Bitcoin investment helps Metaplanet stock soar 900% YTD: What’s next?

- Metaplanet soared over 900% YTD as its BTC strategy paid off.

- Metaplanet has been accumulating BTC over the last two months, totaling to 225.611 BTC

Throughout the year, major companies have been turning to BTC to boost their stock. Metaplanet, a Japanese firm, has been at the forefront of this movement, driving institutional interests in Bitcoin [BTC].

Metaplanet’s strategy pays off

Over the past two months, Metaplanet has been on a BTC buying spree, increasing their total holdings through accumulation. On the 28th of May 2024, the company announced the purchase of BTC worth $1.6 million.

Earlier in the month, the company had purchased 19.87 BTC worth $1.7 million. In June, Metaplanet announced another purchase of 23.25 BTC worth $1.59 million, totaling $141.07 million.

In July so far, the company has continued with the accumulation with the latest purchase of 21.877 BTC, driving the total holding to 245.611 BTC worth $14.8 million, based on prevailing market rates.

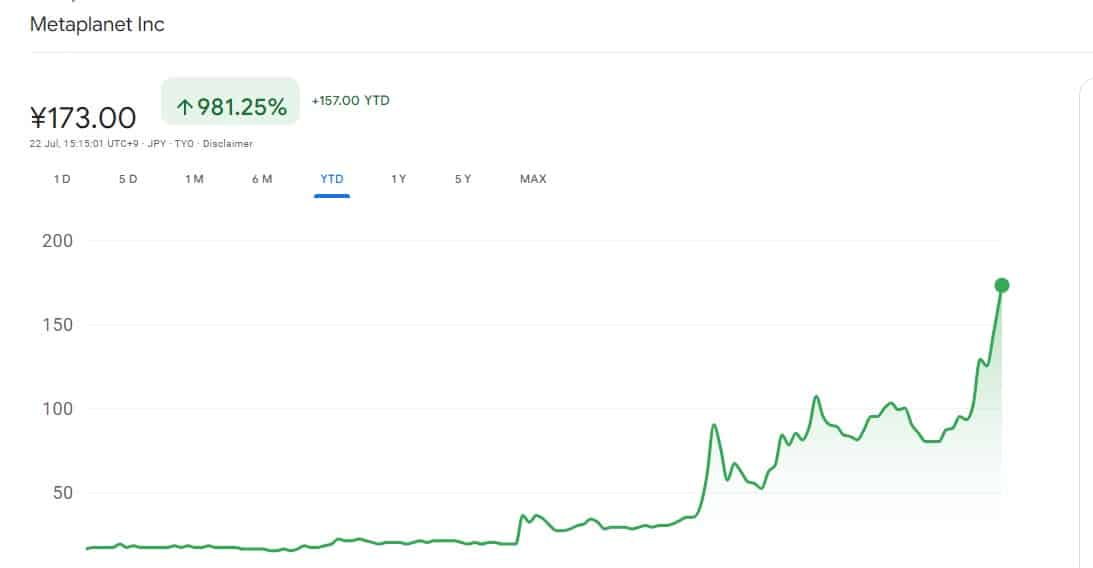

Metaplanet’s strategic BTC accumulation over the past months has seen its stock rise exponentially.

The recent buying spree is paying off, with Metaplanet becoming one of the key institutional players on the global stage. According to CoinGecko, Metaplanet was the 2oth-largest corporate BTC holder at press time.

The continued accumulation of BTC has seen its shares rise exponentially. As of this writing, Metaplanet’s shares have surged by 19.31% over the past 24 hrs.

According to Google Finance, its shares have surged by 51.75% over the past five days and an 82% surge over the past month. The recent surge has pushed the year to date-to over 900%.

Therefore, the continued surge in shares suggested their initiative to use BTC as a strategic treasury reserve asset is paying off tenfold.

Bitcoin as an alternative in Japan?

The Japanese economy has been suffering more than any other economy among developed and G-7 countries.

Therefore, Metaplanet’s strategy includes means to avoid and manage risks associated with a poorly performing economy.

Currently, Japan has a high national debt of 261% of the country’s GDP, which has affected the currency. The Japanese Yen has been depreciating against the dollar, exchanging from $1 to 156.70 yen at press time.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, Metaplanet incorporated BTC into its treasury assets, and the company aimed to mitigate its exposure to the Yen, which has significantly depreciated over the last year.

With BTC projected to grow further past $100k by 2024, Metaplanet aims to leverage this growth and boost its share performance.