MATIC closes in on DOT: Time for a flip?

- If MATIC’s price climbs while DOT stalls, the latter’s position might be taken.

- Sentiment around DOT was bearish, while MATIC was bullish.

Polygon [MATIC], currently ranked the 14th most valuable cryptocurrency, was within reach of flipping Polkadot [DOT] at press time.

According to CoinMarketCap, Polygon’s market cap was $9.17 billion. Polkadot, on the other hand, had a market cap of $9.39 billion.

Needless to say, the difference between both projects would not just appear out of nowhere. But with increasing interest in MATIC, DOT could be pegged back.

Market cap is a product of the price and circulating supply. As such, it is important to consider the state of these two factors.

Same strokes, different pens

At press time, DOT’s price was 7.32, while MATIC changed hands at $0.95. Both cryptocurrencies have experienced notable increases over the last few weeks.

In the last 30 days, MATIC’s price has increased 26.13%. DOT, on the other hand, jumped by 11.25%.

The disparities in performance suggest that demand for MATIC could be twice that of DOT. AMBCrypto also highlighted how the Polygon native token showed a bullish signal recently.

If the signals become a reality, then there is a high chance that MATIC’s market cap could flip that of DOT. But that is not to say that Polkadot would remain stagnant.

One area where Polkadot has repeatedly excelled is in terms of development activity. Its position at this end has helped build confidence in the project.

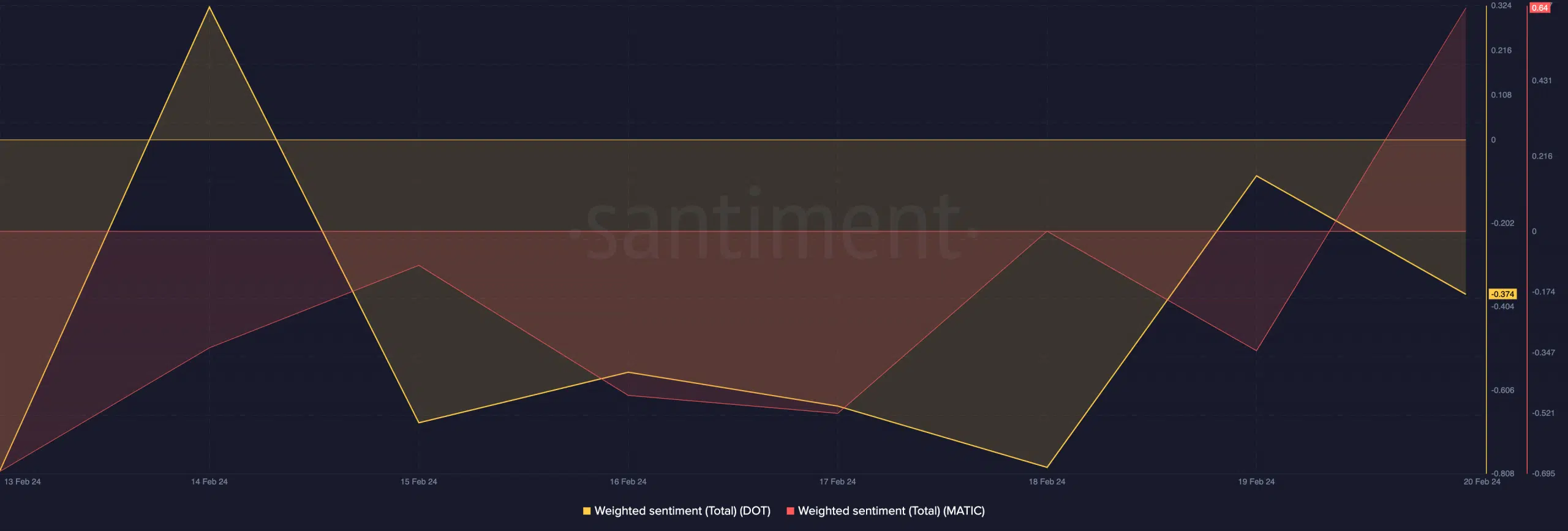

However, this has not always translated to a better price action. When AMBCrypto looked at the Weighted Sentiment, we noticed a major difference in both projects.

