Top reasons why MATIC’s price might double in April

- MATIC was down by nearly 10% in the last seven days.

- Metrics supported the possibility of a price uptick.

Polygon [MATIC] continued to remain under bears’ influence as its daily and weekly charts were red. However, a key metric flagged a buy signal as the chances of MATIC’s price skyrocketing were high.

Polygon bears are refusing to leave

According to CoinMarketCap, MATIC was down by nearly 10% in the last seven days. However, the bearish momentum declined as Polygon’s value only dropped marginally in the last 24 hours.

At the time of writing, MATIC was trading at $0.8985 with a market capitalization of over $8.8 billion, making it the 17th largest crypto.

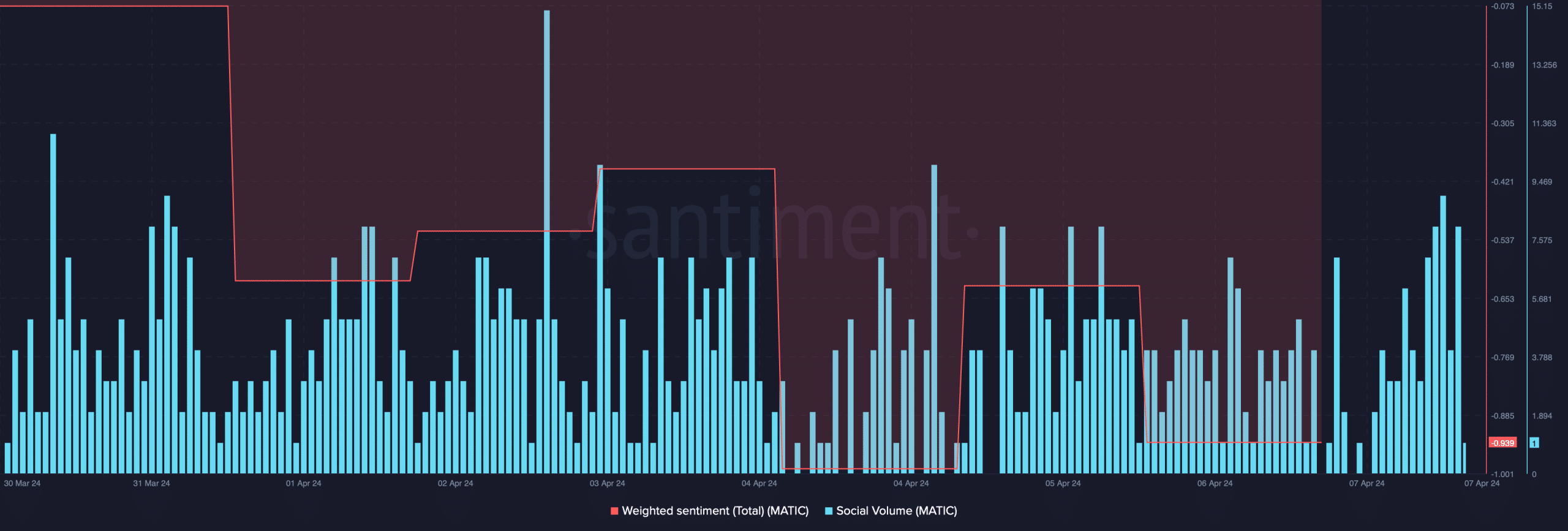

The decline in value took a toll on MATIC’s social metrics. Our analysis of Santiment’s data revealed that Polygon’s weighted sentiment dropped sharply, meaning that bearish sentiment was dominant in the market.

But its social volume remained stable, reflecting its popularity in the crypto space.

The trend might change soon

While that happened, Ali, a popular crypto analyst, posted a tweet highlighting a key MATIC metric. As per the tweet, the token’s 30-day MVRV ratio hit a critical zone, flagging a buy signal.

Historically, when MATIC’s MVRV ratio touched that level the last two times, the token’s value surged by 112% and 87%.

Therefore, AMBCrypto took a closer look at MATIC’s current state to better understand whether history would repeat itself for the third time. AMBCrypto’s analysis of CryptoQuant’s data revealed that Polygon’s Relative Strength Index (RSI) was in the oversold zone.

Similar to the RSI, the stochastic was also in the oversold zone, which hinted at a price uptick. Additionally, MATIC’s exchange reserve was dropping, meaning that buying pressure on the token was already increasing.

