Is Cardano’s 20% hike enough? Not if Litecoin has its say and…

- ADA’s performance fueled by rising net positioning and another notable change

- Altcoin shares a strong correlation with LTC, indicating that its price might continue to climb

Cardano’s [ADA] price climbed by 20.75% in the last seven days and hit a weekly high of $0.42. The price hike ensured that the token, which was at some point one of the market’s worst performers, became the top gainer out of the top 10.

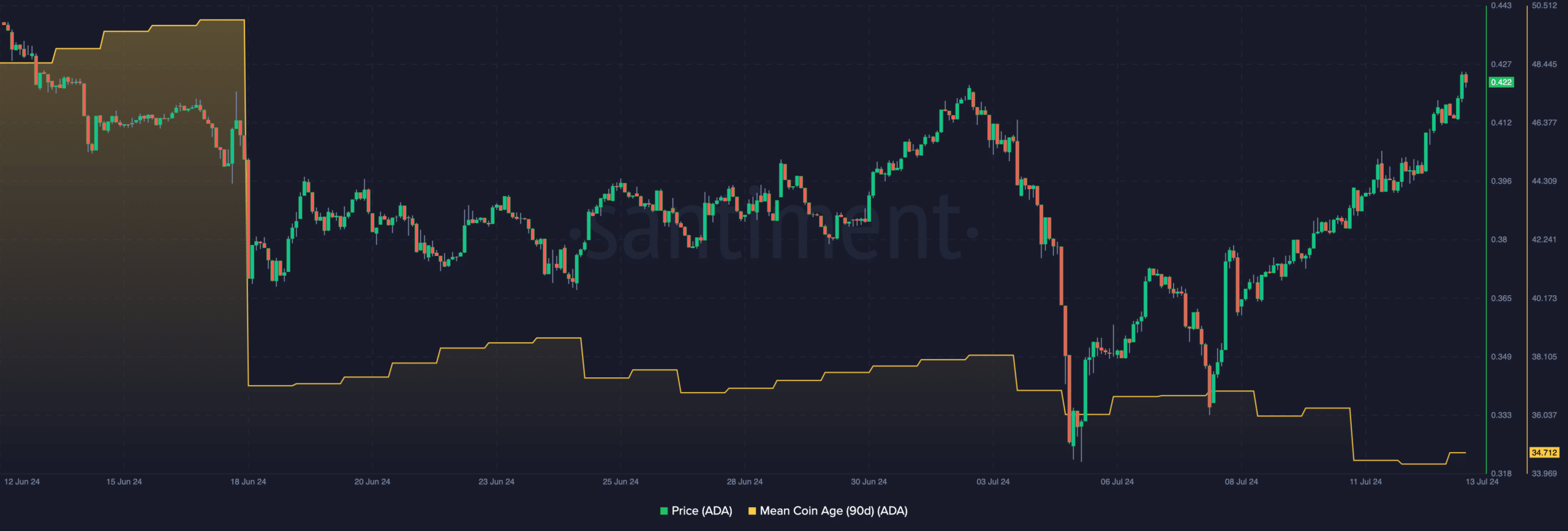

However, ADA did not just rise to the top without any solid ground. According to AMBCrypto’s on-chain analysis, the Mean Coin Age was one of the reasons why the price jumped as it did.

Often called by its short form, the MCA measures the average age of all tokens on the blockchain. When the coin age increases, it means that holders of a cryptocurrency are moving their old tokens.

Less distribution, more interest and accumulation

In most cases, this leads to distribution and affects the price negatively. On the other hand, when the coin age falls, it means that holders are choosing to keep their coins off exchanges.

In our analysis using Santiment’s data, we observed that the 90-day MCA went down to 34.71. This indicated that Cardano holders have been retiring their assets into non-custodial wallets.

If this remains the case, there is a high chance that ADA’s price would move closer to $0.45.

