Binance Coin holds steady at $590: Will BNB cross $600 soon?

- BNB has struggled with gains and losses in the last few hours.

- Its price has stayed in the $590 price zone despite the fluctuations.

Binance Coin [BNB] experienced a strong performance in the previous trading session, reaching one of its highest price levels in months.

However, when examining a shorter timeframe, the data indicated that BNB was experiencing a decline, suggesting a temporary pullback or consolidation after its recent gains.

Despite this short-term decline, the gains BNB accumulated over the longer timeframe are still intact.

Binance slips on a smaller timeframe

The analysis of Binance Coin (BNB) on different timeframes revealed distinct market behaviors and trends. On a daily timeframe, BNB has demonstrated strong performance, rising over 3% in the last 24 hours and accumulating gains of over 10% in the past week.

These figures indicate a solid bullish trend over the medium term, suggesting positive sentiment and buying interest among investors.

Conversely, a more granular view using the one-hour timeframe showed a slight retreat, with BNB declining by almost 1%. While this decline might seem minor, it could be indicative of short-term profit-taking or market corrections following the recent gains.

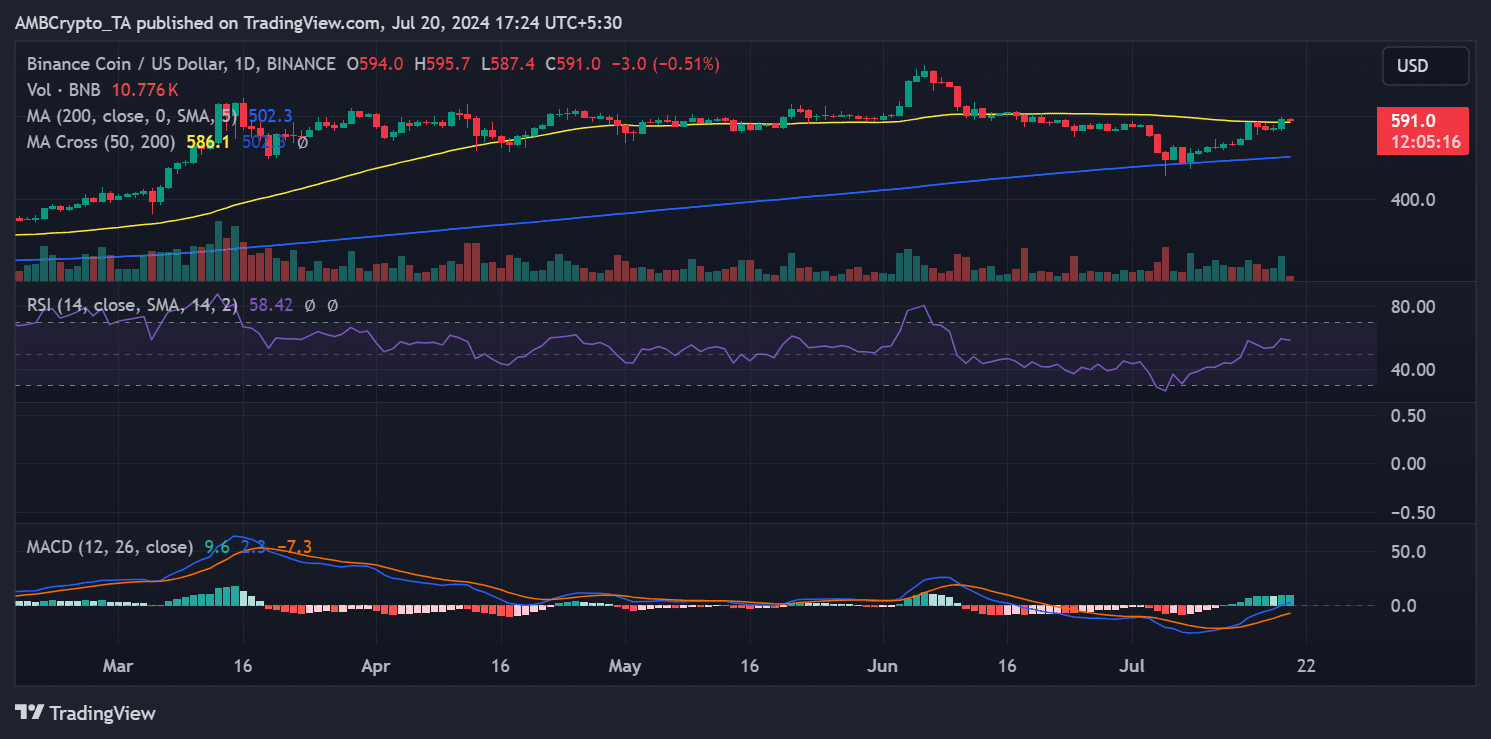

An extensive view of the Binance price trend

The daily timeframe analysis of Binance Coin revealed a significant upswing in its last trading session. The chart showed a 3.86% increase that brought the closing price to around $594, up from an opening price of around $572.

