Chainlink price prediction: Short-term dip ahead, but a trend shift seems likely

- Chainlink reflected bearish structure and momentum.

- The CMF showed significant buying pressure but the spot demand was weak in the short term.

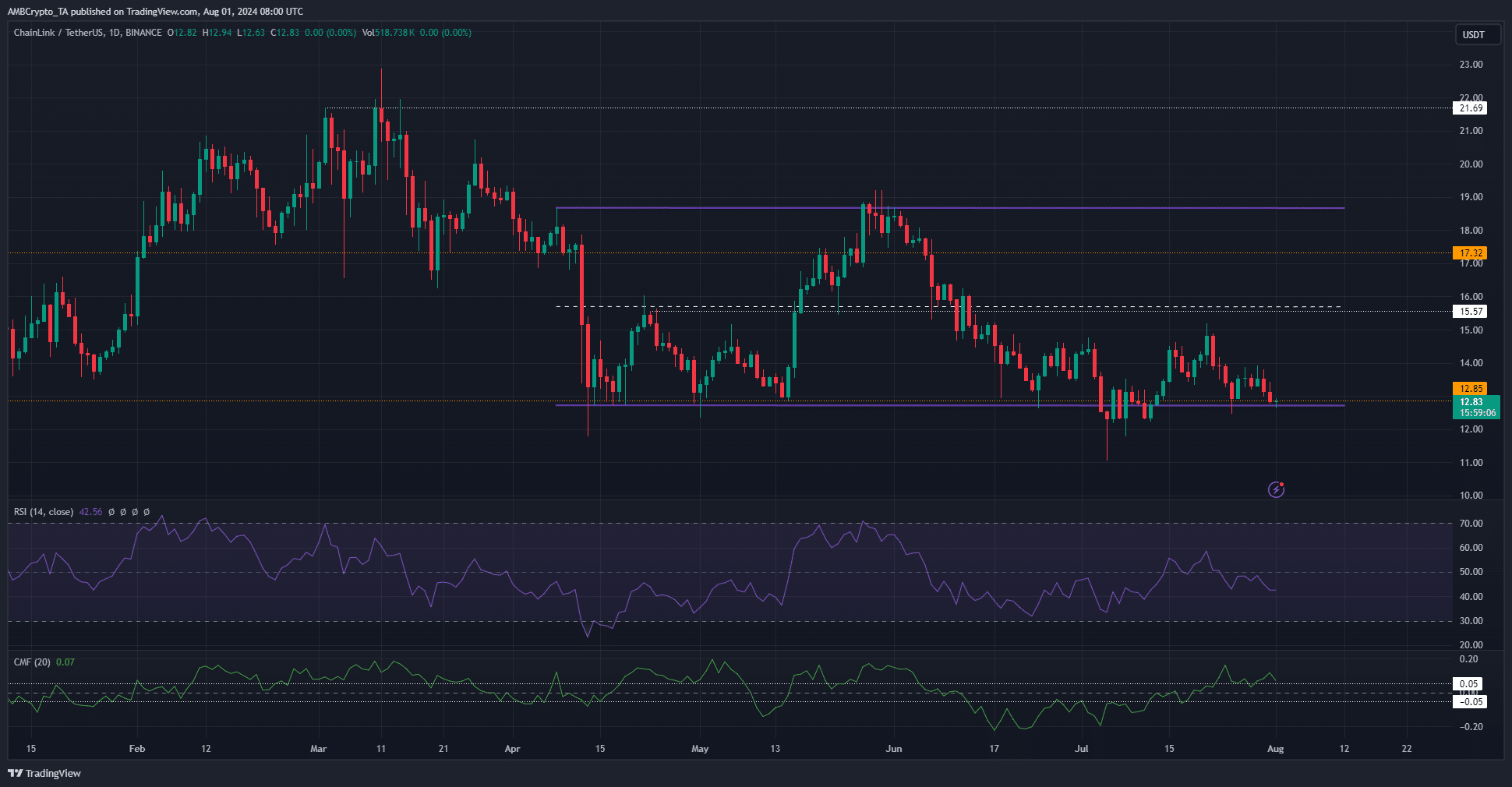

Chainlink [LINK] has been in a bearish trend for most of the time from May to July. On the 21st of July, a market structure break in the 1-day timeframe was spotted when LINK climbed past $14.75.

The price gains made in mid-July were wiped out over the past week’s trading. Momentum and volume indicators disagreed, but a price bounce was anticipated.

The range lows could save the bulls

Since April, Chainlink has traded within a range that reached from $12.73 to $18.68. The bearish sentiment in early July saw a price drop to $11.07, with a few days of trading at $12.33. Therefore, in the coming days, $12.3 could be a support zone that sets up a reversal

The CMF was above +0.05 even though the price has fallen in recent days. This showed that buying pressure was prevalent overall. However, the RSI fell below neutral 50 and signaled a bearish momentum shift.