For MATIC, the Weighted Sentiment was 0.64. However, DOT’s Weighted Sentiment was in the negative region at -0.37.

The metric gauges the unique social volume concerning positive/negative commentaries in the market.

Thus, it seems that most market participants had a bullish view of MATIC. For DOT, it was the other way around. Bullish sentiment for a token might trigger buying pressure, which could foreshadow higher prices.

On the other hand, bearish sentiment could cause a stalemate or drawdown.

MATIC seems ready to take charge

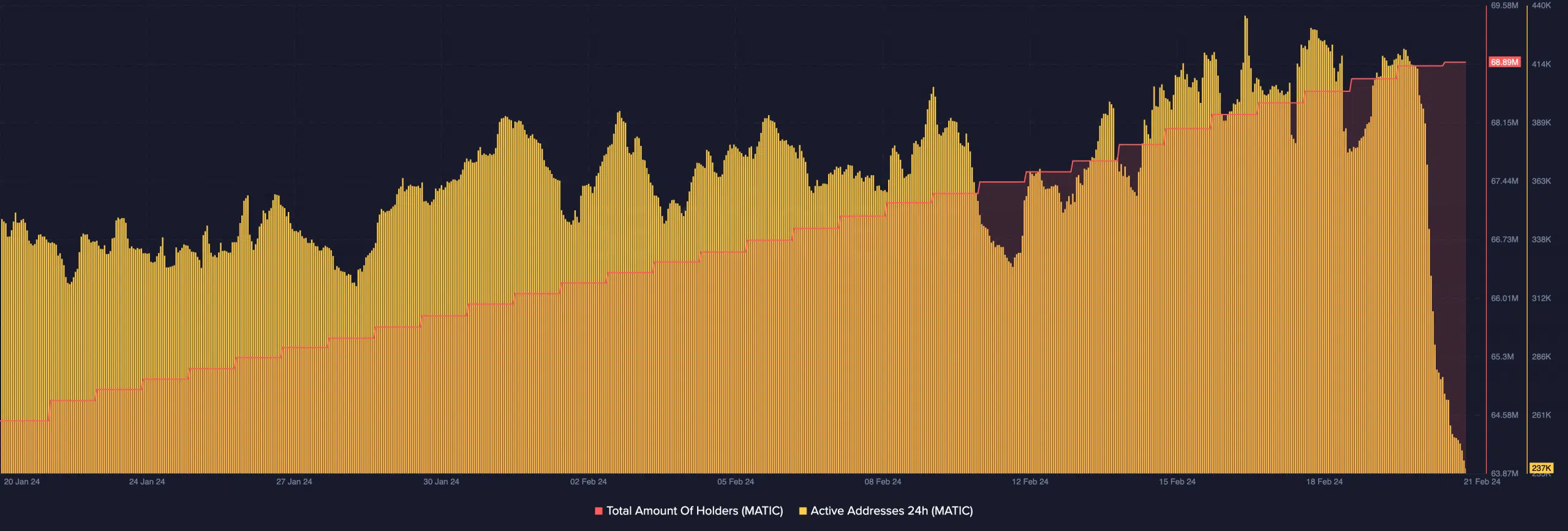

If this is the case, DOT’s price might decline while MATIC climbs, possibly leading to the latter flipping the former. Another factor that could lead Polygon to flip Polkadot is the total number of holders.

In the last 30 days, AMBCrypto discovered that the number of MATIC holders had risen from 64.51 million to 68.91 million

The increase could be termed as proof that many participants are bullish on the token in the long term. For active addresses, the count jumped to 421,000 on the 20th of February.

This indicated impressive usage of the blockchain, which was also a bullish signal.

Realistic or not, here’s MATIC’s market cap in DOT terms

However, press time data showed that active addresses on the Polygon network had decreased. Going forward, DOT might need to watch its back, as MATIC could keep it on its heels.

If demand for DOT increases, then maybe it would maintain number 13. But if that does not happen, the projects might switch positions.