Bitcoin vs Ethereum – Every $1 invested in either of these cryptos will…

- Both Bitcoin and Ethereum hiked by over 3% in the last trading session

- Compared to ETH, BTC seemed overvalued at press time

Bitcoin and Ethereum have long been two of the market’s biggest cryptos. However, tribalism within the community has often placed them at opposite ends of any spectrum, which is why comparisons are common.

According to recent data though, Bitcoin may be delivering a greater response for every dollar invested, than Ethereum. This differential response may indicate market perceptions regarding the valuation of these two prominent cryptocurrencies.

Bitcoin and Ethereum see different investment impact

According to the Realized Capitalization Multiplier indicator from CryptoQuant, in 2024, for every $1 invested in Bitcoin, its market capitalization increased by $5. On the contrary, for Ethereum (ETH), it increased by only $1.3. To put it simply, Bitcoin’s market capitalization is more responsive to new investments than Ethereum’s.

Considering the Realized Capitalization Multiplier, Bitcoin’s greater responsiveness to new investments suggests a higher multiplier. This could imply that Bitcoin is perceived as more overvalued, relative to the actual realized value of its coins.

On the other hand, Ethereum’s lower hike in market cap per dollar invested suggests it has a lower multiplier. This may be a sign that its market price is closer to its realized value, potentially making it more stable or undervalued.

What can be drawn from Bitcoin and Ethereum’s MVRV?