Together, they presented conflicting signals. Overall, given the range lows, bulls could initiate a recovery over the next week, but caution is warranted.

The short-term Chainlink price prediction is bearish

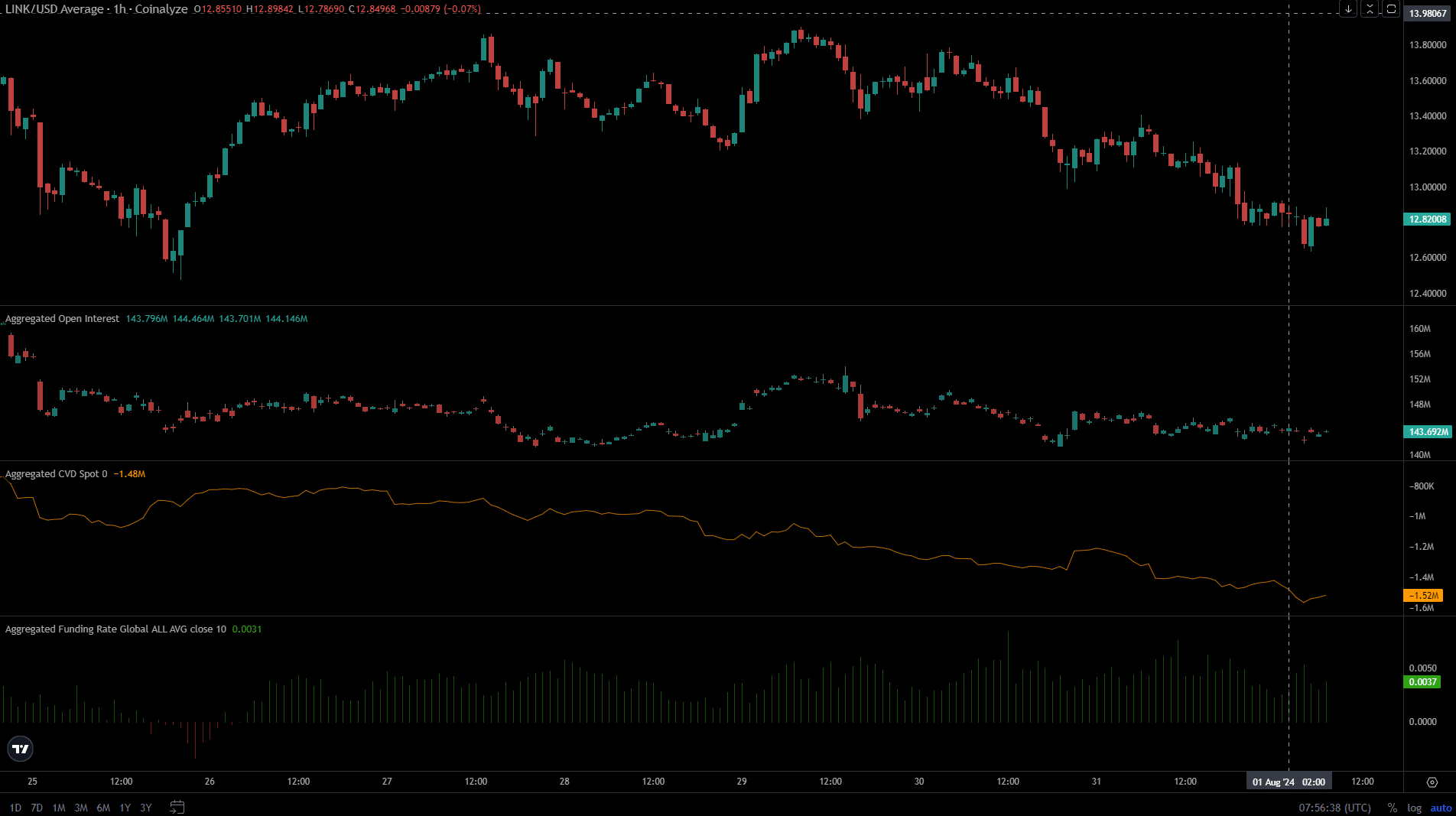

Source: Coinalyze

Over the past three days, the price of LINK has slowly slipped lower. The Open Interest also fell from $152 million to $143.7 million. The OI and price slump together signaled bearish sentiment.

Read Chainlink’s [LINK] Price Prediction 2024-25

Speculators lack confidence and were not willing to go long on the token.

The spot CVD was also trending downward. The demand was weak and futures traders were bearish. Together, it signaled that Chainlink could see some more losses.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.