How MATIC whales getting ‘greedy’ can push altcoin to $1

- MATIC recorded weekly and monthly losses of 12% and 23%, respectively

- MATIC whales appeared to be dip-buying, at press time.

MATIC has maintained its downtrend over the last 24 hours, losing 2.5% of its value, according to CoinMarketCap. In fact, the 17th-largest cryptocurrency crashed by more than 12% over the week, and 23% on a monthly timeframe, leaving holders anxious about what is yet to come.

However, amidst the uncertainty and bearishness, an analyst drew attention to a bullish signal emerging from the coin’s daily chart.

Is a recovery on the cards?

Ali Martinez, known for his insightful takes on crypto-markets, spotted a buy signal on the TD Sequential indicator. He added that if MATIC doesn’t fall below $0.87, there is a higher chance of it rebounding to the $0.95-$1 range. At the time of writing, MATIC was trading just around $0.87.

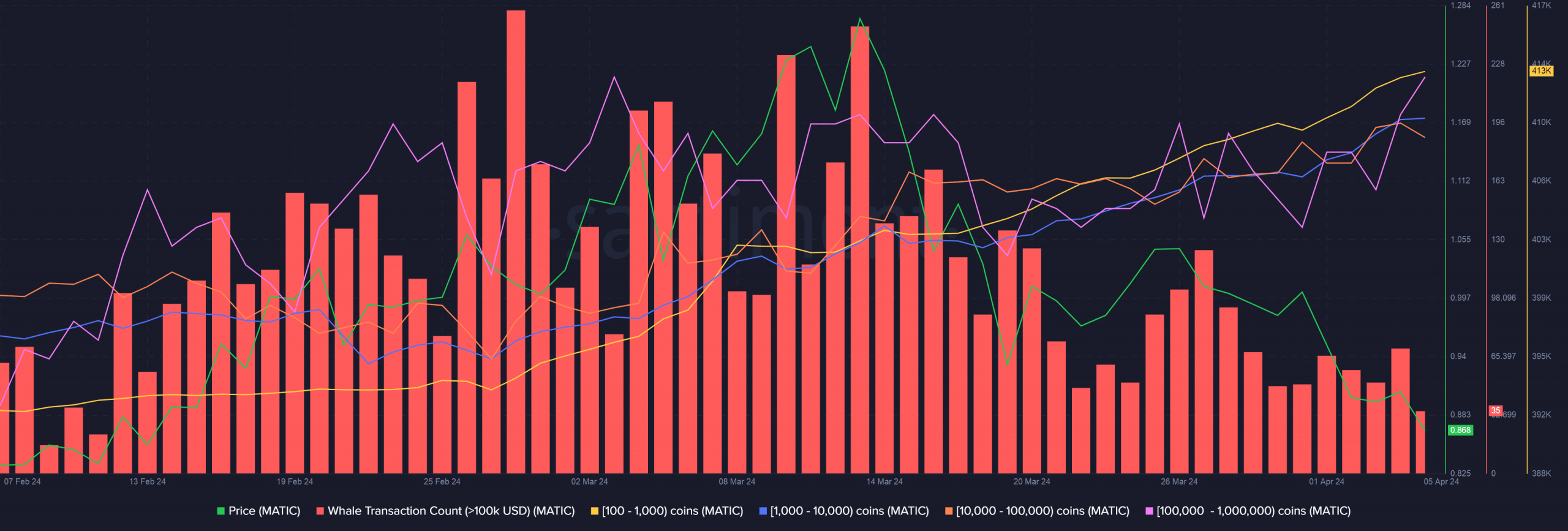

Interestingly, whale investors have indulged in dip-buying. According to AMBCrypto’s analysis of Santiment’s data, wallets holding between 100 to 1 million coins steadily accumulated while MATIC’s price was on the decline.

As is well known, dip-buying is an investment strategy of buying assets when the price is falling, hoping to benefit from potential price rises in the future. This is generally employed by traders with a deep understanding of the market.

