Will Bitcoin, Ethereum ETFs turn the crypto bloodbath around?

- The crypto market cap has plunged to $1.92 trillion, marking a significant drop.

- Factors like geopolitical tensions and economic uncertainties have exacerbated the market’s fall.

The global crypto market has been in a notable downturn since the beginning of the month.

This decline has brought a significant amount of outflow from the global crypto market cap, which sat at $1.92 trillion at press time, a notable plunge from the $2.5 trillion seen as of late July and roughly 13.1% in the past day.

Factors behind the current crypto slump

Micheal Van De Poppe, a well-known crypto analyst, has described the current period of plunge in the market as one of “capitulation,” where investors were rapidly selling off their holdings, leading to a steep decline in prices.

This pattern, according to the analyst, has emerged strongly post the listing of the Ethereum [ETH] ETF, which, rather than boosting the market, triggered a massive outflow from Grayscale’s Trust.

This amounted to significant sales pressure on Ethereum.

Further contributing to the downturn is the liquidation by prominent trading firms, with Jump Trading offloading substantial amounts of Ethereum shortly after the ETF’s introduction.

This aggressive selling activity is indicative of larger market fears and a shift towards risk aversion among investors.

Additionally, global political tensions and adverse economic indicators, including escalating conflicts and poor economic data from multiple countries, have steered the market towards one of its lowest points this year.

When rebound?

Regardless of the reasons, the impact of the crypto market downturn has been quite severe on the market.

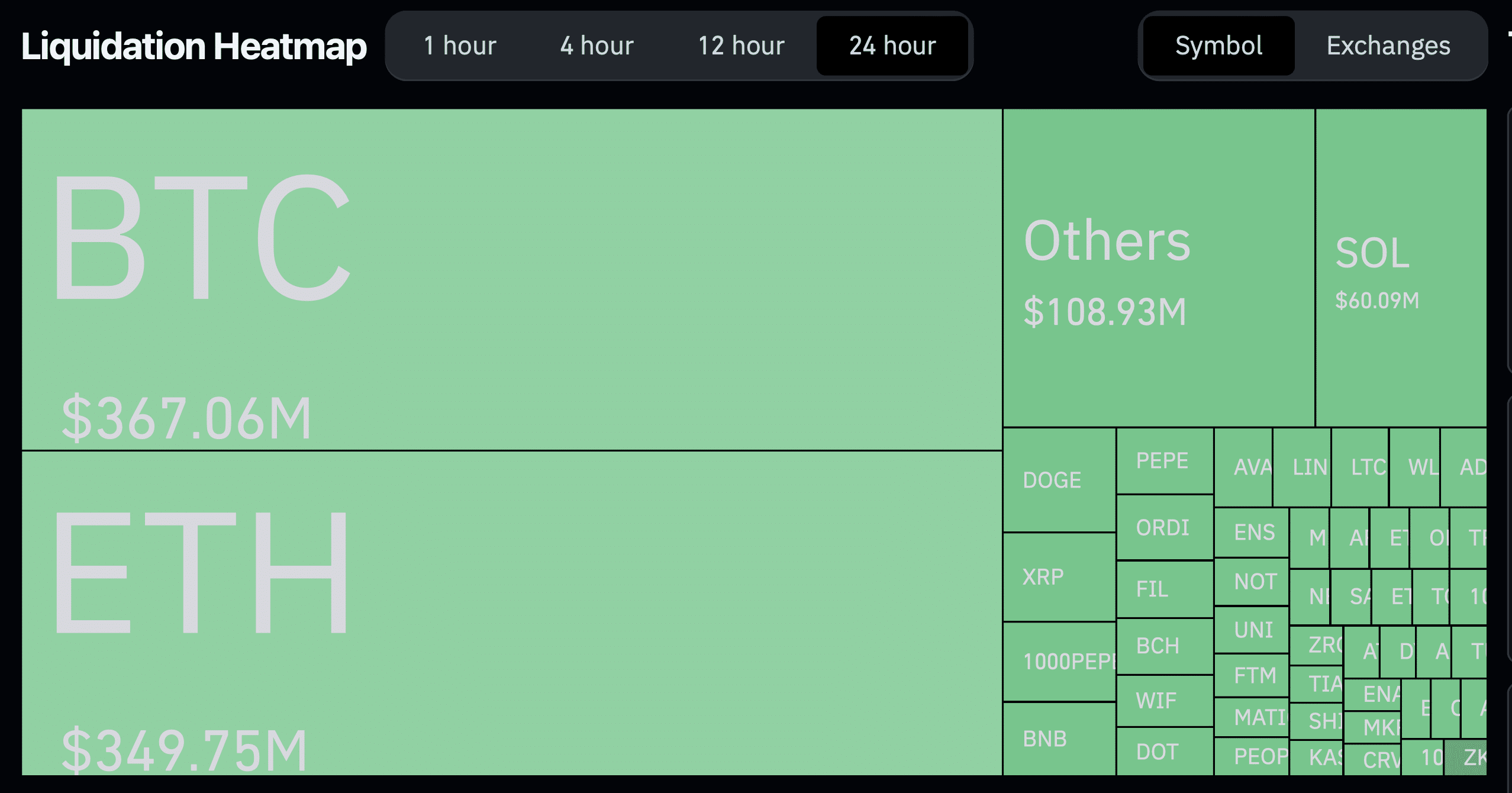

According to data from Coinglass, in the past 24 hours, 279,901 traders were liquidated, with the total liquidations coming in at over $1 billion.

Out of this total liquidation, BTC and ETH traders felt the brunt. Bitcoin [BTC] liquidations sat at $367 million at press time, while Ethereum liquidations were $349.75 million.

Meanwhile, Santiment, a leading market intelligence platform, has reported a notable uptick in discussions about buying dips following the recent sharp decline in cryptocurrency prices.

However, the increase in discussions hasn’t reached the levels typically expected with such significant market drops.

The platform predicted a more pronounced reaction as U.S. markets open, suggesting that emotional sell-offs might hasten the timing for a cryptocurrency rebound.

Nevertheless, it might be certain that the crypto market will still recover as major dips like this can be considered normal, especially given the factors behind it.

However, the question remains when this recovery will take place.

Given past similar occurrences, a rebound of the crypto market could likely occur once the initial panic cools off or perhaps when major assets like Bitcoin and Ethereum reach overbought levels, therefore resulting in a rally.