Solana at a major turning point: Can SOL hold on to its gains?

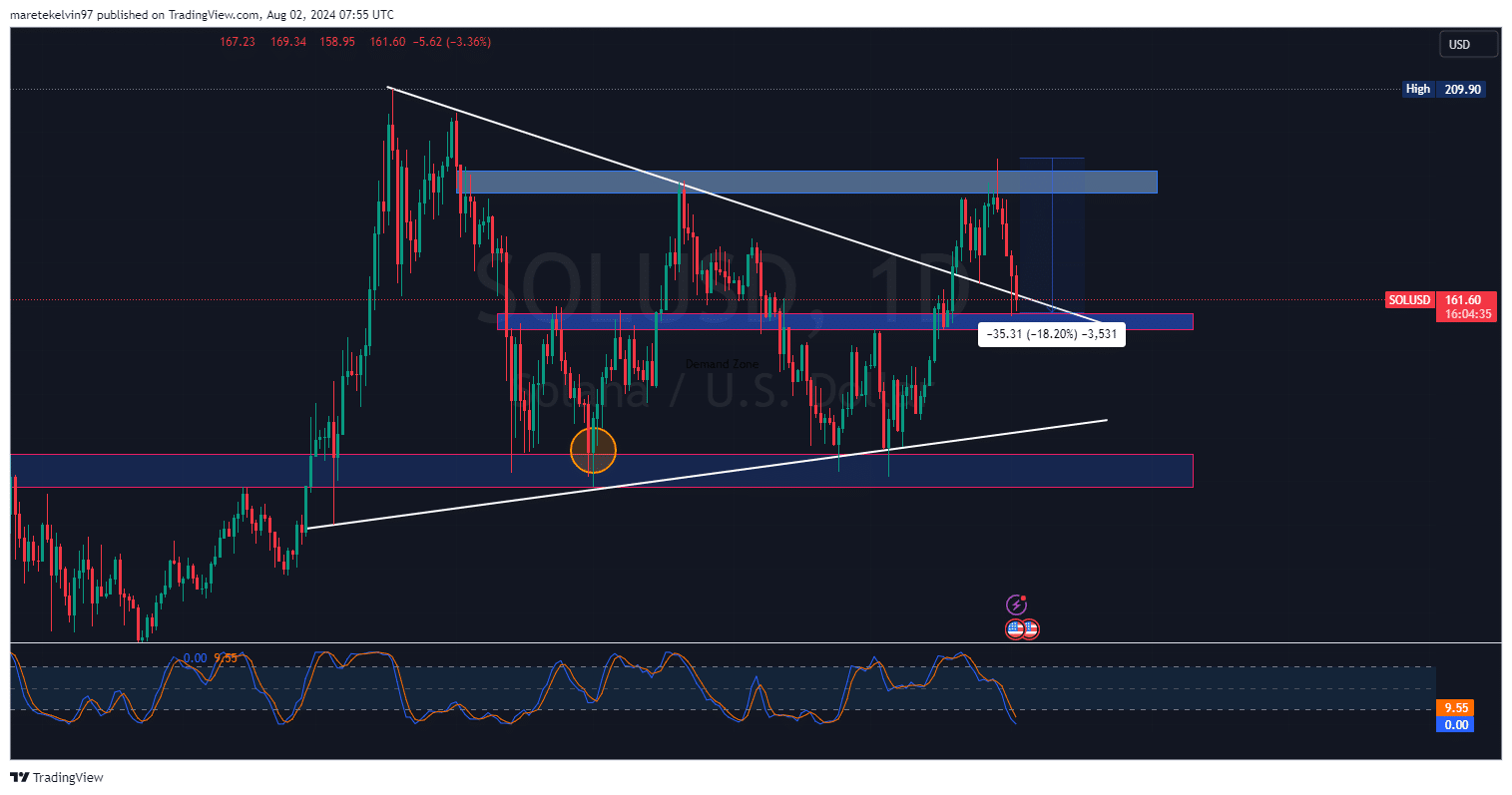

- Solana has dropped 18.2% after being rejected at the $190 resistance over the last four days.

- Metrics signaled a potential bullish reversal.

Solana [SOL] has faced a sharp decline, dipping by about 18% in value over the last four days. This bearish downturn comes after a rejection at the $190 resistance level.

The rejection ended a previous bullish rally, leading to a bearish run that is currently testing the resilience of the Solana support level of $160 at press time.