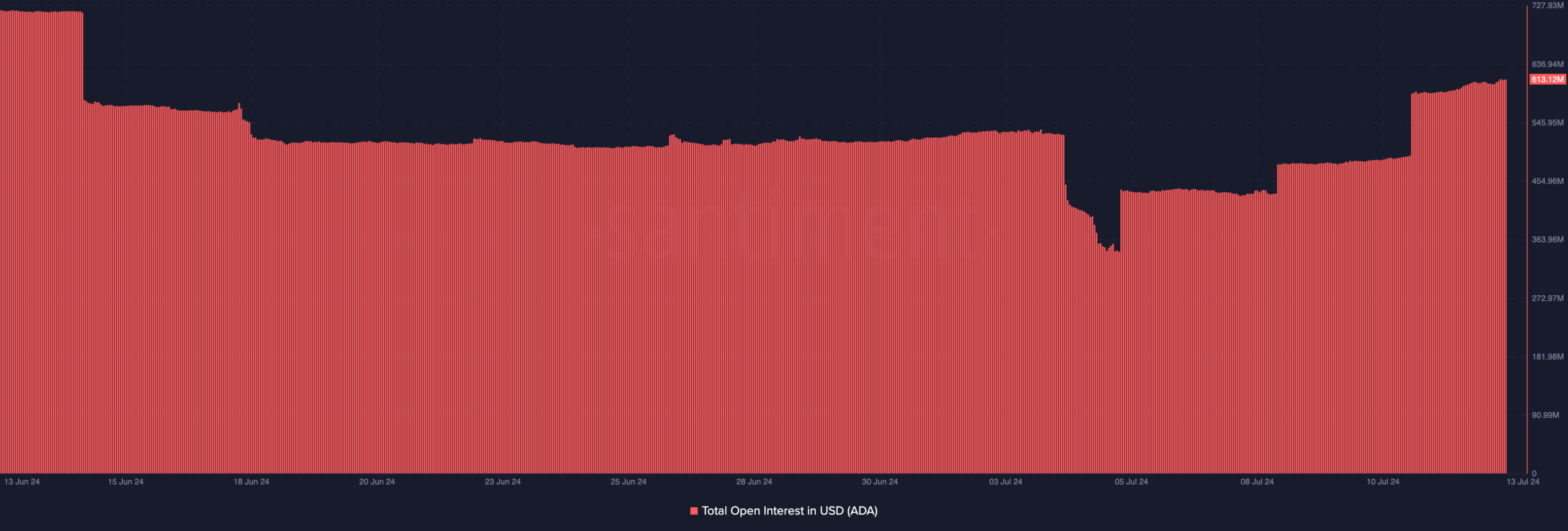

Another indicator responsible for the price hike is the Open Interest (OI). Here, Open Interest refers to the sum of the value of contracts open in the market. When the OI increases, it means that there has been a hike in net positioning. Put simply, an increase in the OI implies that traders are adding more liquidity to the market.

However, when the OI falls, traders are closing positions and withdrawing money from the market. When this happens, it puts the price at risk of a decline.

For Cardano, on-chain data revealed that the Open Interest was $613.12 million at press time. This was the metric’s highest level in over a month.

Should the value continue to rise, it could serve as strength for ADA’s sustained uptrend. If this happens, there is a high chance Cardano’s native token might climb to $0.45.

If Litecoin moves, will Cardano follow?

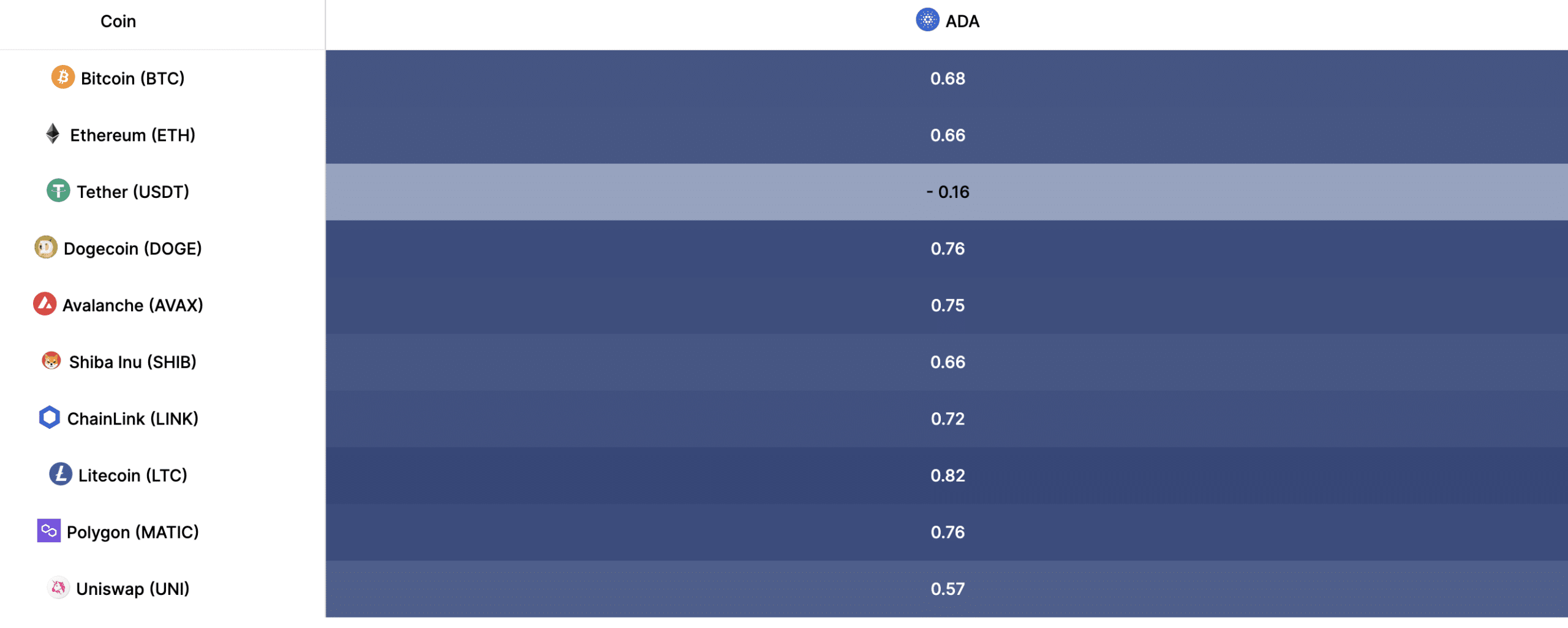

Additionally, AMBCrypto’s analysis of Cardano’s correlation with other cryptocurrencies suggested that the price might continue to climb too. Of all cryptos in the top 20, Litecoin [LTC] is the one ADA shares the strongest correlation with.

As an indicator provided by IntoTheBlock, the Correlation Matrix ranges from -1 to +1. When the reading is close to -1, it means a divergence in the prices. However, a reading close to +1 implies that prices are mostly moving in the same direction.

Realistic or not, here’s ADA’s market cap in LTC terms

That was the case with ADA and LTC. Moreover, like Cardano’s price, Litecoin also hit a weekly high recently.

With a value of $70.56 at press time, if LTC continues to climb, there is a high possibility ADA’s price will follow suit.