Uniswap – Whale sell-off sparks fear among UNI holders, but…

- Uniswap whales observed to be selling a significant amount of their tokens

- Network growth for UNI declined significantly over the last few days

Uniswap [UNI], one of the largest DEXs (Decentralized Exchanges) in the crypto sector, witnessed major gains due to the bullish momentum around UNI when the year began. Despite how well the DEX has done lately though, at the time of writing, interest in UNI seemed to be waning.

Whales swim away

According to Lookonchain, a major whale deposited 561,782 UNI, worth approximately $4.38 million, into Binance a few hours ago. This deposit followed a period of accumulation over the past year and represented the whale’s first sale of UNI during that time.

Interestingly, the whale still holds a significant amount of UNI, with a remaining balance of 2 million UNI, valued at $15.48 million.

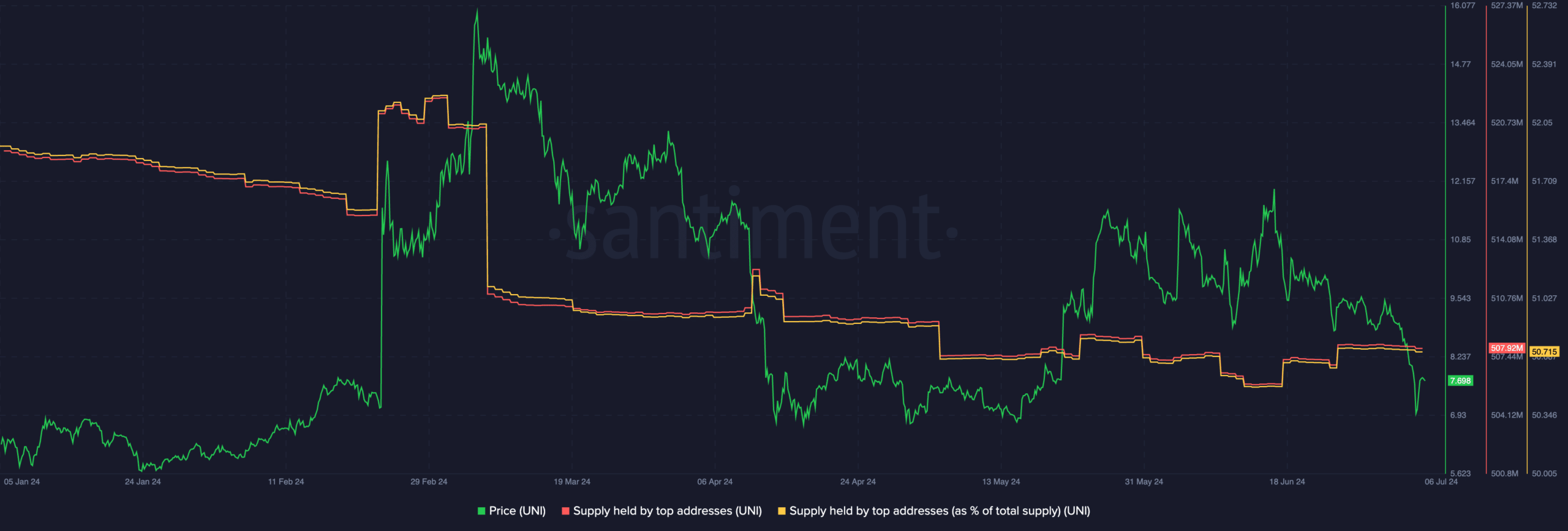

An analysis by AMBCrypto, based on Santiment’s data, suggested that the percentage of large addresses holding UNI has fall too. This implied that this whale’s sale might be part of a larger trend of declining whale interest in UNI.