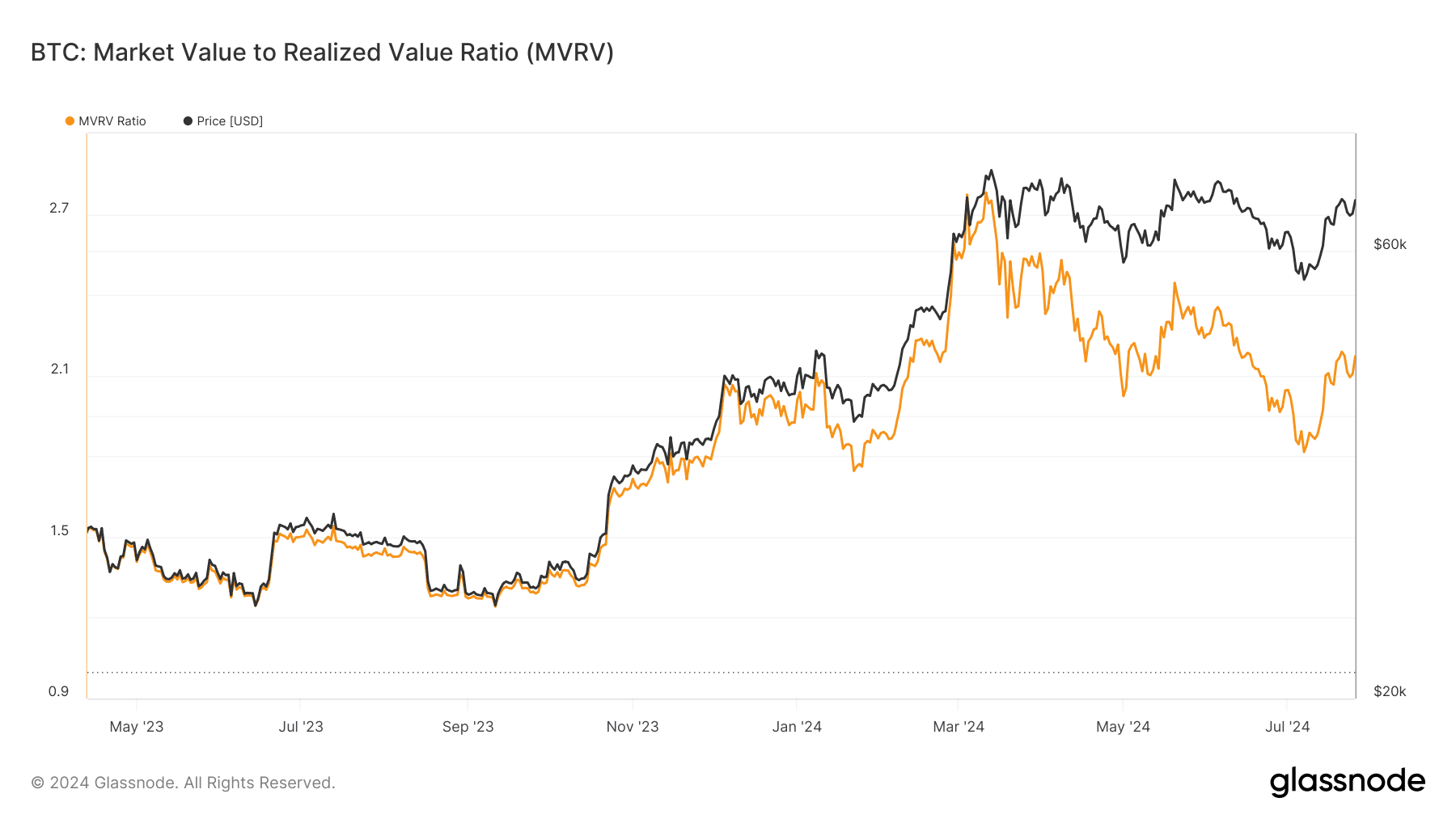

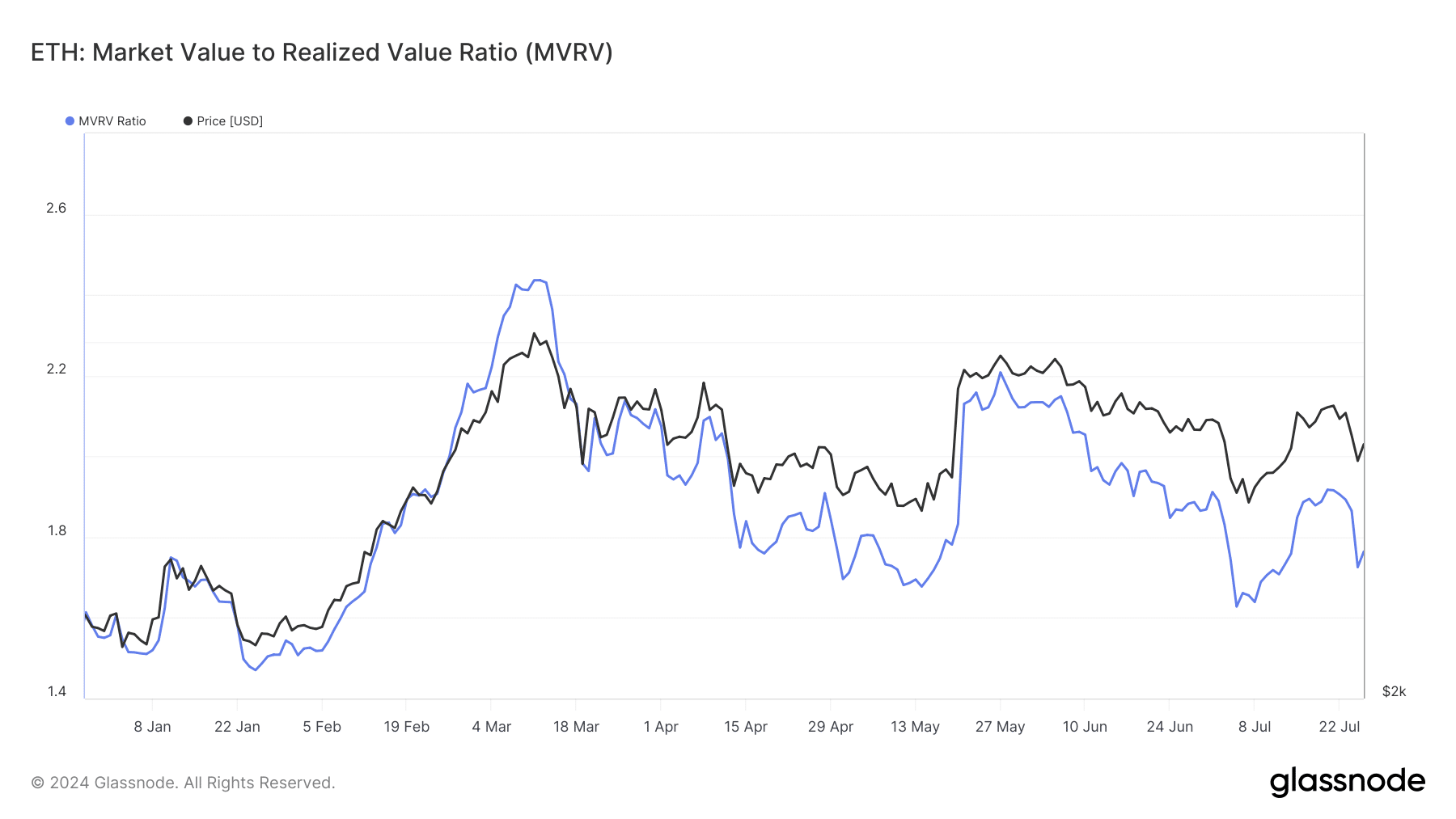

A recent analysis of the Market Value to Realized Value (MVRV) ratios for Bitcoin and Ethereum, based on data from Glassnode, highlighted differing trends for these two cryptocurrencies over the last few weeks.