This peak nears the price level BNB achieved a month ago when it reached around $599 before experiencing subsequent declines.

As of this writing, BNB has slightly receded to around $591. This minor slip of less than 1% still allows BNB to maintain its standing in the $590 price range.

This indicated that the recent gains were largely preserved despite this small pullback.

Furthermore, the technical indicators continued to support a bullish outlook for BNB. The Relative Strength Index (RSI) was trending above the neutral line, signaling sustained buying pressure.

Also, there was no apparent decline in momentum at the moment. This positioning of the RSI suggests that the market sentiment remains positive and the bullish trend is still in force.

BNB could recoup gains

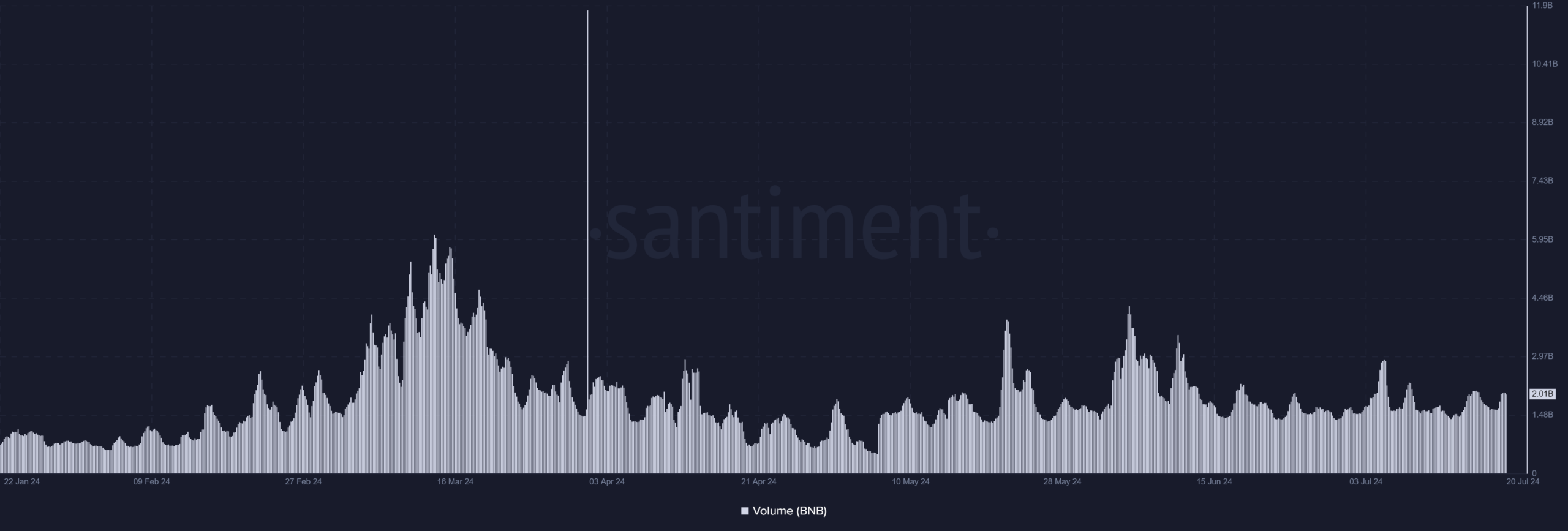

The analysis of Binance Coin (BNB) trading volume from Santiment shows consistent activity, with volumes remaining robust in successive trading sessions.

On 19th July, BNB’s trading volume surpassed $2 billion, and similar levels are observed in the current session. This steadiness in trading volume indicates that market engagement has not waned, suggesting sustained interest and participation from traders.

Read Binance (BNB) Price Prediction 2024-25

The fact that the volume has stayed high despite the slight price decline of less than 1% is particularly notable. Such volume stability often acts as a buffer against significant price drops, as it suggests a balanced dynamic between buying and selling pressures.

The ongoing strong volume could support BNB in maintaining or even increasing its market value as the trading day progresses.