Ethereum’s sell-off means 64% of holders are ‘out of the money’ – What next?

- ETH has continued to decline on the charts

- Significant inflows to exchanges suggested many traders are selling off the altcoin

Ethereum recently saw a notable drop during the last trading session, causing its price to fall below its crucial support levels. Breaking through these levels might be perceived as a bearish signal though, leading to panic selling. If traders holding ETH at these levels start to panic and sell off their holdings, it could exacerbate the decline, creating a downward spiral.

Ethereum breaks below support levels

An analysis of Ethereum’s price trend on the daily timeframe indicated a significant downtrend over the last four days, with the most significant drop occurring on 2 August. In fact, its price plummeted by 6.71% that day, dropping from around $3,200 to approximately $2,985.

Over the last four days, the cumulative decline has exceeded 10.5%, with the most recent session contributing heavily to this downturn.

Also, while the support level for Ethereum was around $3,200, following its recent market movements, this threshold was soon breached. The latest support region can now be identified between $2,900 and $2,700.

Furthermore, analysis revealed that the Relative Strength Index (RSI) was around 34. This value is a sign of a strong bearish trend, as RSI levels below 30 are considered oversold.

The break below a key support level could lead to further declines if the new support zones fail to hold.

Fate of Ethereum’s price lies here

The recent decline in Ethereum’s price has significantly affected the profitability of its holders, as evidenced by data from IntoTheBlock.

Previously, the $3,000-mark was a critical support level, with over 1.7 million addresses having purchased ETH below this price. However, with the current downturn in market prices, this number has fallen.

According to ITB, at the time of writing, approximately 15.12 million ETH addresses were “out of the money.” Meaning, the press time price of ETH was lower than the price at which these coins were bought. This accounted for over 64% of all Ethereum addresses.

Conversely, about 8.08 million addresses remained “in the money,” representing 34.51% of holders. These addresses acquired their ETH holdings in the price range of $2,600 to $2,900.

This situation presents a precarious position for Ethereum’s market. The holders “in the money” are at a critical juncture, as their holdings are still profitable but nearing the lower purchase price threshold.

Should these holders begin to panic sell, fearing further losses, it could trigger a cascading effect, pushing the price of Ethereum down even more sharply.

What do the ETH netflows say?

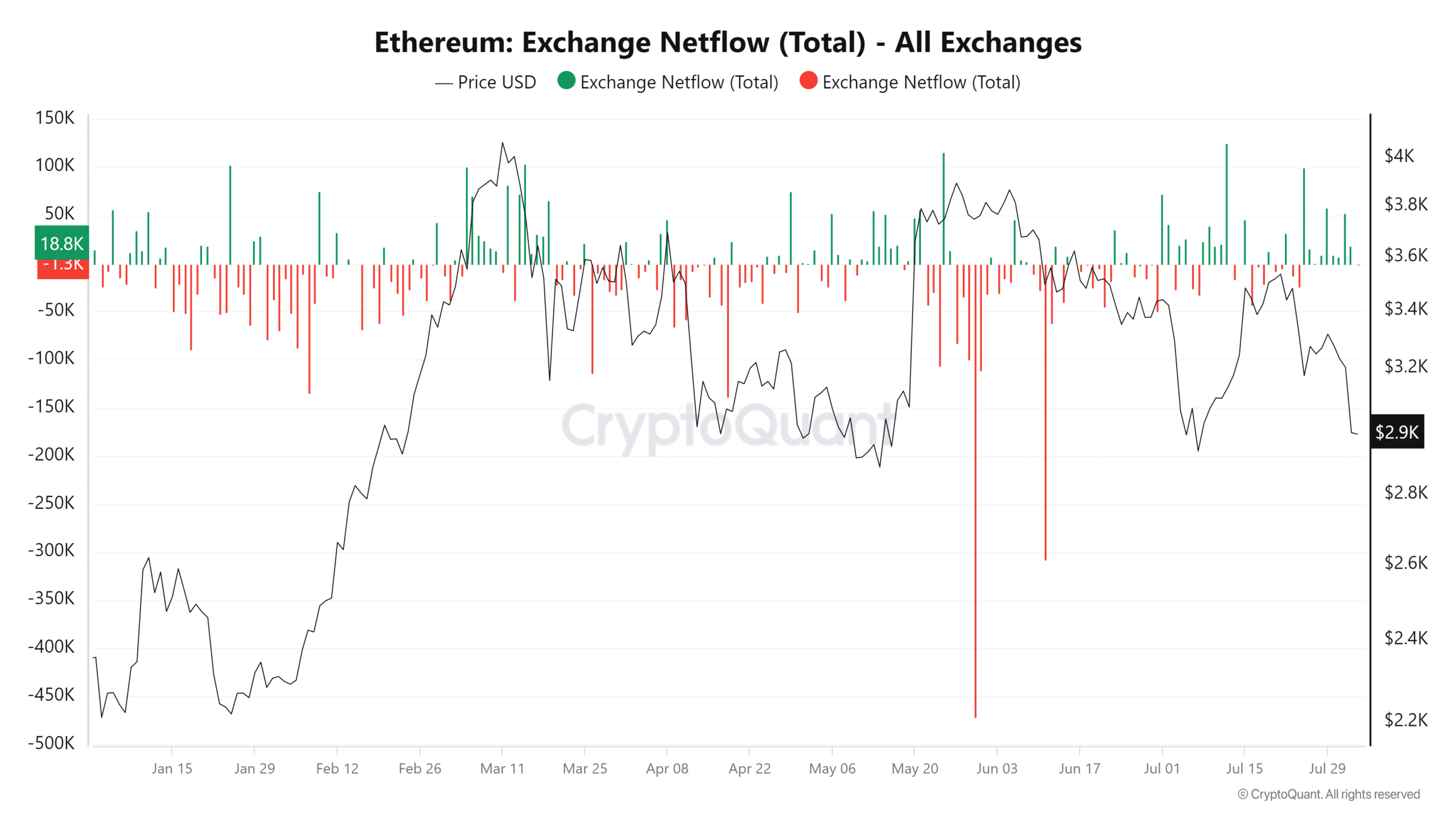

A recent data analysis of Ethereum’s netflows from CryptoQuant indicated a significant trend of inflows to exchanges. According to AMBCrypto’s analysis, there were positive netflows of nearly 53,000 on 1 August and almost 19,000 on 2 August. This suggested that ETH worth approximately $216 million was moved to exchanges during the first two days of this month alone.

Such substantial inflows to exchanges implied that many traders opted to sell off their holdings. The move is likely a bid to capitalize on current market prices or to cut losses. This sell-off has added selling pressure to the market, which can contribute to a downward price spiral.

– Read Ethereum (ETH) Price Prediction 2024-25

For Ethereum’s price to stabilize, there needs to be a reversal in this trend of net inflows to exchanges.