This support level aligned with the symmetrical triangle pattern, confluencing at around $160.

It is worth noting that the symmetrical triangle pattern sometimes indicates a continuation or reversal, depending on which way it breaks out.

The convergence of the triangle’s resistance with the support level makes this area especially important. A break below may signal more downside potential, while a bounce could suggest an impending reversal.

Bullish signs ahead?

Although we have seen a lot of bears lately, it seems that there may be something bullish brewing.

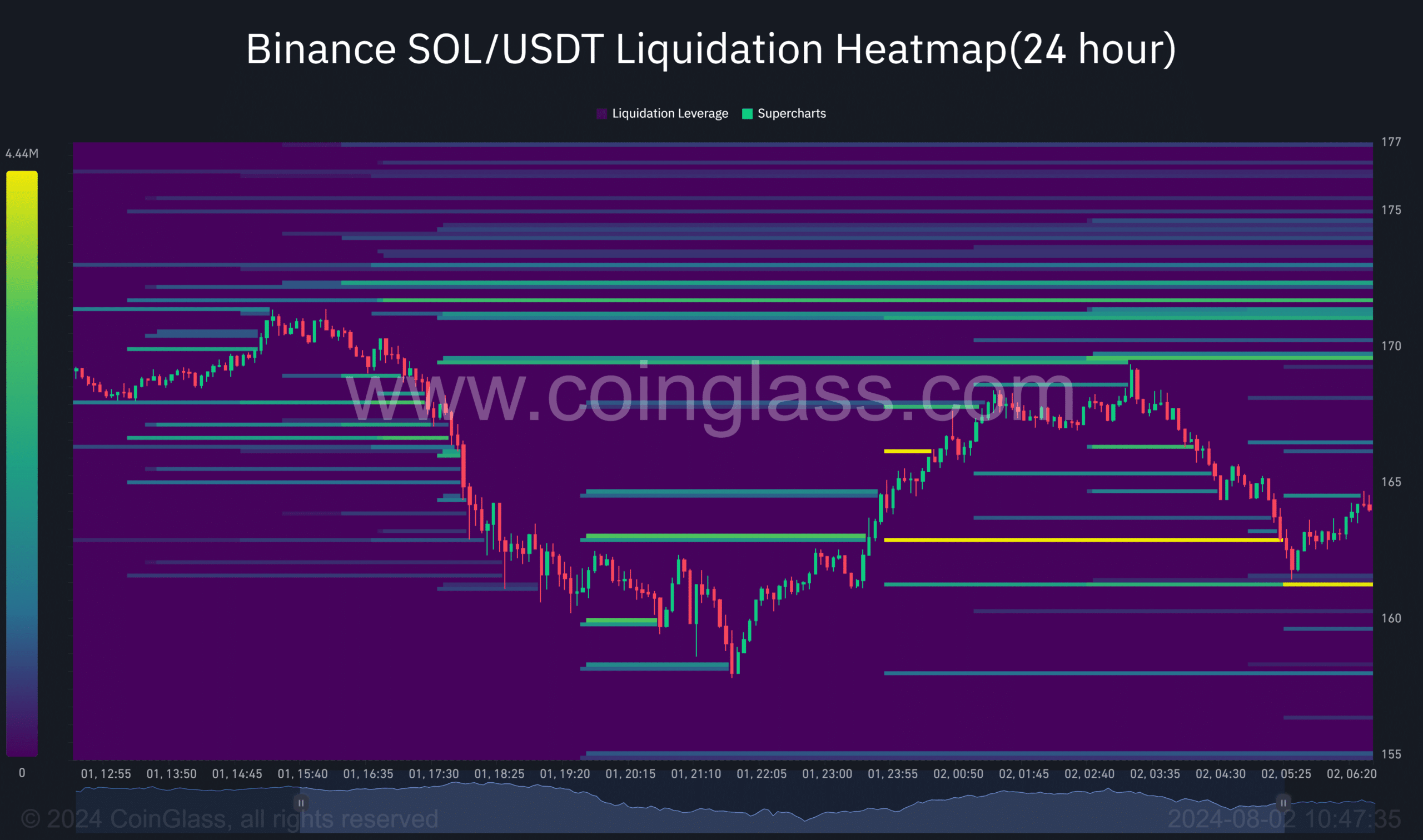

This comes after a big market liquidation where $3.71 million worth of positions were cleared at the $161 price point, according to Coinglass data.

