Ethereum bounces to $3.2K as investors turn bullish: What’s next?

- Ethereum showed signs of bullish momentum after a recent price pullback.

- Metrics indicated reduced selling pressure and increased market participation.

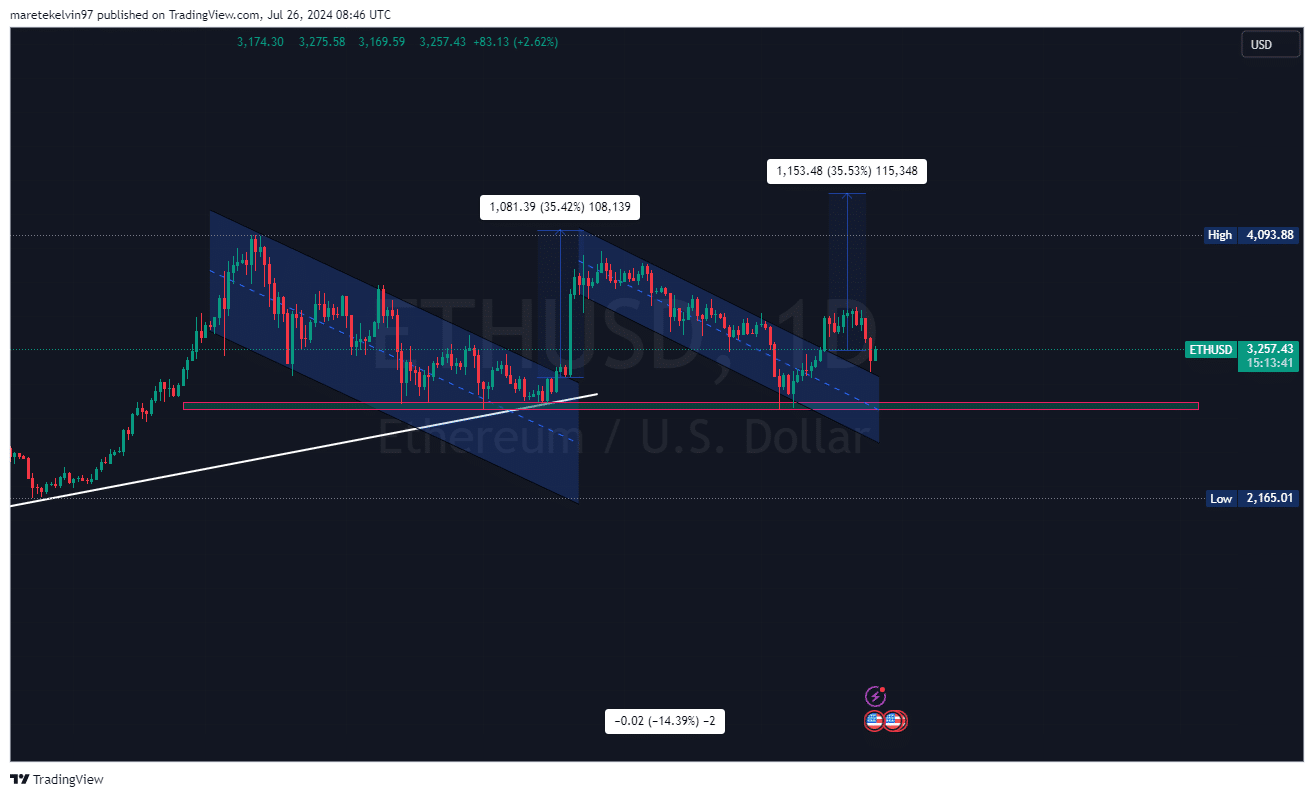

Ethereum [ETH] was showing a strong bullish signal after a recent 13.25% pullback. Its prices have bounced off the bullish flag resistance level and surged by 6% to $3257.44 at press time.

This pullback to the bullish flag formation’s lower boundary often precedes a potential breakout.

As of this writing, Ethereum was accumulating bullish momentum as it headed towards the next resistance level.

Historically, this pattern indicates accumulation phases where buyers outpace sellers, setting the basis for a significant bullish rally.