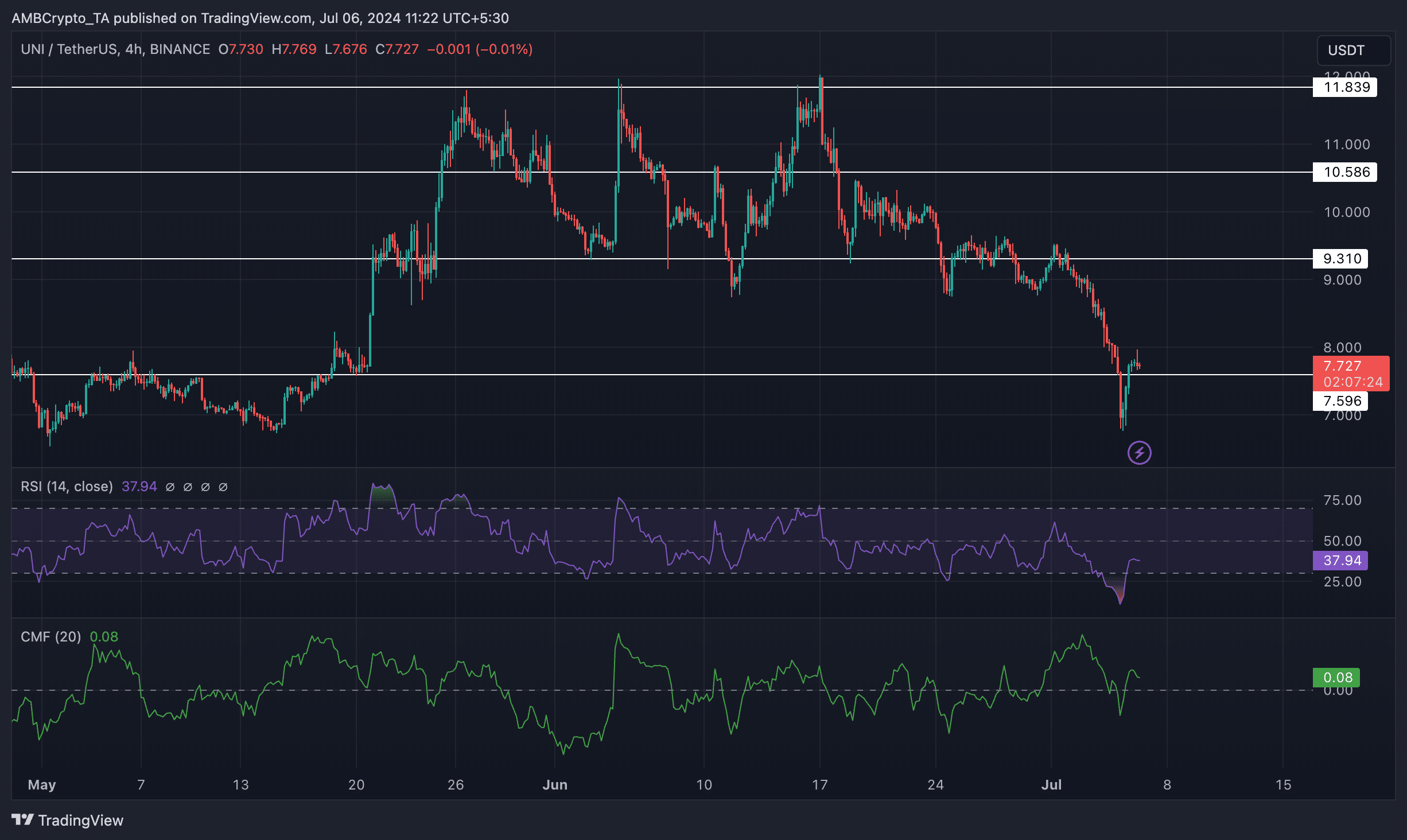

From 26 May to 17 June, a triple bottom pattern flashed across UNI’s price charts. Following the same, the token’s price fell materially – Highlighting lower lows and lower highs. This was indicative of a bearish trend. For UNI to recover in the future, it would need to re-test the $9.310-level multiple times before a reversal can be possible.

The RSI (Relative Strength Index) for UNI declined to 37.94 over the last few days too, indicating that the bullish momentum around UNI fell.

Moreover, the CMF (Chaikin Money Flow) for UNI also declined on the charts, implying that the money flowing into the token was low.

What does on-chain data say?

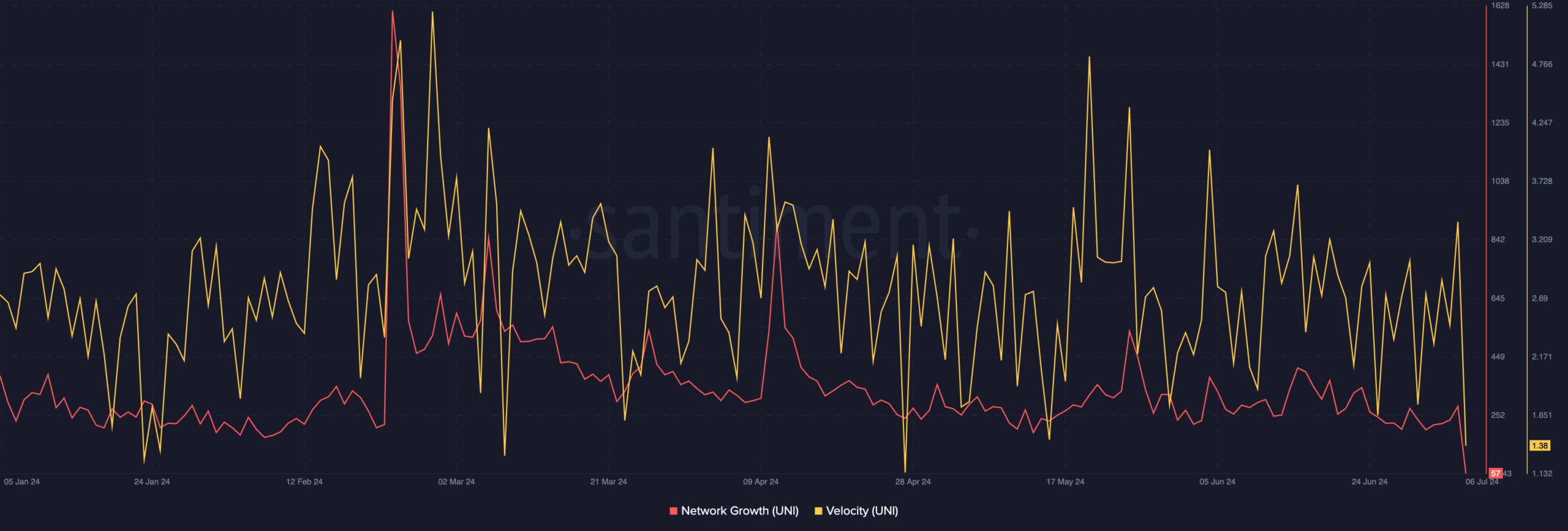

Finally, UNI’s network growth also fell materially, indicative of the fact that new addresses had lost interest in the token.

Additionally, the altcoin’s velocity depreciated significantly over the last few days as well.

The recent Uniswap v4 update could be helpful for UNI, with the potential to drive its price upwards. The key feature behind this update is a revolutionary concept called hooks.

Is your portfolio green? Check out the UNI Profit Calculator

These hooks are essentially small snippets of code designed to run at specific points in a pool’s life cycle. They can be triggered upon a pool’s creation, whenever liquidity providers (LPs) add or remove their holdings from the pool, or even before and after a swap takes place.