Optimism, Arbitrum, and Polygon: Here’s a look at the state of L2s

- Optimism leads Arbutrum and Polygon in L2 rankings.

- Their native assets had a poor trend in the past month.

Recent reports indicate that Optimism [OP] has emerged as the Layer 2 platform with the highest level of development activity. Arbitrum [ARB] and Polygon [MATIC] also featured prominently in the top 10.

Despite this, an analysis of the prices of OP, ARB, and MATIC tokens has revealed distinct trends over the past few weeks.

Optimism, Arbitrum, and Polygon features in top dev activity

Data from Santiment showed the development activity of Layer 2 networks in the past 30 days. Optimism led the pack with an average development activity score of 540, highlighting a significant level of ongoing work and progress on the platform.

Arbitrum followed closely in third place with a score of 110, indicating substantial development efforts as well. Meanwhile, Polygon secured the eighth position with a score of 20.43, showing relatively lower activity compared to Optimism and Arbitrum.

Additionally, there was a correlation in their Total Value Locked (TVL).

Arbitrum leads Optimism and Polygon in TVL

The recent analysis of the Total Value Locked (TVL) of these Layer 2 platforms on DefiLlama revealed some interesting trends.

Despite leading in development activity, Optimism currently has the lowest TVL among the three platforms, standing at nearly $860 million.

Polygon, with a TVL of almost $872 million, closely followed, indicating a relatively higher value locked in projects on the network. Arbitrum stands out with the highest TVL among the three, surpassing $1 billion and nearing $2.5 billion at the time of analysis.

However, despite these differences in TVL, all three platforms have experienced recent declines in their respective TVL figures. This decline may suggest a decrease in the value of projects on these platforms or a reduction in the value of their native tokens.

