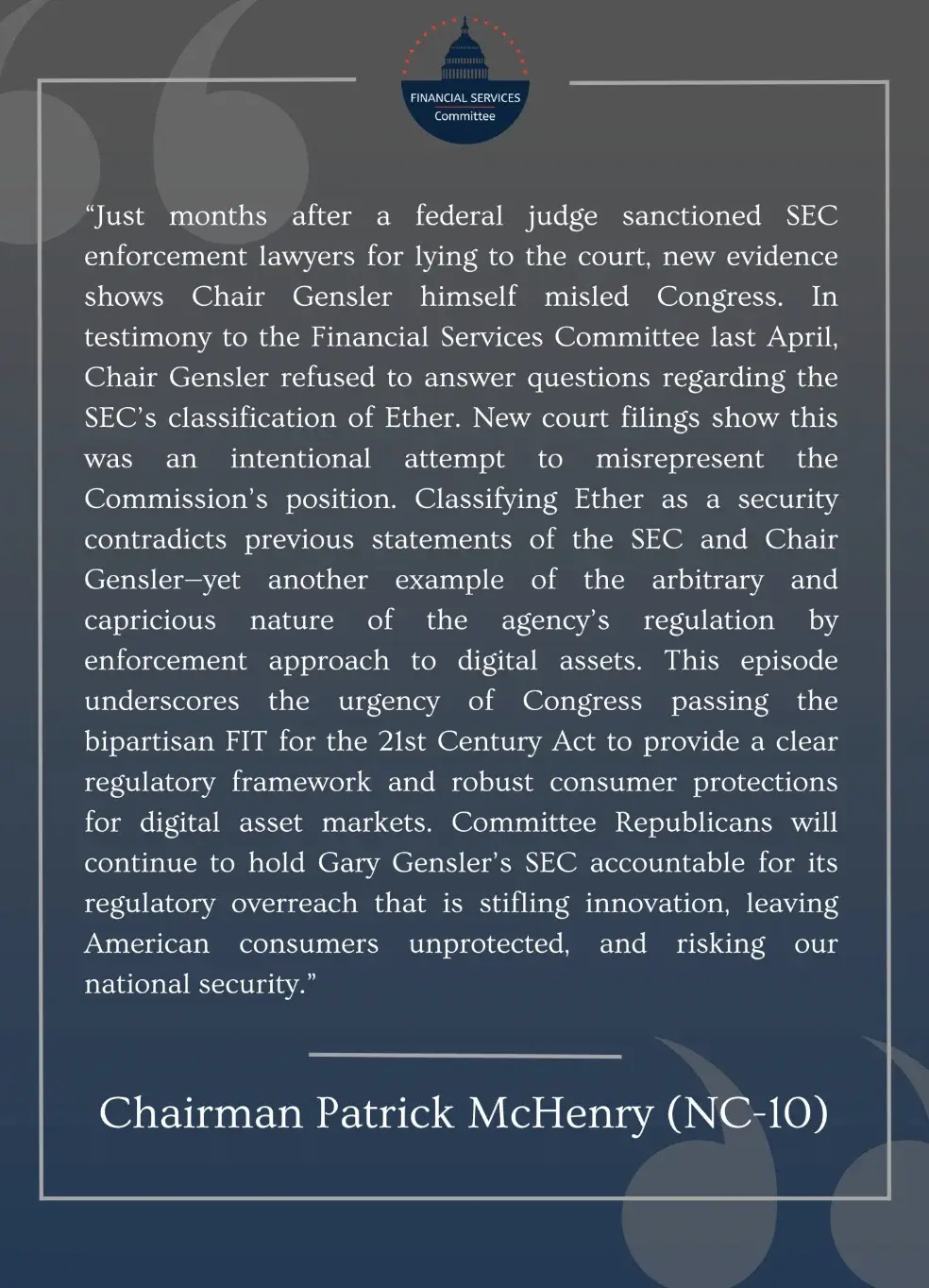

Amidst these metrics, a new development also took place wherein Rep. Patrick McHenry, the chairman of the House Financial Services Committee noted,

“New court filings indicate that @SECGov Chair Gary Gensler knowingly misled Congress when pressed on the classification of #ETH at a @FinancialCmte hearing to conduct oversight of his agency.”

This highlights the increasing uncertainty surrounding Ethereum’s regulatory status and its impact on investor sentiment.

Echoing similar sentiments, @TheDustyBC, a content creator, took to X (Formerly Twitter) and said,

“Ethereum not being kind on the feelings today.”

Way forward

However, now with the hawkish stance at the Federal Open Market Committee (FOMC) meeting on the 1st of May. And, the Hong Kong ETFs being a major disappointment, the execs are still waiting for the tables to turn. Needless to say, Krüger claims,

“The cycle is not over.”