Will you still trust DOGE after reading this?

- DOGE accumulated gains of 8% MTD.

- Whale transactions spiked to a two-month high recently.

Dogecoin [DOGE], the original memecoin, sharply corrected in the last 24 hours of trading, raising questions about the sustainability of its latest rally.

Despite the allure of quick gains, the so-called memecoins continue to be a risky proposition in crypto-markets. And no, it’s not just me saying this either! Your school buddy, your boss after that boring meeting, your Facebook penpal, ALL may have warned you about the dangers of owning these “non-serious” digital assets.

Testing the patience, eh

The dog-themed token started gaining momentum on the 17th of February and sailed 8% to as high as $0.090 on the 2oth of February at 12:45 am UTC, according to CoinMarketCap.

This was enough to light up the eyes of diamond hands. As they decided to profit-take, the curve started to bend. At the time of writing, DOGE was trading at $0.086, erasing a big portion of gains made during the uptick.

Network fundamentals a silver lining

However, to cut Elon Musk’s darling some slack, DOGE has actually performed better since February began. On a month-to-date (MTD) basis, DOGE accumulated gains of 8%.

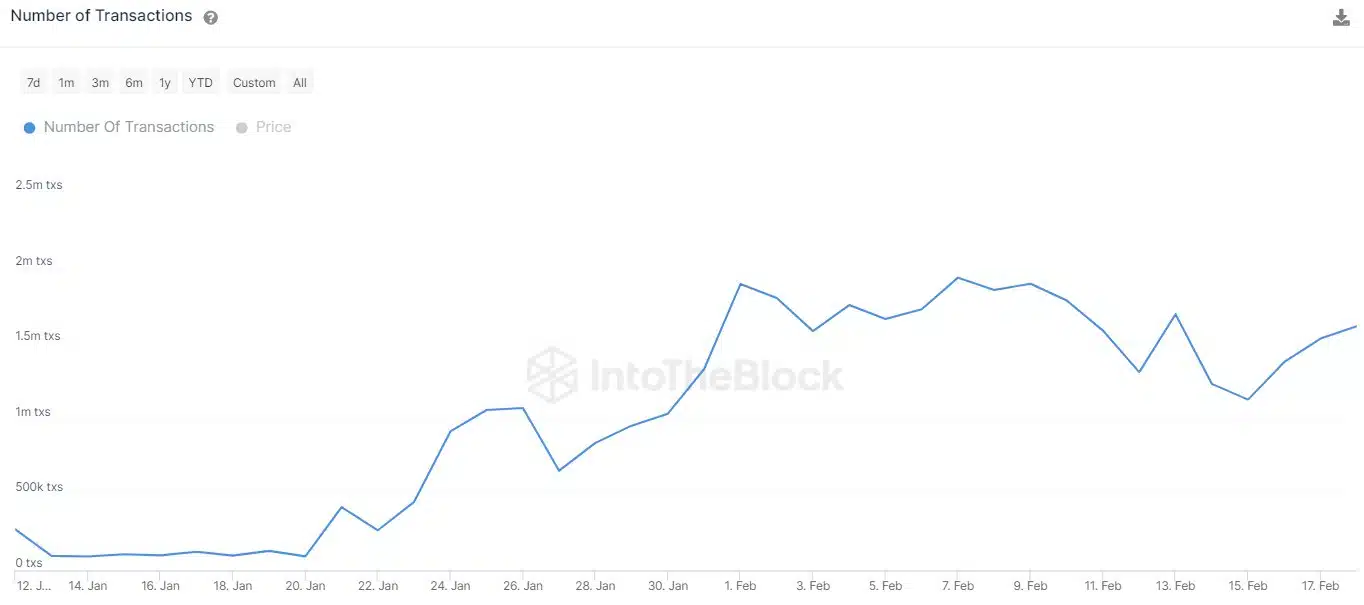

On-chain activity also saw a marked improvement during the month. Dogecoin processed more than a million transactions every day in the last three weeks, according to on-chain analytics firm IntoTheBlock.

Source: IntoTheBlock

AMBCrypto analyzed some other key indicators to gain a broader perspective. Santiment data showed that the daily active address count also surged while DOGE was booming. However, the pull back had a proportional impact on the indicator.

The rally also got the whales interested for a while. Transactions worth more than $100K spiked to a two-month high before the price dip brought about a reversal.

Musk-eteer?

One of the biggest pain points for DOGE in recent months, at least what we at AMBCrypto have observed, has been the over-reliance on its biggest “fanboy” Elon Musk.

It’s a given that Dogecoin would invariably react positively to payments-related developments at any of Elon Musk-owned companies.

Well, that’s not a problem in real sense! It’s more about what happens when the dust settles. DOGE comes down as quickly as it went up.

Realistic or not, here’s DOGE’s market cap in BTC terms

On the other hand, the coin’s lack of meaningful real-world use cases mean there isn’t any other bullish catalyst to fall back to. Quite undesirable for a token which is dubbed as the biggest memecoin.

How DOGE addresses this issue in the medium to long-term would be interesting to watch out for. “Issue” is the operative word here. What if DOGE doesn’t consider this an issue at all (crying in the corner).