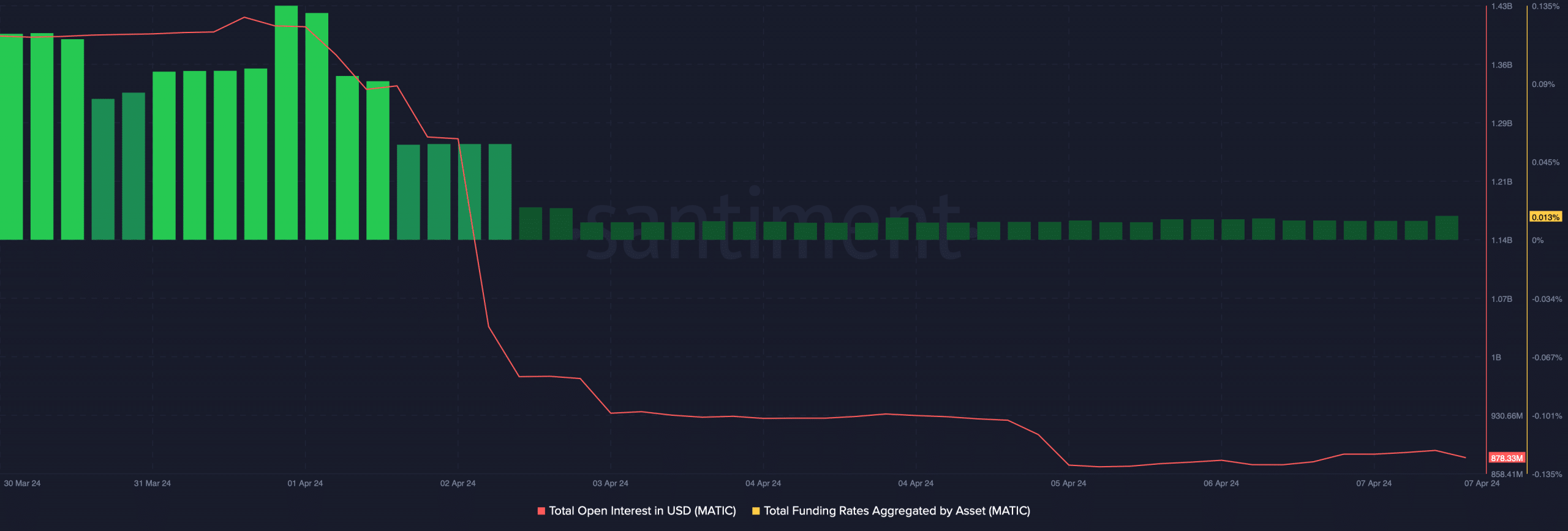

Things on the derivatives market also looked optimistic for the token. MATIC’s open interest dropped sharply along with its price. This suggested that the possibility of a trend reversal was high.

Its funding rate also dropped, meaning that futures investors were not buying MATIC at its lower price.

Read Polygon’s [MATIC] Price Prediction 2024-25

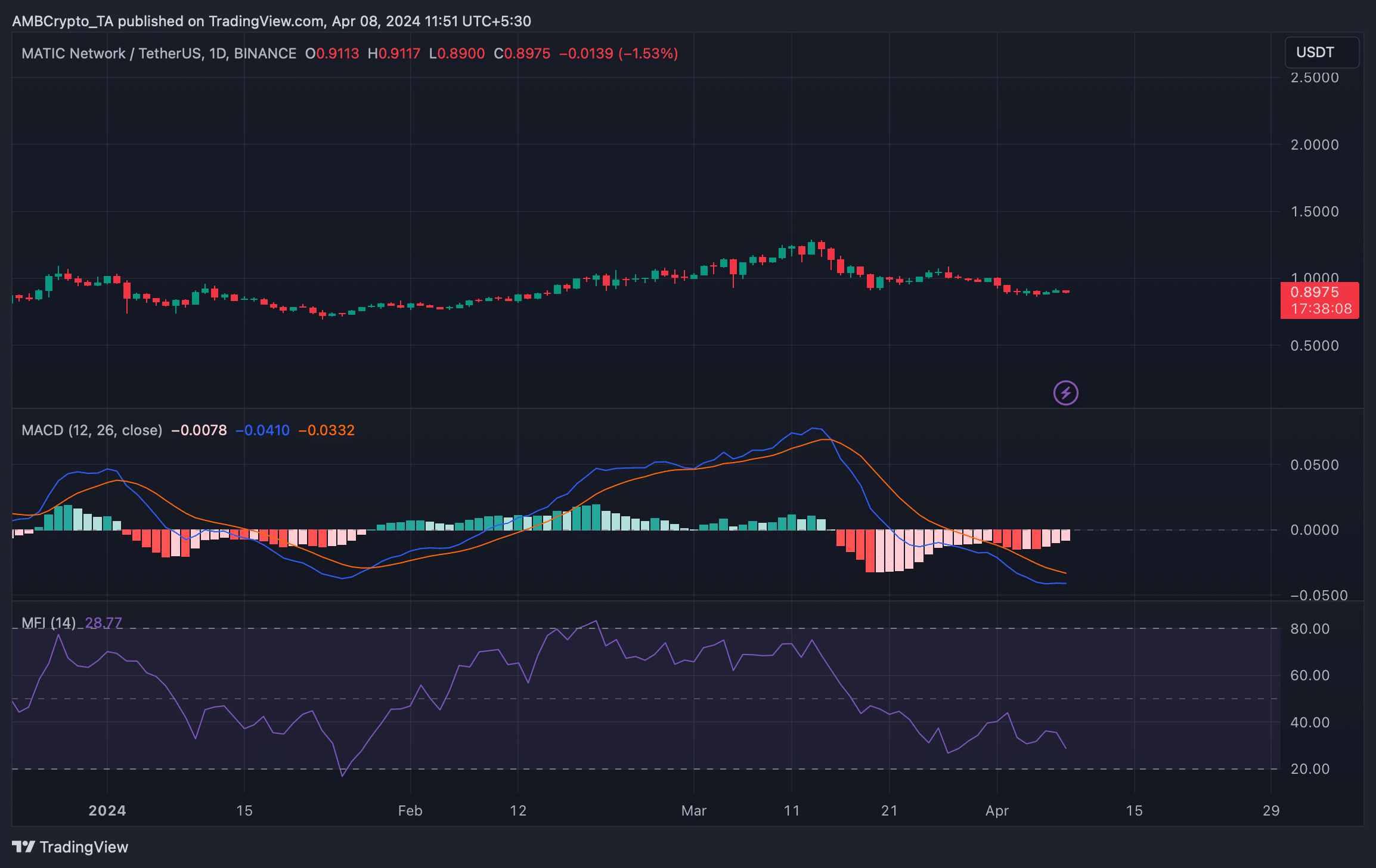

The technical indicator MACD displayed the possibility of a bullish crossover in the coming days. However, the Money Flow Index (MFI) was bearish as it registered a sharp downtick.

This might restrict MATIC’s price from gaining bullish momentum in the short term.