OP, ARB, and MATIC’s prices show poor trends

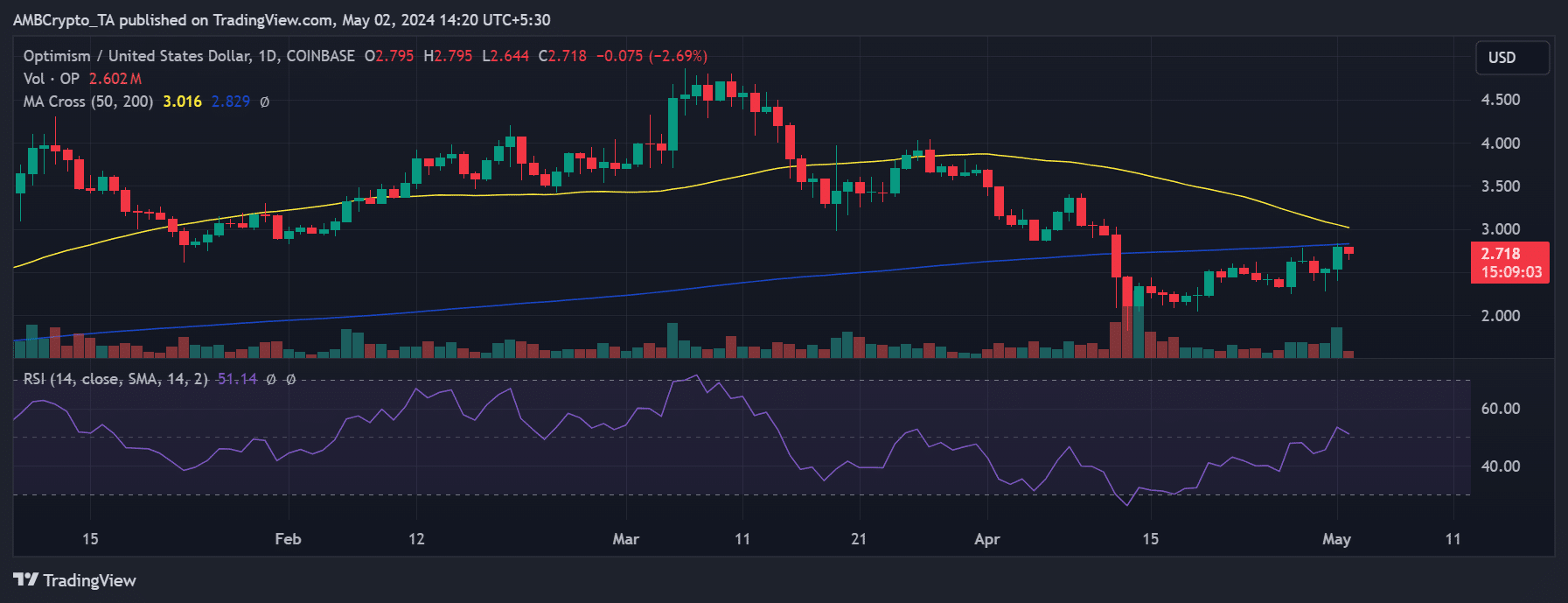

The analysis of the price trends for Optimism, Arbitrum, and Polygon on 1st May revealed varying performances within the Layer 2 ecosystem.

Optimism stood out with a notable increase of over 10%, bringing its price close to $2.80. This positive momentum marked a promising start to the month, especially considering its relatively poor performance in April.

However, at the time of analysis, it experienced a decline of over 2%, trading around $2.71.

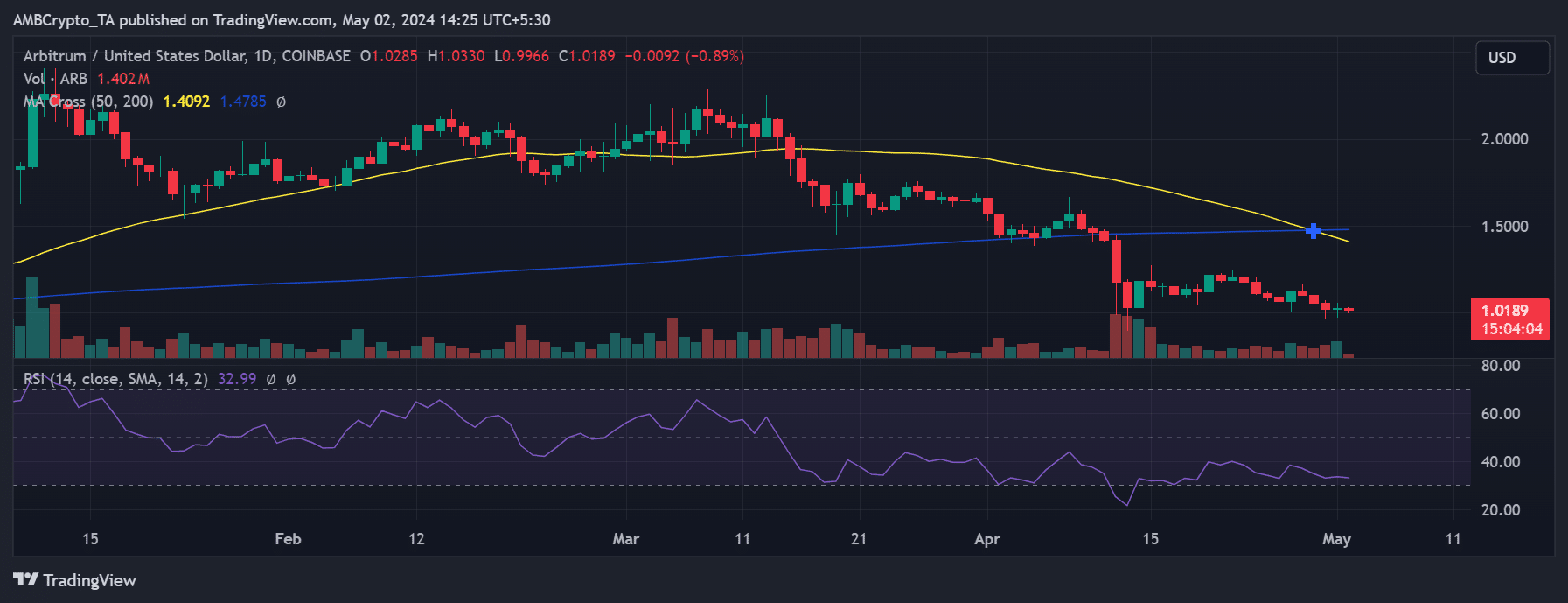

Arbitrum, on the other hand, had a more challenging trend, with consecutive declines leading up to 1st May. Although it attempted a modest increase on that day, the gain was less than 1%.