Historically, when this happens, selling pressure is exhausted and over-leveraged bearish investors are being taken out of the market. This creates room for new buyers to enter, which could result in prices bouncing back.

Solana whale dominance

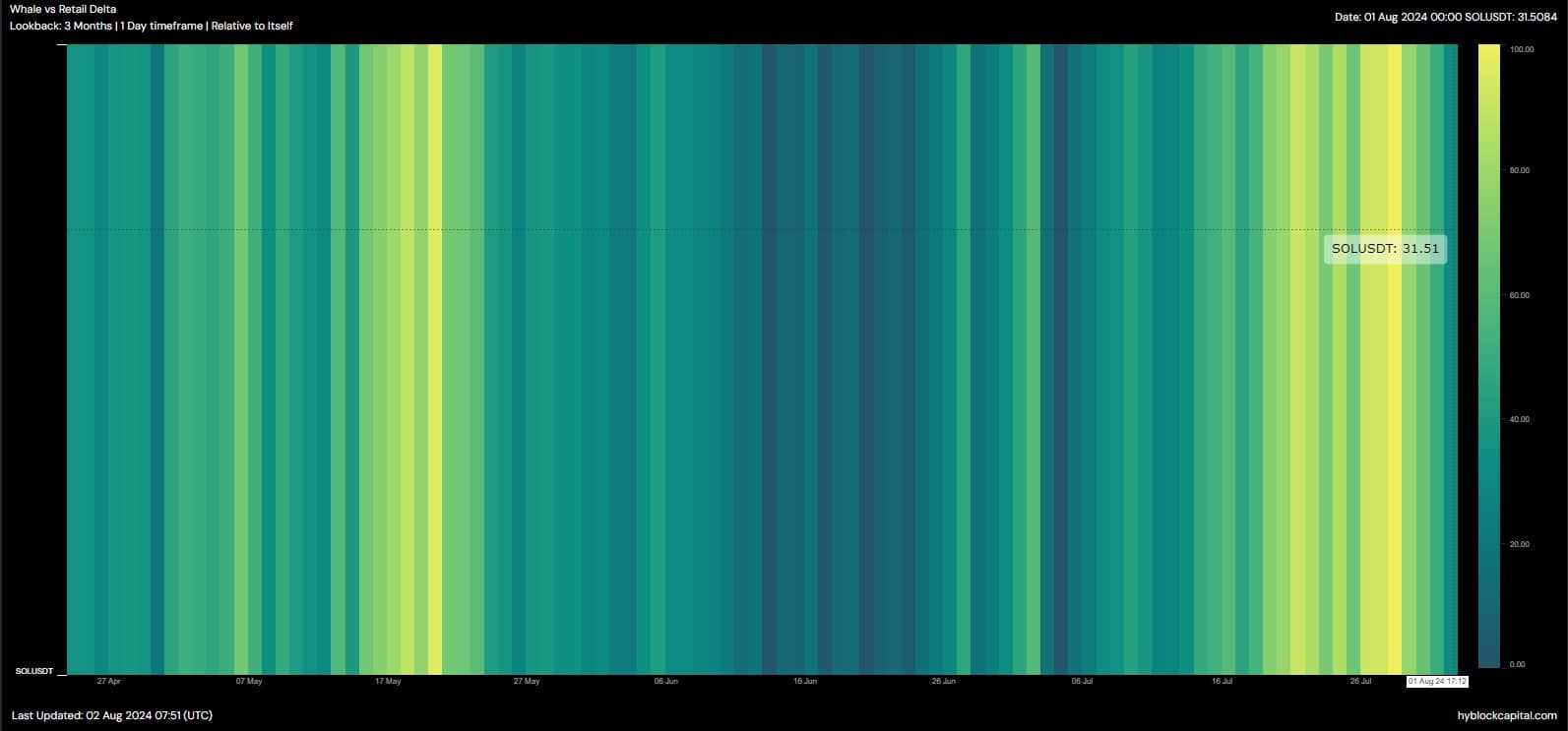

According to Hyblock data, 31.51% of Solana is held by whales. This indicated that these large investors controlled a significant amount of the total supply compared to smaller retail investors.

This kind of concentration often leads to more volatile price action.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana is in the middle of a make-or-break period. The recent test of the symmetrical triangle support line at $160, paired with liquidation and high whale activity, can give way to increased price fluctuation.

A break could mean a more bearish run, while a price reversal might indicate a potential bullish rally.