Dormant wallet activity

A noteworthy development within the Ethereum network is the recent transfer of 92,500 ETH from a dormant wallet. Lookonchain tweeted this significant on-chain movement on X, noting,

“An #EthereumFoundation-related wallet transferred 92,500 $ETH ($294.9M) to a new wallet 9 hours ago after being dormant for 6.6 years. Through on-chain tracking, it was found that these $ETH were received from the #EthereumFoundation on Sept 1, 2015.:

Reduced Ethereum selling pressure

AMBCrypto’s deep analysis of the metrics indicated some interesting insights. According to the exchange net flow data, net deposits on exchange are lower than the weekly average.

This drop in deposits translated to lower selling pressure, as fewer coins were being moved to exchanges for sale.

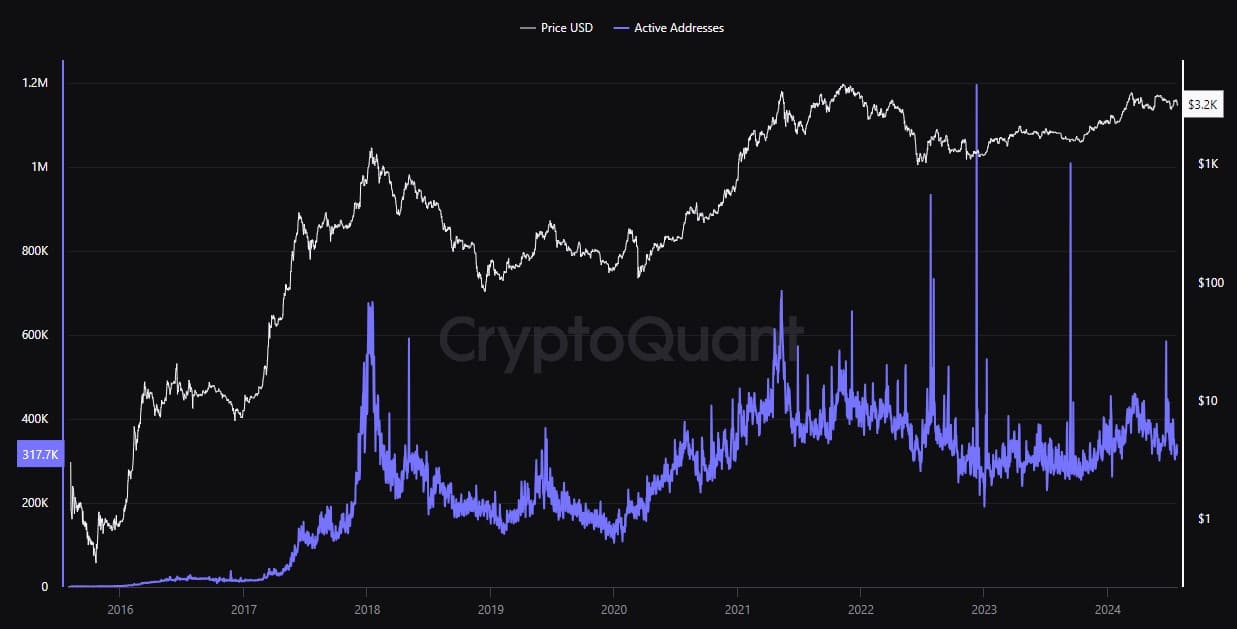

To add to the aforementioned, the total number of active addresses has surged by 39.14% compared to the preceding day.

This increase in active addresses suggested growing market participation and interest in Ethereum, consequently supporting the bullish outlook.

Another positive sign for Ethereum’s bullish rally was the dominance of long positions in the market at press time.

According to the Funding Rate, long-position investors were willing to pay a premium to short-position investors to maintain their positions. This sentiment implied that leveraged investors believed in ETH’s price rally.

What’s ahead for ETH?

Ethereum’s current market sentiment signaled a potential bullish continuation. Technical analysis pointed at a potential rally after retesting the bullish flag support level.

Read Ethereum’s [ETH] Price Prediction 2024-25

On-chain metrics suggested a reduced selling pressure on Ethereum.

All the metrics converged to signal a potential bullish rally to the next resistance level, probably at the $3565.33 level.