A 143% boost for Chainlink? Why the next few days are crucial for LINK

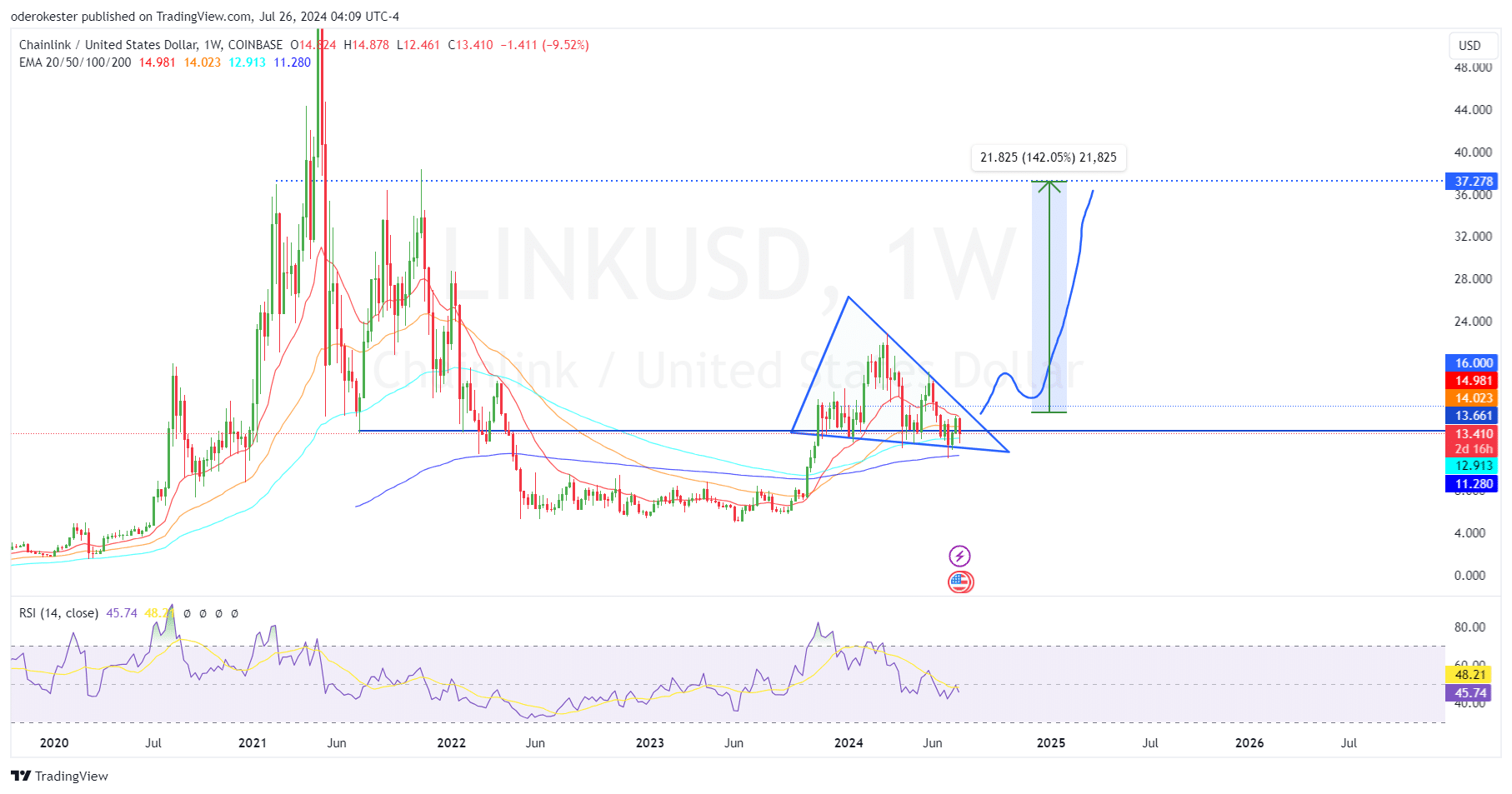

- Chainlink’s symmetrical triangle pattern suggested a potential bullish breakout.

- Breaking the $16 resistance could lead to a significant price surge, with a target price of $37.278.

Chainlink [LINK] traded at $13.42 at press time, marking a 3.07% increase in the last 24 hours, according to Coingecko.

A clear symmetrical triangle pattern has emerged on the weekly timeframe, drawn from the $22.87 highs on the 11th of March to the $11.01 low on the 1st of July.

This pattern suggested a high probability of a bullish breakout.

Meanwhile, Crypto analyst Ali on X (formerly Twitter) highlighted that the TD Sequential presented a buy signal on the 4-hour chart, adding to the bullish sentiment.