Be mindful of these findings

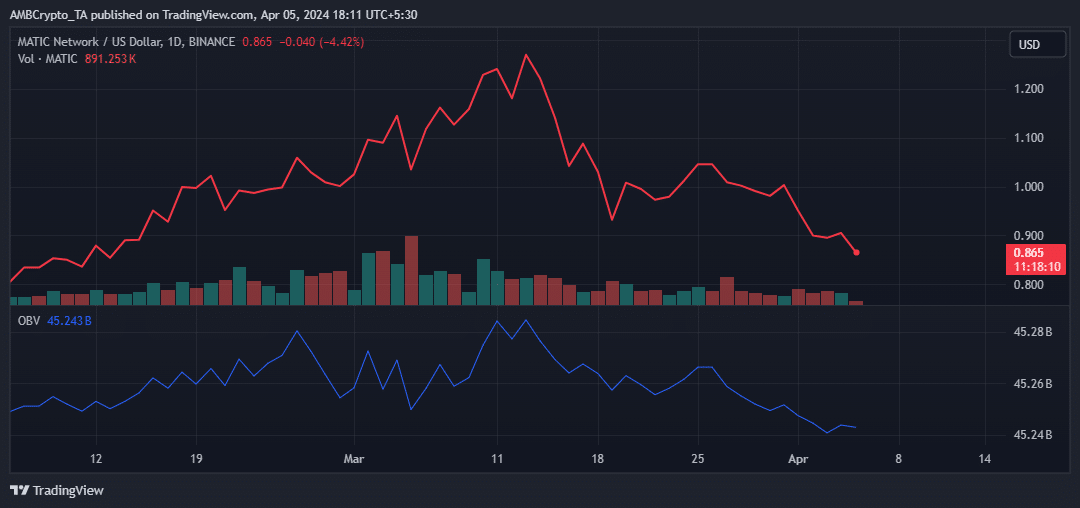

However, the examination of the On Balance Volume (OBV) indicator didn’t yield bullish results.

OBV, a volume indicator that monitors buying and selling pressure, was seen making lower highs and lower lows, consistent with the price trajectory. When this happens, the downtrend is assumed to continue. At least in the short-term.

Is your portfolio green? Check out the MATIC Profit Calculator

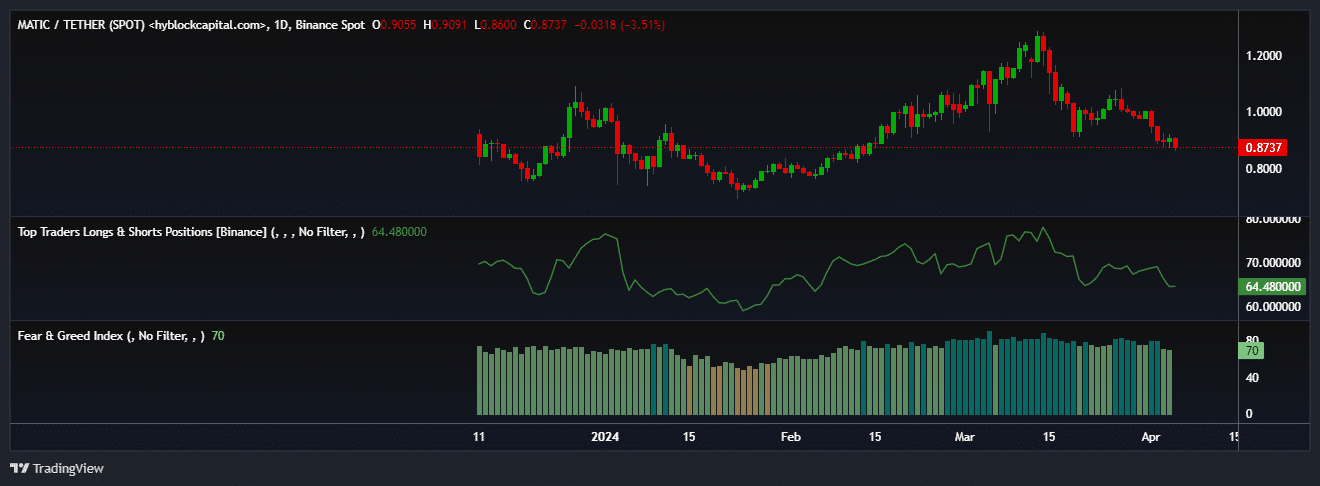

The derivatives market also flashed pessimistic news for the altcoin. The total number of whale positions going long on MATIC dropped significantly following the price drop, as per AMBCrypto’s analysis of Hyblock Capital data.

However, the overall sentiment in the market remains one of “greed,” potentially leading to an increase in buying pressure in the days ahead.