For Bitcoin, the MVRV ratio has shown more uptrends than downtrends throughout July. At the time of writing, the MVRV stood at over 2%. Typically, an MVRV ratio approaching the 3% mark indicates being overvalued.

This can also be interpreted as a sign that the price of BTC might be exceeding the average value at which coins were last moved (i.e., their “realized” price).

Conversely, Ethereum’s MVRV ratio has exhibited more declines than uptrends this month, compared to BTC.

At press time, ETH’s MVRV ratio had a reading of around 1.7 – Farther from the threshold commonly associated with being overvalued.

These trends in MVRV ratios suggest that BTC may be closer to being considered overvalued, than Ethereum. This conclusion aligns with the observations made based on the Realized Capitalization Multiplier’s analysis too.

Another 3% in value

An analysis of Bitcoin’s price trend on the daily timeframe indicated a significant increase of over 3% on 26 July. According to AMBCrypto, the price rose by 3.24%, climbing above $67,000 and nearly touching $68,000.

– Read Bitcoin (BTC) Price Prediction 2024-25

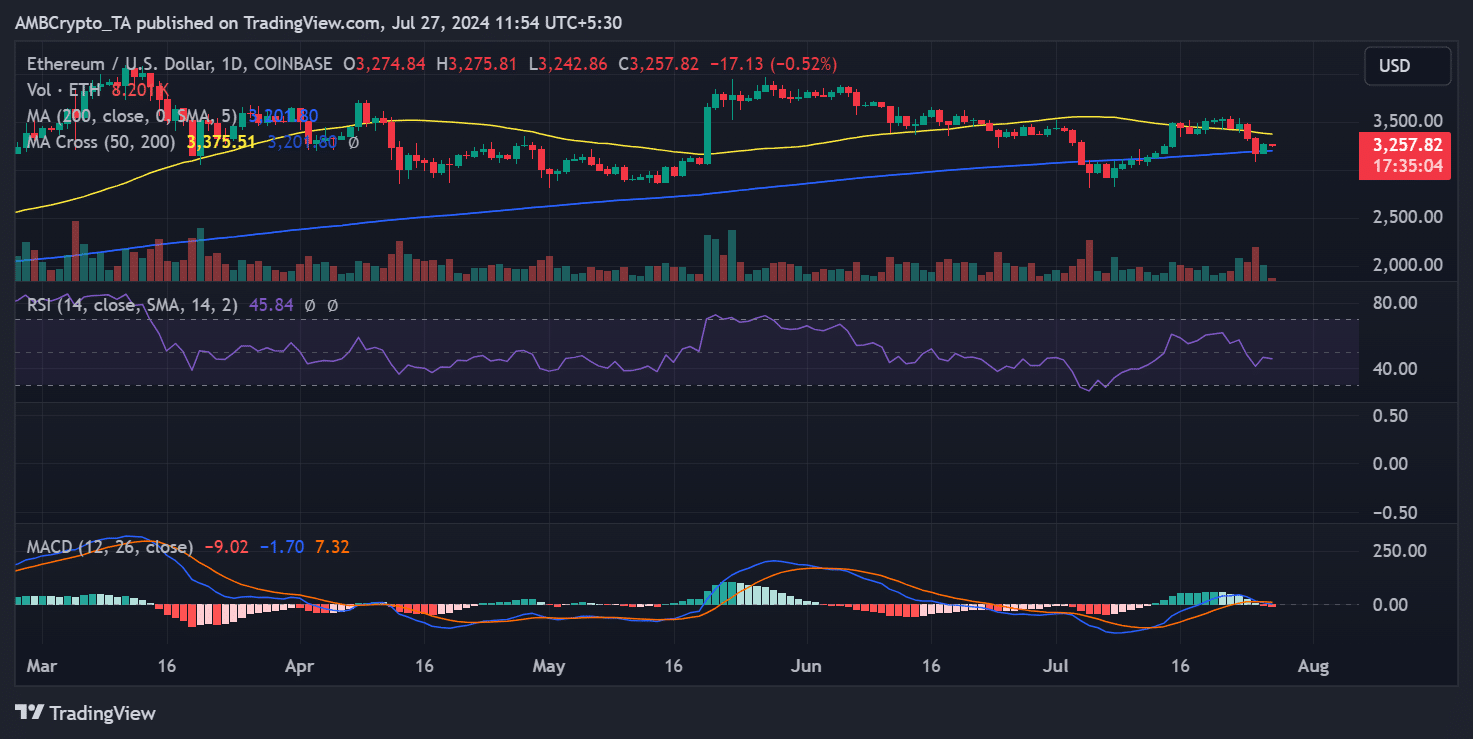

Similarly, Ethereum also recorded a notable hike on the same day. Its price appreciated by 3.17%, bringing it to approximately $3,274.

However, there has been a slight retracement since then, with ETH trading at around $3,258 at press time.