At the time of this writing, Arbitrum was trading with a slight decline at around the $1 price range.

Realistic or not, here’s MATIC market cap in BTC’s terms

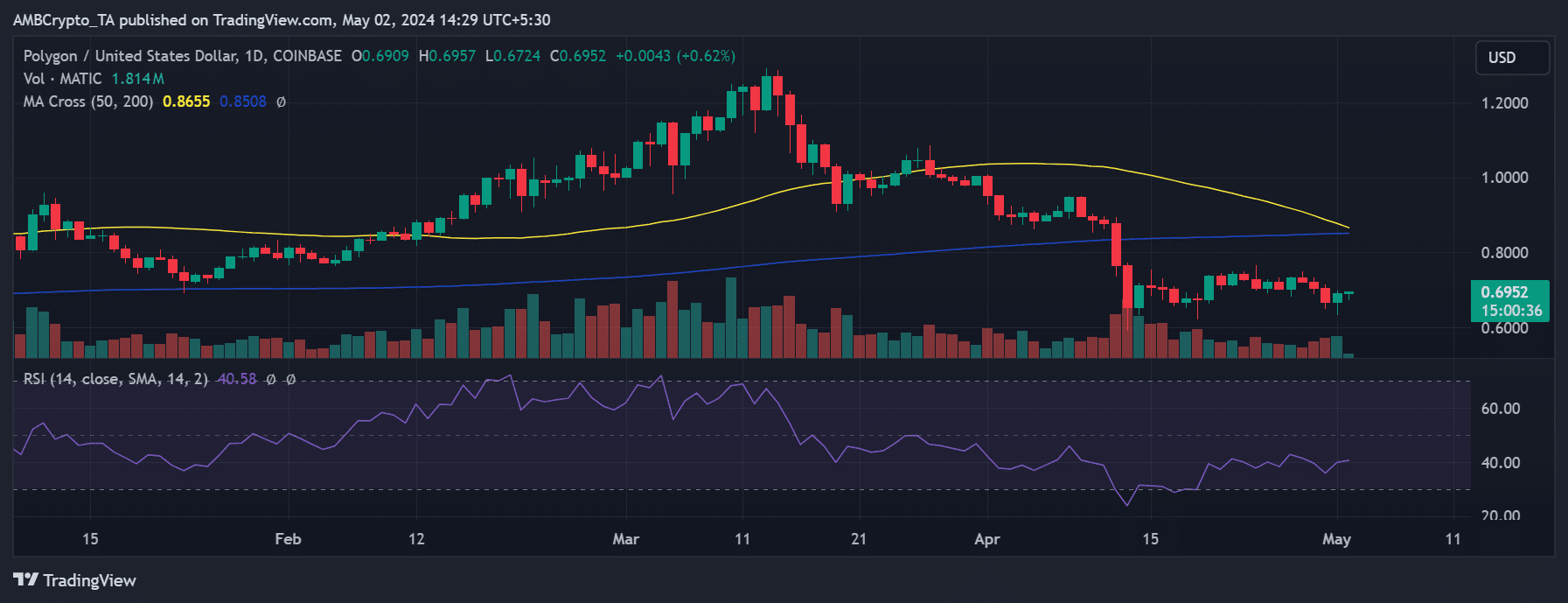

Despite experiencing more downtrends than uptrends in April, Polygon saw a positive start to May with an over 3% increase, reaching approximately $0.6.

As of this writing, it maintained its gain, trading with a less than 1% increase and remaining at the $0.6 price range. Notably, Polygon was the only Layer 2 asset trading with a gain at the time of this writing.