If LINK manages to break through the $16.0 resistance level, a surge of up to 143% is anticipated, projecting the price to approximately $37.278.

This potential breakout could mark a significant upward movement for the coin, reflecting a strong market interest and confidence in Chainlink.

Technical analysis and resistance levels

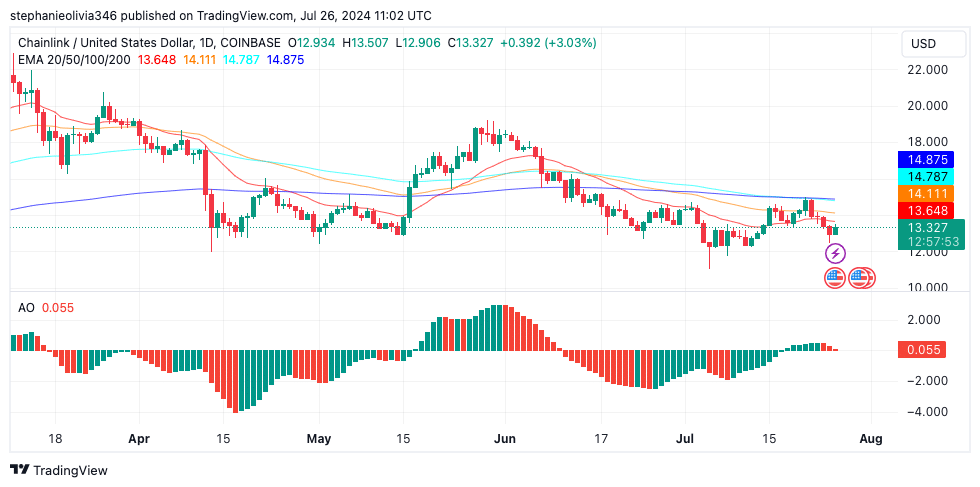

LINK has faced resistance at the $13.66 level throughout Q1 and Q2, extending the correction move to the trendline support of $12.08.

Recently, LINK bounced off this support and traded higher at $13.42, aligning with key moving averages (EMA 20/50/100/200). If these levels hold, LINK could rally by 27.6% to retest the weekly resistance at $16.22.

At the time of writing, the Relative Strength Index (RSI) on the daily chart has dipped just below the 50 mid-line, while the Awesome Oscillator (AO) is following suit.

For a bullish comeback, both indicators must stay above their mean levels.

A sustained rise in these indicators would provide a strong boost to the recovery rally, potentially leading LINK towards the $16.22 resistance level.

Potential downside and key price levels

Despite the bullish outlook, if LINK’s price closes below $11.04 on the weekly chart, it could invalidate the bullish theme.

This scenario would create a lower low, potentially causing LINK’s price to decline by 60.9% to retest its weekly lows of $4.996 from the19th of June 2023.

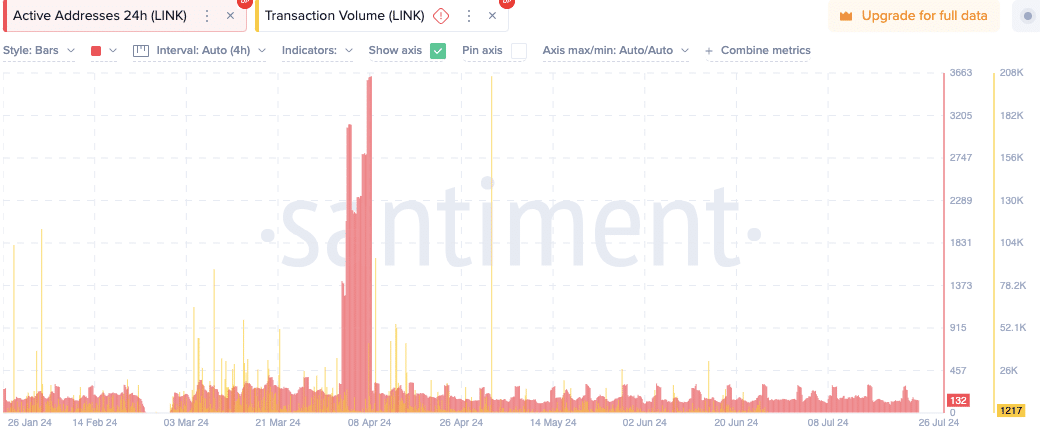

The activity on the Chainlink network, indicated by active addresses and transaction volume, showed a stable trend with occasional spikes.

Realistic or not, here’s LINK’s market cap in BTC’s terms

A significant surge in both metrics was observed around the 8th of April 2024, suggesting a temporary increase in activity.

Following this peak, the metrics returned to consistent levels, pointing to a stable period before and after the April surge.