How EigenLayer seems to be giving a boost to ETH staking

- EigenLayer was the second-largest DeFi protocol at the time of writing.

- EigenLayer’s exponential growth spurred rise of projects like Ether.fi.

EigenLayer’s growth since the beginning of 2024 has been nothing short of historic.

The restaking protocol saw a mindboggling 11x jump in total value locked (TVL) since the 1st of January, according to AMBCrypto’s examination of DeFiLlama data. The DeFi project, which was currently the second-largest, was not even in the top 10 list when 2024 began.

Restaking>>Staking

One of the hottest new DeFi narratives, restaking involves repurposing staked ETH to extend security to other applications, thus allowing stakers to earn extra rewards on their investments.

Apart from staking ETH natively, users have an option of staking the liquid derivatives of their staked assets (LSD), such as those from Lido [LDO], Rocket Pool, and Coinbase.

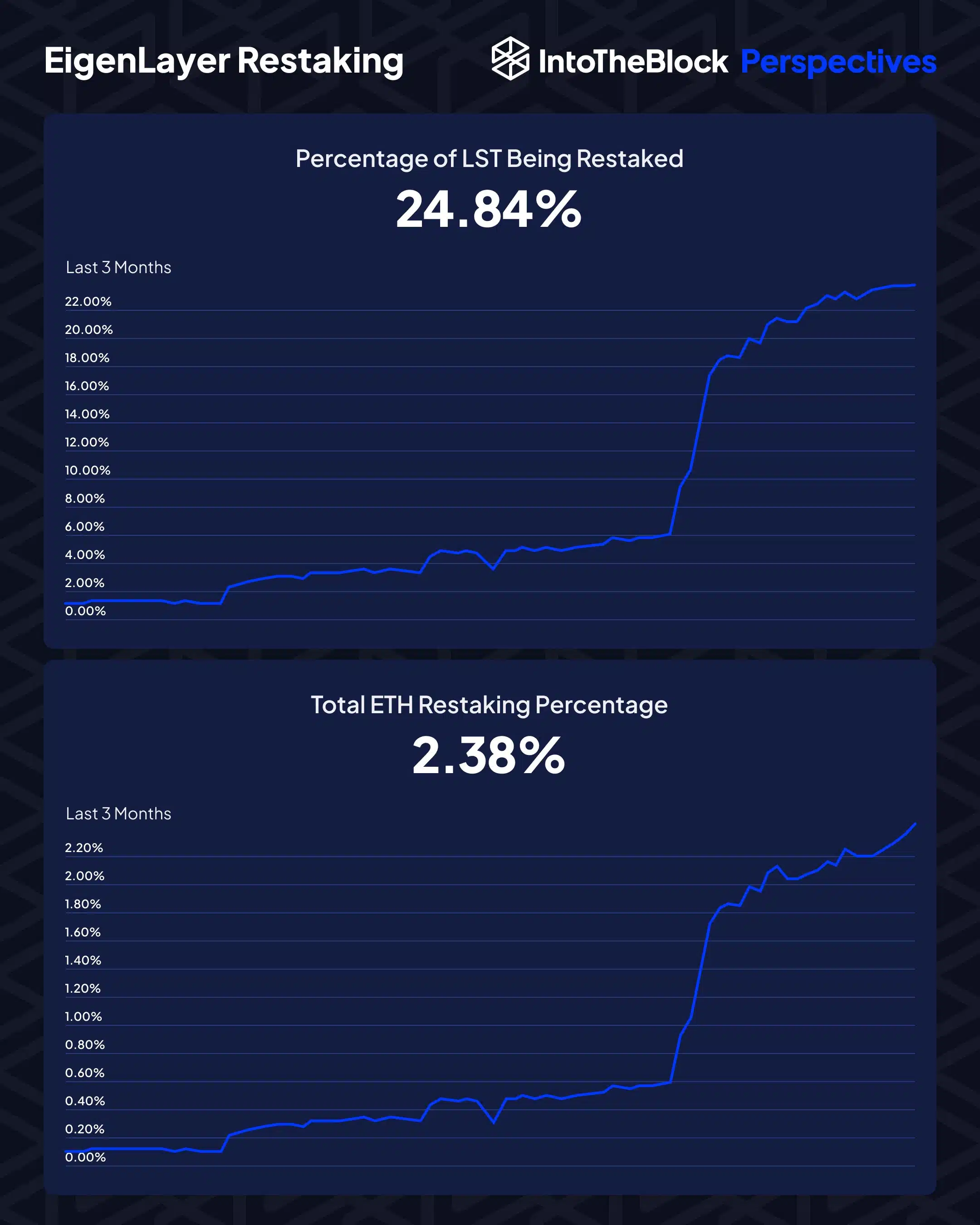

As per a recent X post by IntoTheBlock, about a quarter of all LSD was restaked on EigenLayer, while 2.38% of ETH’s total supply has been deposited.

Sharp rise in ETH staking

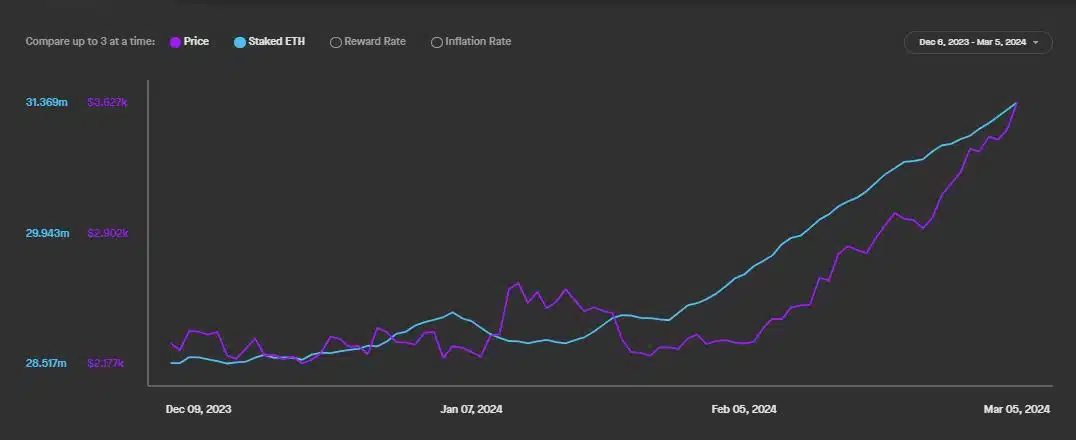

The hype around EigenLayer also seemed to have boosted the broader ETH staking market.

According to AMBCrypto’s analysis of Staking Rewards’ data, more than 26% of all ETH in circulation were locked on the network’s deposit contract at press time.

Interestingly, the growth curve went parabolic in the last month, mimicking EigenLayer’s TVL rise.

Native ETH restaking gaining traction

EigenLayer’s exponential growth has also resulted in the rise of unique business models looking to tap into the growing restaking market.

Ether.fi, for instance, introduced the so-called native restaking concept. It involves staking ETH on the protocol, which would be then automatically restaked on EigenLayer.

Is your portfolio green? Check out the ETH Profit Calculator

This is different from the traditional restaking idea where a user deposits already staked ETH onto EigenLayer.