Ethereum dips as ICO whale unloads: What’s next for ETH traders?

- Ethereum’s price fell 2.7% after a $19.3 million transfer to Kraken.

- The transfer indicates possible sell-off activity by long-term Ethereum holders.

Ethereum [ETH] has declined by 2.7% in the past 24 hours, trading at $3,442. This marks a substantial decrease from its March peak of over $4,000.

Concurrently, an interesting trend has surfaced within the Ethereum market, with on-chain data revealing that participants from Ethereum’s initial coin offering (ICO) have started to liquidate holdings that are nearly a decade old.

Whale moves and market ripples

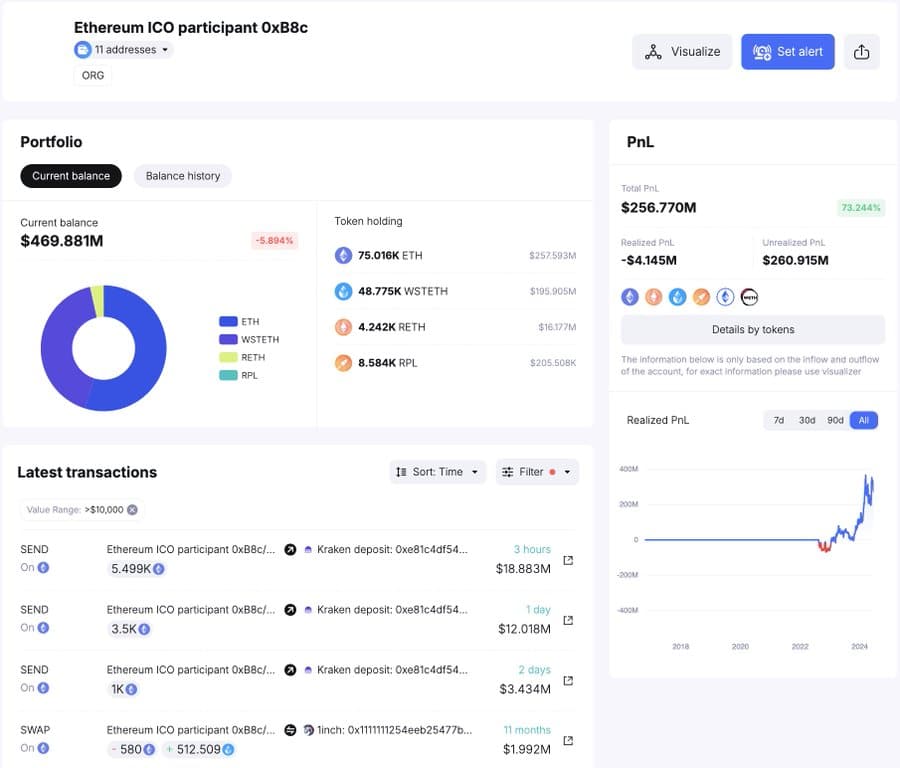

Recent on-chain data from Spotonchain revealed that an Ethereum ICO whale has transferred substantial holdings to the Kraken exchange, totaling approximately 5.5K ETH or about $19.3 million.

This move precedes a notable sell-off that pushed ETH’s price downwards.

Further analysis reveals that this individual, who originally acquired 150K ETH during Ethereum’s ICO phase at a mere $0.31 per token, has been actively managing their substantial crypto assets.

Over the past few days, this whale has moved 10K ETH, valued at roughly $35.4 million, to Kraken.

Despite these large transactions, they retain about 139K ETH spread across three wallets, currently valued around $469 million.

Source: Spotonchain

The actions of such significant market players often lead to speculation about potential price impacts.

Transferring large amounts of cryptocurrency to an exchange typically suggests preparation for selling, which can lead to price drops due to increased supply on the market.

Diverging signals in Ethereum’s market

In this case, while there’s an observable correlation between the whale’s transfers and ETH’s price movements.

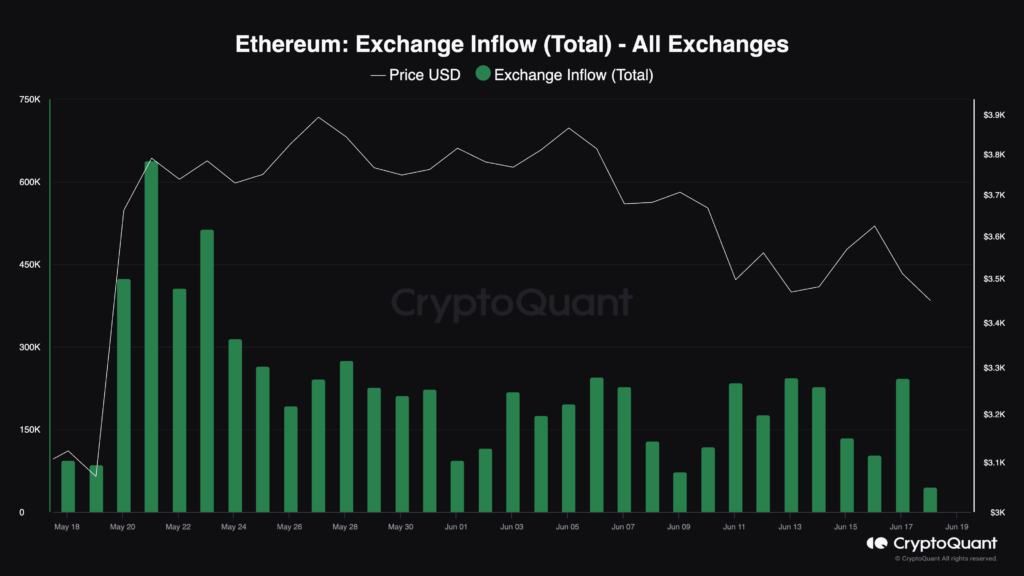

Broader market data from CryptoQuant indicates a general decrease in ETH being moved to exchanges—down from over 600K ETH in March to under 50K ETH currently.

This trend suggests that, aside from a few large players, the overall investor sentiment is leaning more towards holding rather than selling.

Source: CryptoQuant

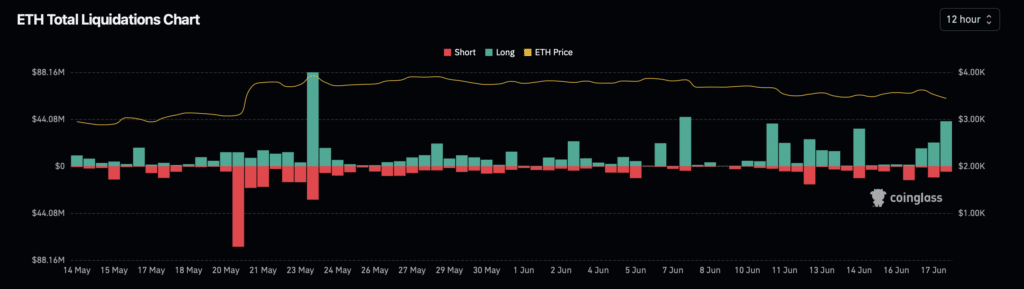

Recent liquidation data also paints a stark picture of the market’s volatility. In the past 24 hours, Ethereum liquidations have contributed $92.8 million to a total of $465.20 million across various cryptocurrencies.

Such high liquidation volumes can exacerbate price declines, leading to further market instability.

Source: Coinglalss

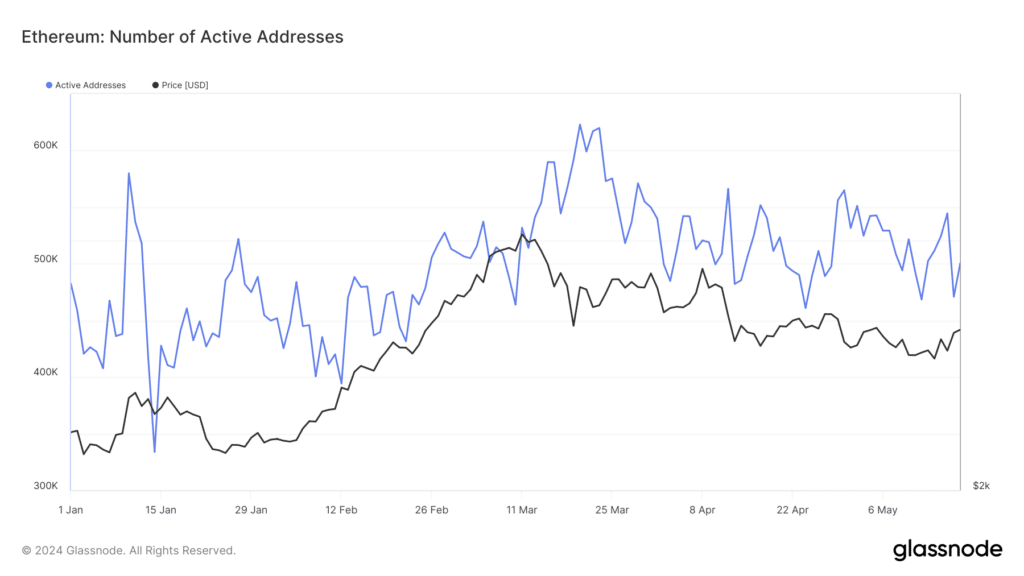

However, it’s not all bleak for Ethereum. Glassnode data shows a rise in new Ethereum addresses, signaling fresh interest and potential support for the cryptocurrency.

This growth could buffer the negative effects of large-scale sell-offs, stabilizing the price over time.

Source: Glassnode

Moreover, AMBCrypto suggests that current price levels might be nearing a bottom, indicating a potential turnaround in the near future.

If this assessment holds true, the recent price drops could present a buying opportunity for investors believing in Ethereum’s long-term value.